Global Ceramic Membrane Market - Key Trends and Drivers Summarized

Why Are Ceramic Membranes Gaining Popularity Over Conventional Filtration Methods?

Ceramic membranes are increasingly becoming a go-to choice in the world of filtration technology due to their robust physical and chemical properties. Unlike polymeric membranes, ceramic membranes are made from inorganic materials like alumina, zirconia, or titania, which confer high thermal and chemical resistance. This makes them highly durable, particularly in challenging environments that involve high temperatures, extreme pH levels, or corrosive chemicals. Their porous structure allows for efficient separation of particles from liquids or gases, making them ideal for microfiltration, ultrafiltration, and even nanofiltration processes. Traditional polymer membranes degrade over time when exposed to harsh operating conditions, but ceramic membranes maintain their structural integrity, leading to longer service life and reduced maintenance costs. Additionally, their resistance to fouling - a common issue in filtration - means they require less frequent cleaning, and when cleaning is necessary, they can withstand aggressive chemical cleaning agents. This durability and resilience make ceramic membranes particularly attractive for industries like wastewater treatment, food and beverage processing, pharmaceuticals, and petrochemicals, where efficiency, safety, and long-term cost savings are crucial considerations. As industries increasingly prioritize sustainability and operational efficiency, ceramic membranes are emerging as a superior alternative to conventional filtration methods.How Are Ceramic Membranes Revolutionizing Key Industries?

The use of ceramic membranes has seen substantial growth across several industries, largely because of their versatility and adaptability to a wide range of filtration processes. In water and wastewater treatment, ceramic membranes are proving invaluable in removing bacteria, viruses, and suspended solids from water, offering a higher level of purification compared to traditional filtration methods. This is particularly critical in regions facing water scarcity, where advanced filtration systems are needed to recycle wastewater for reuse in industrial processes or even potable water. In the food and beverage industry, ceramic membranes are used for the clarification and sterilization of products such as beer, wine, and fruit juices, ensuring the removal of unwanted particles without compromising flavor or quality. Their inertness also ensures that they do not interact with the liquids being filtered, maintaining the purity of the product. In the pharmaceutical and biotechnology industries, where precision and reliability are paramount, ceramic membranes are used for the filtration of proteins, enzymes, and other biological substances. Their ability to withstand autoclaving and steam sterilization makes them ideal for processes that demand strict hygiene and sterility. The petrochemical industry, too, has adopted ceramic membranes for the separation of oil-water emulsions and the treatment of process fluids, benefiting from their resilience to harsh chemicals and high temperatures. Beyond these sectors, ceramic membranes are increasingly being explored for gas separation applications, such as in biogas purification and hydrogen production.What Challenges Are Slowing the Widespread Adoption of Ceramic Membranes?

Despite the clear advantages of ceramic membranes, several challenges hinder their full-scale adoption across all industries. The most significant barrier is the high initial cost associated with their production. Manufacturing ceramic membranes involves complex processes, including the sintering of ceramic powders at high temperatures to create the porous structure necessary for filtration. This leads to higher production costs compared to polymeric membranes, making ceramic membranes less accessible for smaller companies or industries with tight budget constraints. While ceramic membranes offer long-term cost benefits due to their durability and lower maintenance requirements, the upfront investment remains a deterrent for many potential users. Additionally, ceramic membranes can be prone to brittleness, which means that in certain applications involving high mechanical stress or impact, they may be more susceptible to cracking than polymer membranes. Although they excel in environments with high thermal and chemical stress, their mechanical limitations can restrict their use in specific industrial settings that involve significant physical force or vibration. Another challenge is that scaling up the production and application of ceramic membranes for large industrial systems can be complex and time-consuming. While research into new materials and manufacturing techniques is helping to reduce costs and improve the mechanical properties of ceramic membranes, widespread adoption across all sectors will likely require further technological advancements and cost reductions.What Are the Key Growth Drivers in the Ceramic Membrane Market?

The growth in the ceramic membrane market is driven by several factors, all reflecting a shift toward more sustainable and efficient filtration technologies. One of the primary drivers is the increasing demand for clean water and the need for advanced water treatment solutions. As global water scarcity intensifies and environmental regulations become more stringent, industries are turning to ceramic membranes for their ability to provide high-quality water filtration with minimal environmental impact. Ceramic membranes are particularly effective in wastewater recycling, desalination, and the treatment of industrial effluents, making them indispensable in addressing the growing global water crisis. In addition to the water treatment sector, the rise of the pharmaceutical, biotechnology, and food and beverage industries is fueling demand for ceramic membranes. These industries require precise and reliable filtration systems that ensure product safety and quality, and ceramic membranes offer the performance and durability needed to meet these stringent requirements. Furthermore, the push for sustainability and green manufacturing practices across various sectors is driving the adoption of ceramic membranes. Their longer lifespan and lower energy requirements, compared to polymeric membranes, align with the increasing focus on reducing operational costs and minimizing environmental footprints. Another key driver is the advancement of membrane technology itself, including innovations that are improving the efficiency and affordability of ceramic membranes. These advances, such as hybrid ceramic-polymer membranes or the development of new manufacturing techniques like sol-gel processing, are making ceramic membranes more versatile and cost-effective, broadening their application across industries. Lastly, the increased investment in research and development by key players in the market is also accelerating the adoption of ceramic membranes, as companies strive to meet the rising demand for high-performance filtration solutions in a wide array of industries.Report Scope

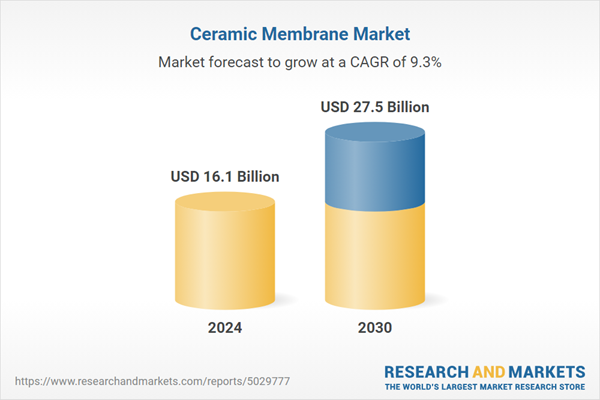

The report analyzes the Ceramic Membrane market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Material (Titania, Alumina, Zirconium Oxide, Other Materials); Technology (Ultrafiltration, Microfiltration, Nanofiltration, Other Technologies); Application (Water & Wastewater Treatment, Pharmaceuticals, Food & Beverage, Chemical Processing, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Ultrafiltration Technology segment, which is expected to reach US$10.4 Billion by 2030 with a CAGR of 7%. The Microfiltration Technology segment is also set to grow at 11% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $4.2 Billion in 2024, and China, forecasted to grow at an impressive 12.3% CAGR to reach $6.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Ceramic Membrane Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Ceramic Membrane Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Ceramic Membrane Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Atech Innovations GmbH, GEA Group AG, Hyflux Ltd., Itn Nanovation AG, Jiangsu Jiuwu Hi-Tech Co., Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Ceramic Membrane market report include:

- Atech Innovations GmbH

- GEA Group AG

- Hyflux Ltd.

- Itn Nanovation AG

- Jiangsu Jiuwu Hi-Tech Co., Ltd.

- Metawater Co., Ltd.

- Pall Corporation

- SIVA

- Tami Industries

- Veolia Water Technologies

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Atech Innovations GmbH

- GEA Group AG

- Hyflux Ltd.

- Itn Nanovation AG

- Jiangsu Jiuwu Hi-Tech Co., Ltd.

- Metawater Co., Ltd.

- Pall Corporation

- SIVA

- Tami Industries

- Veolia Water Technologies

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 194 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 16.1 Billion |

| Forecasted Market Value ( USD | $ 27.5 Billion |

| Compound Annual Growth Rate | 9.3% |

| Regions Covered | Global |