Global Kefir Products Market - Trends & Consumer Insights

Why Are Kefir Products Gaining Popularity in the Health and Wellness Market?

Kefir products are gaining significant popularity in the health and wellness market due to their rich probiotic content and numerous health benefits. Kefir, a fermented milk drink that originated in the Caucasus region, is known for its high levels of beneficial bacteria and yeast, which contribute to gut health and overall well-being. The rising consumer interest in digestive health, driven by growing awareness of the gut microbiome's role in immunity, mental health, and chronic disease prevention, is propelling the demand for kefir. Moreover, kefir's versatility as a beverage and ingredient in smoothies, dressings, and baked goods is increasing its appeal to a broader audience, including those seeking functional foods that offer more than basic nutrition. As consumers continue to prioritize health-conscious choices, kefir products are becoming a staple in the diets of those looking to improve their digestive health and overall wellness.How Are Innovations in Flavors and Formats Expanding the Kefir Market?

Innovations in flavors and formats are playing a crucial role in expanding the kefir market, making these products more accessible and appealing to a wider range of consumers. Traditionally, kefir has a tart and tangy flavor, which may not appeal to everyone. However, manufacturers are now offering a variety of flavored kefir options, such as berry, vanilla, and honey, that cater to diverse taste preferences while still delivering the probiotic benefits. Additionally, the introduction of non-dairy kefir made from coconut, almond, and soy milk is expanding the market to include consumers who are lactose intolerant, vegan, or simply prefer plant-based products. These innovations are not only broadening the consumer base but also positioning kefir as a versatile and convenient option for health-conscious individuals. The availability of kefir in various formats, such as ready-to-drink bottles, single-serving cups, and powdered mixes, is further driving its popularity by catering to the on-the-go lifestyle of modern consumers.What Challenges Does the Kefir Market Face in Reaching a Broader Audience?

Despite its growing popularity, the kefir market faces several challenges in reaching a broader audience, including consumer education, competition from other probiotic products, and the unique taste profile of kefir. Many consumers are still unfamiliar with kefir, its health benefits, and how it differs from other fermented products like yogurt. This lack of awareness can be a barrier to trial and adoption. Additionally, the market for probiotic foods and beverages is becoming increasingly crowded, with kefir competing against a wide range of products, including yogurt, kombucha, and dietary supplements. The tart flavor of traditional kefir, while appealing to some, can be off-putting to others, particularly those who are new to fermented foods. To overcome these challenges, manufacturers are investing in marketing and education campaigns that highlight the health benefits of kefir and its versatility as a food product. They are also focusing on product innovation, offering milder flavors and convenient formats that make kefir more accessible and appealing to a broader audience.What Factors Are Driving Growth in the Kefir Products Market?

The growth in the kefir products market is driven by several factors, including the increasing consumer focus on digestive health, the expansion of the functional foods market, and the growing demand for natural and organic products. As awareness of the importance of gut health continues to rise, more consumers are turning to probiotic-rich foods like kefir to support their digestive systems and overall well-being. The broader functional foods market, which includes products that offer additional health benefits beyond basic nutrition, is also expanding rapidly, creating more opportunities for kefir products. Additionally, the trend towards natural and organic foods is driving demand for kefir, which is often marketed as a clean-label product with minimal processing and natural ingredients. The ongoing innovation in flavors, formats, and non-dairy options is further fueling the market's growth, making kefir accessible to a wider range of consumers and solidifying its place in the health and wellness sector.Report Scope

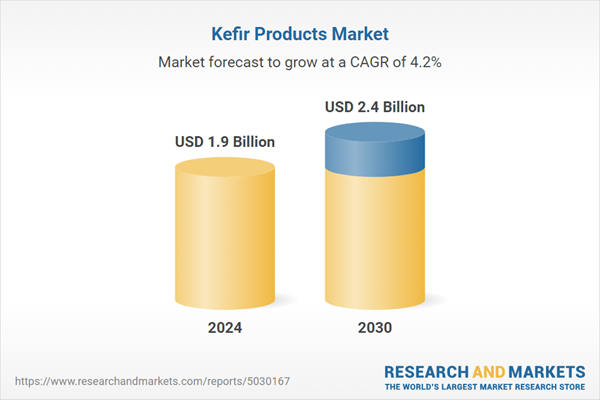

The report analyzes the Kefir Products market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Nature (Conventional, Organic); Product Type (Flavored, Unflavored); Source (Animal Milk, Soy Milk, Coconut Milk, Other Sources); Application (Food & Beverage, Pharmaceuticals).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Flavored Kefir Products segment, which is expected to reach US$1.5 Billion by 2030 with a CAGR of 4%. The Unflavored Kefir Products segment is also set to grow at 4.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $501.8 Million in 2024, and China, forecasted to grow at an impressive 7.4% CAGR to reach $544.1 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Kefir Products Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Kefir Products Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Kefir Products Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Best of Farms LLC., Bio-tiful Dairy Ltd., Danone S.A, Groupe Danone, Liberte inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Kefir Products market report include:

- Best of Farms LLC.

- Bio-tiful Dairy Ltd.

- Danone S.A

- Groupe Danone

- Liberte inc.

- Lifeway Foods, Inc.

- Nourish Kefir

- OSM Krasnystaw

- Redwood Hill Farm & Creamery, Inc.

- Swirls Frozen Kefir Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Best of Farms LLC.

- Bio-tiful Dairy Ltd.

- Danone S.A

- Groupe Danone

- Liberte inc.

- Lifeway Foods, Inc.

- Nourish Kefir

- OSM Krasnystaw

- Redwood Hill Farm & Creamery, Inc.

- Swirls Frozen Kefir Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 293 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.9 Billion |

| Forecasted Market Value ( USD | $ 2.4 Billion |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Global |