Global Hydrofluoric Acid Market - Key Trends and Drivers Summarized

Is Hydrofluoric Acid the Hidden Catalyst Behind Industrial Manufacturing and Chemical Processing?

Hydrofluoric acid (HF) is one of the most potent and dangerous acids used in industrial and chemical applications, but why is it so essential across sectors like electronics, petrochemicals, and glass manufacturing? Hydrofluoric acid is a highly reactive and corrosive compound that can dissolve glass and react with various metals, making it invaluable for numerous industrial processes. Despite its highly hazardous nature, HF is crucial in the production of fluorine-containing compounds, aluminum refining, glass etching, and in the petroleum industry for alkylation processes.The significance of hydrofluoric acid lies in its unique ability to react with silicon-based materials, making it indispensable for etching and cleaning in the semiconductor and electronics industries. In glass manufacturing, HF is used to frost and etch glass surfaces, creating intricate designs and preparing glass for further processing. Its role in alkylation, where it helps convert low molecular weight hydrocarbons into high-octane gasoline, highlights its importance in energy production. Despite the safety challenges associated with its use, hydrofluoric acid remains an irreplaceable asset in industrial chemistry due to its powerful reactivity and versatile applications.

How Have Technological Advancements Improved Hydrofluoric Acid Safety and Industrial Use?

Technological advancements have significantly improved the safety, handling, and efficiency of hydrofluoric acid in industrial processes, mitigating some of the risks associated with its corrosive and toxic nature. One of the key advancements is the development of advanced materials for storage and transportation. Traditional metal containers are unsuitable for HF due to its reactivity with most metals. Modern storage solutions use specialized materials like high-density polyethylene (HDPE) and Teflon-lined containers, which resist HF's corrosive properties and ensure safe handling during transport and storage.Another critical advancement has been in the design of personal protective equipment (PPE) and safety protocols. Due to the severe health risks posed by exposure to hydrofluoric acid, advancements in chemical-resistant clothing, gloves, and respiratory protection have significantly improved worker safety. Modern safety protocols and training programs for handling HF ensure that industrial operators are well-equipped to manage the risks associated with its use. Specialized emergency response kits and calcium gluconate treatments, used to neutralize HF exposure on the skin, are now standard in facilities that handle this hazardous substance.

In the semiconductor industry, where hydrofluoric acid is essential for etching silicon wafers, advancements in etching technology have made the process more precise and safer. Automated etching machines equipped with real-time monitoring and containment systems have reduced the need for manual handling, lowering the risk of exposure to HF. These systems allow for the precise application of hydrofluoric acid to semiconductor materials, ensuring the accuracy needed in microelectronics manufacturing while minimizing waste and hazards.

Hydrofluoric acid is also a key component in the production of fluorine-based chemicals, including refrigerants, pharmaceuticals, and fluoropolymers such as Teflon. Advances in chemical process technologies have optimized the efficiency of HF usage, reducing the amount of acid needed in fluorine compound synthesis. For example, the development of more efficient catalytic processes has improved the yield of fluorinated compounds, ensuring that less hydrofluoric acid is consumed, which in turn minimizes waste and reduces the environmental impact of HF-related industrial processes.

In the petroleum industry, where HF is used in the alkylation process to produce high-octane gasoline, safety measures have been significantly enhanced. Refineries now use closed-loop systems that minimize the release of HF into the environment. Additionally, advanced containment and neutralization technologies ensure that, in the event of a leak or spill, the acid can be rapidly neutralized before causing harm. Newer alkylation units are also being designed with alternative technologies, such as solid acid catalysts, that reduce or eliminate the need for hydrofluoric acid, though HF remains widely used in many existing systems due to its efficiency in this process.

Advances in chemical neutralization technologies have improved the management of hydrofluoric acid waste. Waste treatment systems that safely neutralize HF before it is disposed of or released into the environment have become more efficient, ensuring that the acid is converted into less harmful substances, such as calcium fluoride, which is less toxic and easier to manage. This is especially important in industries like glass etching and semiconductor manufacturing, where HF waste can pose significant environmental hazards if not properly treated.

Why Is Hydrofluoric Acid Critical for Industrial Manufacturing and Chemical Processing?

Hydrofluoric acid is critical for industrial manufacturing and chemical processing because of its unique chemical properties that allow it to dissolve materials, especially silicon compounds, that most other acids cannot. In the electronics and semiconductor industries, hydrofluoric acid is indispensable for the etching and cleaning of silicon wafers. Silicon is the primary material used in the production of integrated circuits, and HF is the only acid capable of precisely removing silicon dioxide without damaging the underlying silicon substrate. This process is essential for the fabrication of microchips, making HF a key chemical in the production of virtually all electronic devices, from computers to smartphones.In glass manufacturing, hydrofluoric acid is used to etch and frost glass, giving it a decorative finish or preparing it for further treatments. HF can dissolve silica (SiO2), which is the primary component of glass, making it ideal for applications where glass needs to be etched or chemically modified. This application is widely used in the production of frosted glass for architectural purposes, optical lenses, and even in the decorative arts. Without HF, the fine control needed to etch intricate designs or create specific textures on glass surfaces would be difficult to achieve.

Hydrofluoric acid is also critical in the production of aluminum, where it is used to refine bauxite ore into alumina (aluminum oxide) in the Bayer process. The use of HF in this process ensures that impurities are removed efficiently, allowing for the production of high-purity aluminum. This aluminum is then used in a wide range of products, from aircraft components to consumer electronics, making HF an integral part of the aluminum supply chain. The metal's widespread use across industries underscores the importance of hydrofluoric acid in modern manufacturing.

In the petrochemical industry, hydrofluoric acid plays a key role in the alkylation process, which is used to produce high-octane gasoline. During alkylation, HF acts as a catalyst to facilitate the combination of smaller hydrocarbon molecules into larger, branched hydrocarbons, which improve the performance of gasoline. High-octane gasoline is essential for modern engines, particularly in meeting fuel efficiency and emissions standards. HF's efficiency as a catalyst in this process makes it indispensable for refineries aiming to maximize gasoline yield and quality.

Hydrofluoric acid is also a key reagent in the synthesis of fluorinated compounds, including refrigerants (hydrofluorocarbons, or HFCs), pharmaceuticals, and fluoropolymers like Teflon. The ability of HF to introduce fluorine atoms into organic molecules is critical for creating compounds with unique properties, such as high chemical resistance, non-stick qualities, and thermal stability. These fluorinated compounds are essential in many industries, from non-stick cookware to medical devices and refrigeration systems. The role of HF in these chemical processes highlights its importance in the global production of both everyday and specialized products.

Another critical use of hydrofluoric acid is in uranium processing, where it is used to convert uranium oxide into uranium hexafluoride (UF6), a crucial step in the enrichment of uranium for nuclear fuel. The reactivity of HF with uranium compounds enables this transformation, which is a key part of the nuclear fuel cycle. Nuclear power plants rely on enriched uranium to generate electricity, making hydrofluoric acid an essential component in the production of nuclear energy. This highlights the acid's importance not only in chemical processing but also in supporting the global energy infrastructure.

What Factors Are Driving the Growth of the Hydrofluoric Acid Market?

Several factors are driving the growth of the hydrofluoric acid market, including increasing demand from the electronics, petrochemical, and industrial manufacturing sectors, as well as its critical role in emerging technologies. One of the primary drivers is the growing demand for electronic devices, particularly smartphones, computers, and other consumer electronics. The semiconductor industry, which relies heavily on hydrofluoric acid for etching and cleaning silicon wafers, is expanding rapidly due to the increasing integration of technology into everyday life. As the demand for smaller, more powerful microchips continues to rise, the need for HF in semiconductor fabrication is expected to grow alongside it.The automotive and energy sectors are also significant drivers of the hydrofluoric acid market. As global demand for high-octane gasoline increases, particularly in regions with strict emissions standards, the petrochemical industry's use of HF in alkylation processes is rising. Refineries require hydrofluoric acid to produce cleaner-burning fuels that meet regulatory requirements for reduced greenhouse gas emissions. Additionally, the ongoing development of alternative fuel technologies, such as hydrogen fuel cells and electric vehicles, may further drive demand for fluorine-based chemicals, many of which are derived from HF.

The production of fluorinated chemicals, including refrigerants, pharmaceuticals, and fluoropolymers, is another major factor contributing to the growth of the hydrofluoric acid market. Fluoropolymers like Teflon are used in a wide range of industries, from aerospace and automotive to medical and consumer goods, due to their unique properties such as chemical resistance and high thermal stability. The demand for fluoropolymers is expected to increase as industries seek materials that can withstand extreme conditions. Additionally, hydrofluoric acid is critical in the production of refrigerants, particularly HFCs, which are widely used in air conditioning and refrigeration systems.

Environmental regulations and the shift toward cleaner energy sources are also influencing the hydrofluoric acid market. The increasing use of nuclear energy as a low-carbon alternative to fossil fuels has created a steady demand for HF in uranium processing. As countries seek to reduce their carbon footprints and invest in nuclear energy as part of their energy mix, the need for HF in the nuclear fuel cycle is expected to grow. Similarly, the expansion of renewable energy technologies, such as solar panels and wind turbines, may drive demand for HF in the production of advanced materials used in these systems.

Technological advancements in chemical processing and materials science are further fueling the growth of the hydrofluoric acid market. Innovations in refining, fluorination, and etching processes have made HF more efficient and safer to use, increasing its attractiveness across industries. Additionally, the development of new fluorine-based materials with applications in high-performance coatings, medical devices, and clean energy technologies is driving further demand for hydrofluoric acid. These advancements are opening up new markets and applications for HF, particularly in high-tech industries.

With growing demand from sectors such as electronics, petrochemicals, and nuclear energy, as well as technological advancements and environmental considerations, the hydrofluoric acid market is poised for continued expansion. As industries prioritize efficiency, sustainability, and advanced material production, hydrofluoric acid will remain a critical chemical in driving industrial innovation and supporting global manufacturing processes.

Report Scope

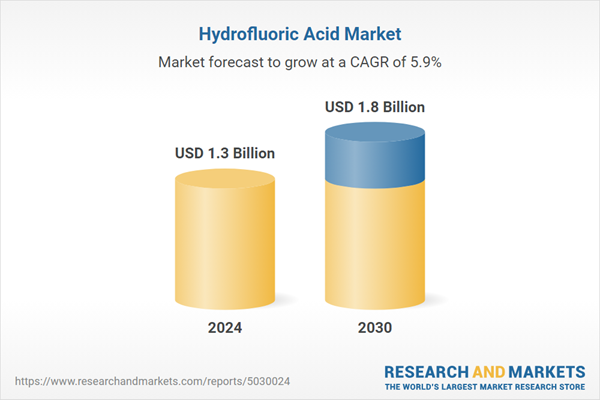

The report analyzes the Hydrofluoric Acid market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Grade (Anhydrous, Diluted); Application (Fluorocarbon, Fluorinated Derivatives, Metal Pickling, Glass Etching, Oil Refining, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Fluorocarbon Application segment, which is expected to reach US$984.6 Million by 2030 with a CAGR of 6%. The Fluorinated Derivatives Application segment is also set to grow at 6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $335.1 Million in 2024, and China, forecasted to grow at an impressive 9% CAGR to reach $428.4 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Hydrofluoric Acid Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Hydrofluoric Acid Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Hydrofluoric Acid Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Daikin Industries Ltd., Dongyue Group Ltd., Fluorchemie Stulln GmbH, Fubao Group, Fujian Longfu Chemical Co., Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 12 companies featured in this Hydrofluoric Acid market report include:

- Daikin Industries Ltd.

- Dongyue Group Ltd.

- Fluorchemie Stulln GmbH

- Fubao Group

- Fujian Longfu Chemical Co., Ltd.

- Fujian Shaowu Yongfei Chemical Co., Ltd.

- Gulf Fluor

- Honeywell International, Inc.

- Lanxess AG

- Mexichem Fluor S.A. de C.V.

- Morita Chemical Industries Co., Ltd.

- Navin Fluorine International Limited

- Shaowu Huaxin Chemical Industry Co., Ltd.

- Sinochem Group Co., Ltd.

- Solvay S.A

- SRF Ltd.

- Tanfac Industries Ltd.

- Ying Peng Group

- Zhejiang Sanmei Chemical Incorporated Company

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Daikin Industries Ltd.

- Dongyue Group Ltd.

- Fluorchemie Stulln GmbH

- Fubao Group

- Fujian Longfu Chemical Co., Ltd.

- Fujian Shaowu Yongfei Chemical Co., Ltd.

- Gulf Fluor

- Honeywell International, Inc.

- Lanxess AG

- Mexichem Fluor S.A. de C.V.

- Morita Chemical Industries Co., Ltd.

- Navin Fluorine International Limited

- Shaowu Huaxin Chemical Industry Co., Ltd.

- Sinochem Group Co., Ltd.

- Solvay S.A

- SRF Ltd.

- Tanfac Industries Ltd.

- Ying Peng Group

- Zhejiang Sanmei Chemical Incorporated Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 179 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.3 Billion |

| Forecasted Market Value ( USD | $ 1.8 Billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |