Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Individuals with compromised immune systems are particularly vulnerable to certain infections. This includes those undergoing cancer treatment or recent organ transplant recipients. The individuals who have not been vaccinated against common infectious diseases, healthcare workers, and those traveling to high-risk areas with mosquito-borne pathogens like malaria and dengue fever are at increased risk.

Various laboratory tests are employed by doctors to diagnose infectious disorders. The global infectious disease testing market plays a critical role in the timely diagnosis and management of a wide array of contagious illnesses. With the growing prevalence of both viral and bacterial infections, there is a heightened need for rapid, accurate, and accessible diagnostic tools across healthcare systems. The market includes testing solutions for diseases such as HIV, hepatitis, tuberculosis, influenza, and more recently, emerging threats like COVID-19 and monkeypox.

Technological advancements have been a key driver, particularly the adoption of molecular diagnostics, point-of-care testing, and automation in laboratories. These innovations enable quicker turnaround times, increased sensitivity and specificity, and improved disease surveillance. The expansion of decentralized healthcare settings, such as home care and remote clinics, has further spurred demand for portable and easy-to-use test kits.

For instance, in December 2024, Moroccan biotech company Moldiag launched Africa’s first locally produced mpox test kits, representing a major milestone in strengthening the continent’s healthcare self-sufficiency. This development reduces dependence on imported diagnostic tools and enhances regional capacity to respond to infectious disease outbreaks. Moldiag’s initiative marks a critical advancement in building Africa’s biotechnology infrastructure and improving timely access to essential diagnostic solutions.

Key Market Drivers

Increasing Prevalence of Infectious Diseases

The global infectious disease testing market is experiencing significant growth due to the increasing prevalence of infectious diseases worldwide. The rising prevalence of infectious diseases, particularly tuberculosis (TB), is a key driver of growth in the global infectious disease testing market. According to WHO, TB caused 1.25 million deaths in 2023, making it the world’s leading infectious killer, surpassing COVID-19. With an estimated 10.8 million people falling ill globally, including many with drug-resistant TB, the demand for early, accurate, and accessible diagnostic testing continues to rise. The persistent emergence and re-emergence of infectious diseases have heightened the demand for accurate and timely diagnostic solutions.Outbreaks of diseases like COVID-19, Ebola, Zika, and antibiotic-resistant bacterial infections have underscored the need for rapid and efficient testing methods to detect, track, and manage these diseases. The globalization of travel and trade has facilitated the rapid spread of infectious agents across borders, making early detection and containment crucial to prevent outbreaks. This has driven up the demand for robust infectious disease testing infrastructure, including diagnostic assays, testing equipment, and surveillance systems.

The aging global population is more susceptible to infectious diseases, particularly due to compromised immune systems. As a result, there is a heightened focus on early detection and monitoring of infections in elderly individuals, contributing to market growth.

The rising awareness among healthcare professionals and the general public about the importance of early diagnosis and prompt treatment has also fueled demand. Timely infectious disease testing not only aids in better patient care but also helps in preventing the spread of diseases within communities. The increasing prevalence of infectious diseases, coupled with the need for rapid and accurate diagnosis, has led to substantial growth in the global infectious disease testing market. As infectious disease threats continue to evolve, the market is expected to further expand, with ongoing advancements in testing technologies and increased investment in public health infrastructure playing pivotal roles in addressing these global health challenges.

Key Market Challenges

Inadequate Reimbursements

Inadequate reimbursements within healthcare systems can indeed have a negative impact on the demand for global infectious disease testing. Reimbursements play a critical role in healthcare economics, affecting both healthcare providers and patients. When reimbursement rates for infectious disease testing are insufficient, healthcare providers, including hospitals, clinics, and laboratories, may struggle to cover the costs associated with testing. This financial strain can lead to reduced investment in testing infrastructure, limited availability of testing services, and even closures of diagnostic facilities in underserved areas.Inadequate reimbursement rates can deter healthcare providers from offering a comprehensive range of infectious disease testing services. This may result in reduced access to critical diagnostic tests, leaving patients with limited options for early disease detection and management. Lower reimbursement rates can discourage laboratories and diagnostic companies from investing in research and development to improve testing accuracy, speed, and accessibility. This can stifle innovation and hinder the development of more advanced and cost-effective testing solutions. Reduced access to infectious disease testing due to inadequate reimbursements can exacerbate healthcare disparities, disproportionately affecting underserved populations. These disparities can result in delayed diagnoses and poorer health outcomes in vulnerable communities.

Key Market Trends

Point-of-Care Testing (POCT)

POCT devices that offer rapid results and can be used outside traditional healthcare settings will continue to gain popularity. They are especially valuable in resource-limited and remote areas. POCT devices are designed to be user-friendly and portable, making them accessible even in areas with limited healthcare infrastructure. They can be used in remote clinics, field hospitals, and rural communities, bringing essential diagnostic capabilities closer to patients.In resource-limited and remote areas, access to centralized laboratories for traditional testing can be challenging. POCT devices offer the advantage of providing immediate results, allowing healthcare providers to diagnose and initiate treatment promptly. This is crucial for managing infectious diseases effectively and preventing their spread. Rapid results from POCT devices mean that patients do not have to wait for days or weeks to receive their test results. This helps alleviate anxiety, enables timely medical decisions, and improves patient satisfaction. POCT devices often require lower initial investments compared to establishing and maintaining a fully equipped laboratory. This cost-effectiveness is particularly valuable for healthcare facilities with limited budgets.

Key Market Players

- Biomérieux SA

- Abbott Laboratories Inc.

- Becton, Dickinson and Company

- Bio-Rad Laboratories Inc.

- Danaher Corporation

- F. Hoffmann-La Roche AG

- Siemens Healthineers AG

- Thermo Fisher Scientific Inc.

- Quidel Corporation

- Trinity Biotech PLC

Report Scope:

In this report, the Global Infectious Disease Testing Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Infectious Disease Testing Market, By Product & Service:

- Assays

- Kits

- Reagents

- Instruments

- Services & Software

Infectious Disease Testing Market, By Technology:

- Molecular Diagnostics

- Immunoassay

- Microbiology

- Others

Infectious Disease Testing Market, By Disease:

- Hepatitis

- Human Papillomavirus (HPV)

- Human Immunodeficiency Virus (HIV)

- Tuberculosis (TB)

- Hospital-Acquired Infections (HAIs)

- Others

Infectious Disease Testing Market, By End User:

- Hospital and Clinical Laboratories

- Diagnostic Reference Laboratories

- Academic/Research Institutes

- Others

Infectious Disease Testing Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Infectious Disease Testing Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Biomérieux SA

- Abbott Laboratories Inc.

- Becton, Dickinson and Company

- Bio-Rad Laboratories Inc.

- Danaher Corporation

- F. Hoffmann-La Roche AG

- Siemens Healthineers AG

- Thermo Fisher Scientific Inc.

- Quidel Corporation

- Trinity Biotech PLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | August 2025 |

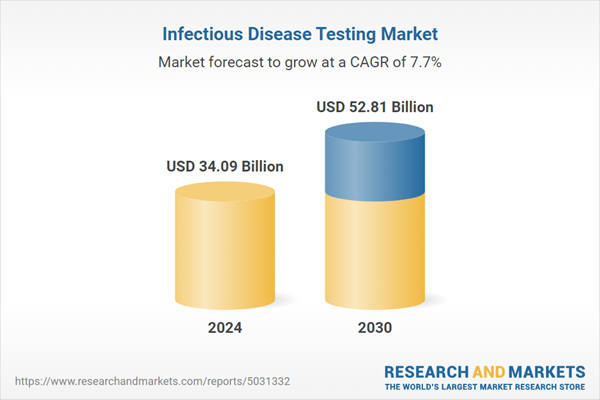

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 34.09 Billion |

| Forecasted Market Value ( USD | $ 52.81 Billion |

| Compound Annual Growth Rate | 7.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |