The COVID-19 pandemic adversely affected treatment and therapies other than COVID-19 since the onset of the outbreak, which significantly impacted the preterm birth prevention and management market. However, preterm birth, premature membrane rupture, and, in rare instances, maternal mortality were among the risks that were heightened by COVID-19 infection during pregnancy. As a result, preterm birth prevention and management therapies were increased to prevent prenatal births and reduce complications. Moreover, in August 2021, a study conducted by researchers at UC San Francisco found that women who contract COVID-19 while pregnant had an increased risk of having any preterm delivery as well as a severe preterm birth. People who had a COVID-19 infection at some point during their pregnancy had a 60% increased risk of having an extreme preterm delivery (birth before 32 weeks) and a 40% increased risk of giving birth before 37 weeks (all preterm births). Preterm birth risk increased by 160% in people who also had COVID-19, hypertension, diabetes, and/or obesity. Another study by the Regents of the University of Minnesota in November 2020 that monitored birth and infant outcomes in 4,442 pregnant women infected with the coronavirus and their 4,527 fetuses and new-borns suggested that of the 3,912 infants with known gestational ages conceived by the pregnant women with COVID-19, 12.9% were born preterm (before 37 weeks gestation), compared with an estimated national rate of 10.2%. Of the 610 new-borns with coronavirus test results, only 2.6% were positive, most of them born to women with active infections at delivery. This greatly highlighted the demand for proper preterm birth prevention and management amid COVID-19, as per the analysis. Moreover, with the growing number of vaccinations, the post-pandemic phase observed positive market growth. For instance, the impact of the COVID-19 vaccination on preterm births was analyzed by several researchers globally. A study report published by the BMJ Publishing Group in August 2022 stated that the COVID-19 vaccination is not associated with a higher risk of preterm birth, small for gestational age at birth, or stillbirth. Hence, as per the study, the market is expected to witness stable growth over the coming years.

Certain factors that are driving the market's growth include the increasing need for preterm birth prevention and management drugs and a growing focus on targeted therapies and standard of care. The increasing need for preterm birth prevention and management drugs depends on the increasing number of cases of preterm birth in various regions and groups. As per the 2022 update report of the National Preterm Birth Prevention Collaborative, Safer Care Victoria, in Australia, one in every 12 pregnancies ends prematurely every year, and more than 26,000 babies are born too early. Thus, the increase in preterm births among various groups is expected to augment market growth during the study period.

Furthermore, the growing focus on research activities on therapies for preterm births is expected to drive market growth over the analysis period. For instance, as per NIH 2022, the estimated funding for research on preterm birth, low birth weight, and the health of the newborn in 2021 and 2022 was USD 455 million and USD 478 million, respectively. Thus, the rise in the funding of research is expected to lead to advanced prevention and management products that can drive the market over the forecast period.

However, the adverse effects associated with drugs used for preterm births are likely to hinder the growth of the market.

Preterm Birth Prevention & Management Market Trends

Tocolytics Therapy Segment Holds Significant Share Over the Forecast Period

Tocolytics are medications used to suppress premature labor. Many different classes of drugs have been used for tocolytic therapy. These include beta mimetics (ritodrine and terbutaline), magnesium sulfate, prostaglandin inhibitors (indomethacin, ketorolac), calcium channel blockers (nifedipine), nitrates (nitroglycerine), oxytocin receptor blockers (atosiban), among others.Tocolytic therapy holds a significant share due to the various advantages and importance of the therapy. For instance, as per the report published by Cochrane in August 2022, tocolytics postpone preterm delivery and give women more time to get medications that can assist a baby to breathe and feed if they are born prematurely, and that reduces the likelihood that the child will have cerebral palsy. As per the same above-mentioned source, the study showed that betamimetics and magnesium sulfate may be effective in delaying preterm birth by 48 hours, whereas calcium channel blockers and oxytocin receptor antagonists are effective in delaying preterm birth by 7 days. Thus, tocolytic drugs or agents have significant importance in delaying preterm birth, which drives the market's growth over the forecast period.

Likewise, in April 2022, a survey was also used in a research study to better understand Taiwanese attitudes and tocolytic therapy practice patterns. 310 professionals attended, and 77 of them completed the survey, with a response rate of 24.8%. The survey found that many of these specialists would prescribe tocolytics for less evidence-based indications, such as 22% for abdominal tightness, 46% for a short cervix, 60% for maintenance tocolysis, and 89% for repeat tocolysis, with ritodrine and nifedipine preferred as first-line drugs. The study concluded that tocolysis is widely accepted and used in Taiwan.

Hence, the aforementioned factors are anticipated to help the segment grow over the forecast period.

North America Dominates the Preterm Birth Prevention and Management Market Over the Forecast Period

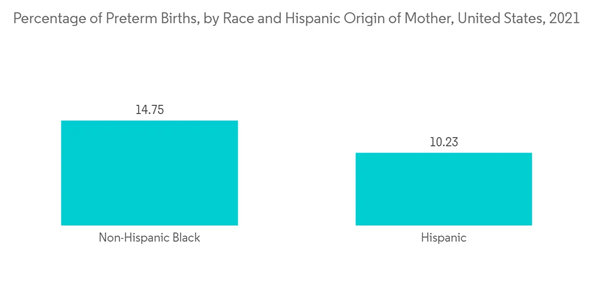

North America is anticipated to have a significant share of the market owing to factors such as increased demand for preterm birth prevention medications due to the growing number of preterm births, rising technical breakthroughs, and well-established healthcare facilities in the region.According to the CDC, the preterm birth rate rose between 2020 and 2021. Preterm births increased as a share of all births by approximately 4% in 2021, going from 10.09% in 2020 to 10.49% in the United States. The preterm birth rate was highest in non-Hispanic black mothers compared with non-Hispanic white and Hispanic mothers. Similarly, according to data published in March 2022 by the Canadian Paediatric Society, preterm births account for approximately 8% of all live births in Canada, with 30% occurring prior to 34 weeks gestational age (GA) and 70% occurring between 34 0/7 and 36 6/7 weeks.

Hence, the significant cases of preterm birth in the region increase the demand for preterm birth prevention medications, which drive the market over the study period.

Furthermore, in August 2021, the US FDA granted a public hearing to discuss Makena, the only FDA-approved treatment for reducing preterm birth in indicated patients, as per Covis Group. Later, in September 2022, as a part of the hearing process, the Obstetrics, Reproductive, and Urologic Drugs Advisory Committee decided to discuss whether the FDA should allow Makena to remain on the market while an appropriate confirmatory study is designed and conducted. Thus, such new developments and post-market studies will help the market grow during the forecast period.

Hence, the rising need for preventing and managing preterm births is expected to propel market growth across the region.

Preterm Birth Prevention & Management Market Competitor Analysis

The global preterm birth prevention and management market is moderately competitive and consists of a few major players. Companies like AbbVie Inc., ObsEva, Covis Pharma GmbH (AMAG Pharmaceuticals, Inc.), Bayer AG, Ferring B.V., Merck & Co., Inc., Viatris Inc., Pfizer Inc., and Takeda Pharmaceutical Company Limited, among others, hold a substantial market share in the market.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AbbVie Inc.

- ObsEva

- Covis Pharma GmbH. (AMAG Pharmaceuticals, Inc.)

- Bayer AG

- Ferring B.V.

- Merck & Co. Inc.

- Viatris Inc.

- Pfizer Inc.

- Takeda Pharmaceutical Company Limited