Free Webex Call

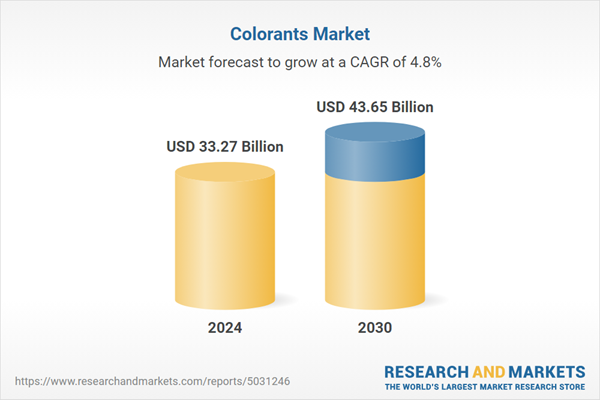

The Colorants Market was valued at USD 33.27 Billion in 2024, and is expected to reach USD 43.65 Billion by 2030, rising at a CAGR of 4.83%. Colorants are essential chemical substances used to impart vivid colors to a variety of materials, broadly categorized into dyes and pigments. Organic colorants are either naturally derived or synthesized using elements like carbon, hydrogen, oxygen, nitrogen, and sulfur, while mineral colorants have distinct chemical and physical characteristics. Pigments alter light color through selective absorption, and due to their insolubility and high tinting strength, they provide excellent durability and stability across applications. Dry pigments are widely used in paints, plastics, and coatings, where they are blended with binders for adhesion. From textiles and food to inks and industrial materials, the use of pigments dominates due to their superior permanence compared to dyes, which are soluble in their mediums. Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Growing Demand of Colorants in Automotive Industry

Colorants serve a crucial role in the automotive sector by providing both aesthetic value and functional protection to vehicle components. They are extensively utilized in automotive paints, plastic parts, and textiles, enhancing visual appeal and material durability. The growing consumer preference for premium and visually distinctive vehicles, particularly in emerging markets, is fueling demand for high-performance colorants.In 2024, global automotive production reached 75.5 million units, though regional variations impacted overall colorant demand. Europe saw a 6.2% decline due to muted business sentiment, while North America recorded a 3.2% drop with 11.4 million units produced. In contrast, South America posted modest growth, with Brazil contributing a 6.3% rise in production, pointing to increased localized demand for automotive colorants. These trends reflect shifting dynamics and potential opportunities for colorant applications in the automotive supply chain.

Key Market Challenges

Volatility in Prices of Raw Materials

A significant challenge for the global colorants market lies in the fluctuating prices of essential raw materials, which include petroleum derivatives, minerals, and increasingly, bio-based resources. These price shifts are influenced by global geopolitical developments, changing environmental regulations, and supply-demand imbalances.Such volatility directly impacts manufacturing costs and profitability, forcing producers to either absorb the higher costs or pass them on to customers - both of which affect market competitiveness. The unpredictable nature of raw material pricing also complicates strategic planning, budgeting, and forecasting. These dynamics underscore the importance for colorant manufacturers to closely monitor supply chains and adopt adaptive pricing and sourcing strategies to remain competitive amid market uncertainty.

Key Market Trends

Advancements in Biotechnology and Synthetic Biology

The emergence of biotechnology and synthetic biology is transforming the colorants industry by enabling the development of eco-friendly alternatives to conventional synthetic products. These innovative technologies use biological processes to produce colorants from renewable and sustainable sources, addressing the growing demand for environmentally responsible solutions.Biotechnologically derived colorants offer reduced environmental impact, making them attractive in a market increasingly focused on sustainability and low-carbon manufacturing. As consumer awareness and regulatory pressures around green chemistry continue to rise, these advancements are expected to gain traction, promoting the shift toward biologically produced colorants that align with global sustainability goals.

Key Market Players

- Clariant AG

- LANXESS AG

- Cabot Corporation

- du Pont de Nemours & Company

- Flint Group Inc.

- PolyOne Corporation

- Sun Chemical Corporation

- BASF SE

- DIC Corporation

- Huntsman Corporation

Report Scope:

In this report, the Global Colorants Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Colorants Market, By Type:

- Dyes

- Pigments

- Masterbatches

- Color Concentrates

Colorants Market, By End User:

- Packaging

- Building & Construction

- Automotive

- Textiles

- Paper & Printing

- Others

Colorants Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Colorants Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

1. Product Overview

2. Research Methodology

3. Executive Summary

5. Global Colorants Market Outlook

6. Asia Pacific Colorants Market Outlook

7. Europe Colorants Market Outlook

8. North America Colorants Market Outlook

9. South America Colorants Market Outlook

10. Middle East and Africa Colorants Market Outlook

11. Market Dynamics

12. Market Trends & Developments

14. Porter’s Five Forces Analysis

15. Competitive Landscape

Companies Mentioned

- Clariant AG

- LANXESS AG

- Cabot Corporation

- du Pont de Nemours & Company

- Flint Group Inc.

- PolyOne Corporation

- Sun Chemical Corporation

- BASF SE

- DIC Corporation

- Huntsman Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | July 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 33.27 Billion |

| Forecasted Market Value ( USD | $ 43.65 Billion |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |