Global Pharmaceutical Glass Packaging Market - Key Trends & Drivers Summarized

Why Is Glass the Gold Standard for Pharmaceutical Packaging?

Glass packaging has long been revered in the pharmaceutical industry for its exceptional barrier properties, chemical stability, and transparency, making it a preferred material for ensuring the safety, purity, and efficacy of pharmaceutical products. Pharmaceutical glass packaging primarily includes bottles, vials, ampoules, and syringes that are used to store everything from simple vitamins to complex biologics and vaccines. The inert nature of glass ensures that it does not react with the contents it holds, a critical requirement for sensitive medications that could be altered or contaminated by other materials. Additionally, glass's ability to withstand sterilization processes at high temperatures makes it indispensable for maintaining the sterile conditions required for many pharmaceutical applications.How Are Innovations in Glass Packaging Benefiting the Pharmaceutical Industry?

The ongoing innovations in pharmaceutical glass packaging focus on enhancing the safety and functionality of glass containers while minimizing risks such as breakage and contamination. One of the key advancements has been the development of borosilicate glass, which is highly resistant to thermal shock and chemical leaching, thereby providing an even safer container for critical medications. Additionally, companies are investing in surface treatments and coating technologies that enhance the durability and performance of glass vials, preventing issues like delamination and particle generation. These technological advancements not only extend the shelf life of pharmaceutical products but also support the industry's shift towards more sustainable practices by reducing material waste and improving manufacturing efficiencies.What Trends Are Shaping the Future of Pharmaceutical Glass Packaging?

Several prevailing trends are shaping the future of pharmaceutical glass packaging. The rise in biotechnology and the increasing development of biopharmaceuticals, including vaccines and biologics, which often require stringent packaging specifications to maintain molecular integrity, is a significant factor. This shift is driving demand for high-quality, durable, and customizable glass packaging solutions. Additionally, the global push towards stricter regulations on pharmaceutical packaging to ensure patient safety and product quality is prompting pharmaceutical companies and glass packaging manufacturers to adhere to higher standards. There is also a growing trend towards sustainability in packaging, with the pharmaceutical sector seeking ways to reduce its environmental footprint through more recyclable materials and efficient manufacturing processes.What Factors Are Catalyzing the Growth of the Pharmaceutical Glass Packaging Market?

The growth in the pharmaceutical glass packaging market is driven by several factors, including the increasing demand for biologics and the need for complex and sensitive drug formulations that require high-quality packaging solutions. Technological advancements in glass production and treatment methods are enabling manufacturers to produce more robust and safer products, catering to the stringent requirements of the pharmaceutical industry. Moreover, regulatory requirements for safer and more secure packaging solutions are pushing the pharmaceutical sector towards more reliable materials like glass. Consumer behavior is also a significant driver; as the awareness of drug safety and quality increases, so does the preference for pharmaceutical products packaged in glass due to its non-reactive nature. The global increase in healthcare expenditures and the expansion of the pharmaceutical industry in emerging markets are further amplifying the demand for pharmaceutical glass packaging, ensuring its pivotal role in the delivery of healthcare products worldwide.Report Scope

The report analyzes the Pharmaceutical Glass Packaging market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Product Type (Bottles, Vials, Ampoules, Cartridges & Syringes); Drug Type (Generic, Branded, Biologic).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Bottles segment, which is expected to reach US$10.5 Billion by 2030 with a CAGR of 5.8%. The Vials segment is also set to grow at 8.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $6.5 Billion in 2024, and China, forecasted to grow at an impressive 8.7% CAGR to reach $5.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Pharmaceutical Glass Packaging Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Pharmaceutical Glass Packaging Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Pharmaceutical Glass Packaging Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Becton, Dickinson and Company, Corning, Inc., Gerresheimer AG, Ardagh Group SA, Agrado SA and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Pharmaceutical Glass Packaging market report include:

- Becton, Dickinson and Company

- Corning, Inc.

- Gerresheimer AG

- Ardagh Group SA

- Agrado SA

- Beatson Clark PLC

- Hindusthan National Glass & Industries Ltd.

- Bormioli Pharma S.p.a.

- DWK Life Sciences LLC

- Haldyn Glass Ltd.

- ESSCO Glass

- Dobbies Garden Centres Limited

- Can Do Company Limited

- As One Corporation

- Dunelm (Soft Furnishings) Limited

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Becton, Dickinson and Company

- Corning, Inc.

- Gerresheimer AG

- Ardagh Group SA

- Agrado SA

- Beatson Clark PLC

- Hindusthan National Glass & Industries Ltd.

- Bormioli Pharma S.p.a.

- DWK Life Sciences LLC

- Haldyn Glass Ltd.

- ESSCO Glass

- Dobbies Garden Centres Limited

- Can Do Company Limited

- As One Corporation

- Dunelm (Soft Furnishings) Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 377 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

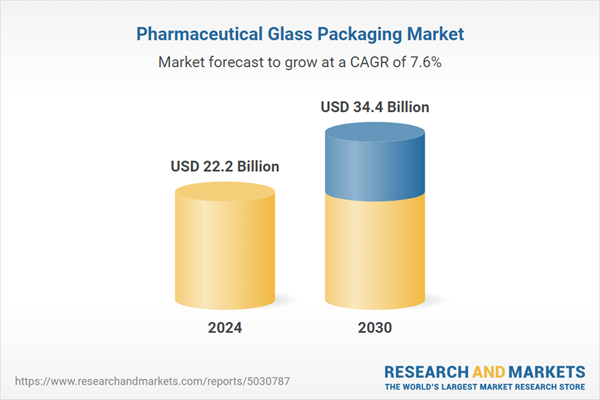

| Estimated Market Value ( USD | $ 22.2 Billion |

| Forecasted Market Value ( USD | $ 34.4 Billion |

| Compound Annual Growth Rate | 7.6% |

| Regions Covered | Global |