Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Regulatory bodies are mandating stricter crash safety norms, pushing automakers to integrate more advanced passive safety systems into both entry-level and premium vehicles. The increasing integration of electronic control units with passive safety features such as electronic brake-force distribution and advanced seatbelt reminders is contributing to market innovation. Automakers are also focusing on modular platforms that allow flexibility in incorporating scalable safety architectures, enhancing mass adoption across vehicle categories.

Market Drivers

Increasing Vehicle Production Volumes

Growing volumes of passenger car production are directly influencing the demand for passive safety systems. As automotive manufacturing scales up across various price segments, automakers are embedding passive safety features into standard vehicle configurations to comply with safety regulations and attract safety-conscious consumers. With more units being produced annually, economies of scale make it feasible to include multiple passive components, such as front and side airbags, reinforced frames, and energy-absorbing structures, even in lower-cost models. Automakers are adopting modular production platforms that simplify the integration of these systems, creating uniform safety standards across different models.The surge in vehicle production also aligns with increasing urbanization and the rising need for personal mobility solutions. For instance, global vehicle sales reached 92.4 million units in 2023, marking a 10.8% increase from 2022. The strong sales growth, bolstered by an 11% rise in December, signals increasing demand and production. The continuous upward trend in global vehicle sales reflects robust recovery and heightened consumer demand across key markets, including North America, Europe, and Asia. This surge highlights the automotive industry's resilience and adaptability, indicating a promising outlook for the sector.

Key Market Challenges

High Cost of Integration for Entry-Level Vehicles

Integrating advanced passive safety systems into entry-level passenger cars poses significant cost-related challenges. Many compact and budget-friendly vehicle segments operate on narrow profit margins, making it difficult for manufacturers to include high-end safety components without affecting retail pricing. Features such as side curtain airbags, structural reinforcements, and pedestrian protection elements require material upgrades and advanced engineering solutions, which increase manufacturing complexity and cost. While some cost can be amortized across production volumes, the initial investment in tooling, design, and supplier contracts creates financial strain. Consumers in the budget segment often prioritize affordability, which makes it harder for automakers to pass on the additional safety-related expenses without pricing themselves out of the market.Key Market Trends

Growth of Sensor-Driven Passive Safety Enhancements

Passive safety systems are evolving beyond traditional mechanical responses to incorporate sensor-based intelligence for pre-crash and crash-phase interventions. This shift is giving rise to smarter airbags, adaptive seatbelt mechanisms, and electronically controlled collapsible steering systems that adjust deployment based on occupant position, collision angle, and impact severity. These sensor-driven enhancements allow for dynamic responses that significantly reduce injury risk. The integration of accelerometers, gyroscopes, and impact force sensors provides real-time data that can inform milliseconds-quick decisions during a collision event. Unlike conventional systems with static behavior, these new-generation passive systems are more context-aware and occupant-specific.Key Market Players

- Robert Bosch GmbH

- Valeo SA

- Denso Corporation

- Autoliv Inc.

- Omni Vision Technologies Inc.

- Gentex Corporation

- Aptiv Plc

- Magna International Inc.

- TRW Automotive

- Wonder Auto Technology

Report Scope:

In this report, the Asia Pacific Passenger Car Passive Safety System Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Asia Pacific Passenger Car Passive Safety System Market, By Product Type:

- Airbag

- Seat belt

- Electronic control unit

- Steering wheels

- Others

Asia Pacific Passenger Car Passive Safety System Market, By Demand Category:

- OEM

- Aftermarket

Asia Pacific Passenger Car Passive Safety System Market, By Vehicle Type:

- Hatchback

- MUV

- Sedan

- SUV

Asia Pacific Passenger Car Passive Safety System Market, By Country:

- China

- India

- Japan

- Indonesia

- Thailand

- South Korea

- Australia

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Asia Pacific Passenger Car Passive Safety System Market.Available Customizations:

With the given market data, the publisher offers customizations according to the company’s specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Robert Bosch GmbH

- Valeo SA

- Denso Corporation

- Autoliv Inc.

- Omni Vision Technologies Inc.

- Gentex Corporation

- Aptiv Plc

- Magna International Inc.

- TRW Automotive

- Wonder Auto Technology

Table Information

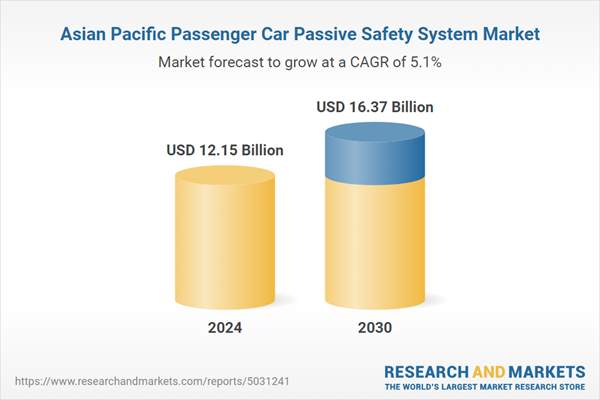

| Report Attribute | Details |

|---|---|

| No. of Pages | 135 |

| Published | July 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 12.15 Billion |

| Forecasted Market Value ( USD | $ 16.37 Billion |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | Asia Pacific |

| No. of Companies Mentioned | 10 |