Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

There are three primary types of blood warmer devices: water bath warmers, which heat fluids by immersion in warm water; dry heat plate warmers, which use heated plates for warming; and intravenous fluid tube warmers, which warm the fluid directly in the tubing as it flows toward the patient. These devices are most effective at low flow rates and are generally used prior to or during blood transfusions. They are widely employed across intensive care units (ICUs), emergency departments, surgical suites, and ambulatory clinics.

Technological advancements have led to the development of portable and smart blood warmers using countercurrent heat exchange and microwave technology. These newer models offer improved efficiency and reliability, making them ideal for emergency and pre-hospital settings worldwide. For instance, as reported by Smart Surgeons in July 2024, around 30 million surgeries are performed each year in India. This substantial surgical volume highlights the growing need for advanced medical support systems. Consequently, the rising number of surgical procedures is anticipated to significantly drive the growth of related healthcare segments, including blood warmer devices, in the coming years, as they are essential in maintaining patient safety and preventing hypothermia during and after surgical interventions.

Key Market Drivers

Rising Cases of Hypothermia

Blood warmer devices are used to prevent or treat hypothermia during surgeries, trauma care, and other medical procedures. For instance, according to Military Health System statistics published in November 2024, cold weather injuries among active U.S. military personnel reached an incidence rate of 31.1 per 100,000 person-years during the 2023-2024 season. This marks an 8.4% increase compared to the 2022-2023 season, which reported a rate of 28.7 per 100,000, highlighting a rising concern for cold-related health risks in military operations.Maintaining a patient's body temperature within a normal range is essential to prevent complications associated with hypothermia, such as increased risk of infections, impaired wound healing, and cardiovascular issues. During surgeries, patients are often exposed to cold environments in operating rooms. Anesthesia can also lead to a drop in body temperature. According to data released by the National Library of Medicine in January 2024, the U.S. reports between 700 and 1,500 hypothermia-related casualties annually.

This growing incidence of cold weather injuries is expected to drive increased demand for blood warmer devices, as they play a crucial role in maintaining patient body temperature during emergency care and treatment, particularly in cases involving severe cold exposure or trauma. Blood warmer devices warm the intravenous fluids and blood before they are administered to the patient.

This helps prevent hypothermia during the surgical procedure, reducing the risk of complications such as slowed metabolism, impaired immune function, and blood clotting issues. Blood warmer devices are valuable in emergency situations where patients need immediate fluid resuscitation. Rapid warming of fluids helps stabilize the patient's condition and prevents further complications from hypothermia. Warming fluids before administration can help maintain proper blood flow, preventing constriction of blood vessels that can occur with cold fluids and reducing the risk of complications like organ dysfunction.

Key Market Challenges

Stringent Regulatory Framework

While regulations are put in place to safeguard patients and maintain high standards of quality, they can sometimes create barriers that hinder market growth and innovation. Stringent regulations often lead to longer and more complex approval processes for blood warmer devices. Manufacturers must go through rigorous testing, documentation, and evaluation before their products can be approved for sale and use. Delays in regulatory approval can slow down product introduction and hinder timely market access. Meeting stringent regulatory requirements requires significant financial investments in research, testing, and documentation.Small and innovative companies may struggle to allocate the resources necessary to navigate these requirements, potentially stifling competition and limiting product diversity. Stringent regulatory frameworks can create barriers to entry for new players in the market. Small startups or companies with limited resources may find it challenging to comply with regulatory requirements, limiting competition and inhibiting market growth. Blood warmer device manufacturers looking to enter international markets must navigate varying regulatory requirements across different regions and countries. This can complicate market expansion efforts and increase the cost and complexity of regulatory compliance.

Key Market Trends

Focus on Perioperative Care

Blood warmer devices help prevent hypothermia in patients before surgery. Hypothermia during the preoperative phase can lead to increased risk of surgical site infections, delayed wound healing, and complications related to anesthesia. During surgery, patients are often exposed to cold operating room environments, and anesthesia can cause temperature drops. Blood warmer devices warm intravenous fluids, blood products, and other fluids used during the procedure. This ensures that the patient's body temperature remains within the normal range, which is critical for optimal surgical outcomes.As the healthcare industry continues to prioritize patient-centered care and evidence-based practices, the demand for blood warmer devices in perioperative care is expected to rise. These devices are essential tools for ensuring that patients maintain optimal body temperature throughout the surgical process, resulting in improved patient outcomes, reduced complications, and overall enhanced perioperative care. Blood warmer devices play a crucial role in perioperative care, ensuring that patients maintain optimal body temperature before, during, and after surgery. This focus on comprehensive patient care will drive the demand for blood warmer devices.

Key Market Players

- Vyaire Medical, Inc.

- Stryker Corporation

- Estill Medical Technologies, Inc.

- The Surgical Company PTM

- Life Warmer Inc.

- MEQU

- Smisson-Cartledge Biomedical

- Gentherm Medical LLC

- Belmont Medical Technologies Ltd.

- 3M Co.

Report Scope:

In this report, the Global Blood Warmer Devices Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Blood Warmer Devices Market, By Product:

- Intravenous Warming System

- Surface Warming System

- Patient Warming Accessories

Blood Warmer Devices Market, By Type:

- Portable

- Non-Portable

Blood Warmer Devices Market, By Application:

- Preoperative Care

- Home Care

- Acute Care

- New-born Care

- Others

Blood Warmer Devices Market, By End User:

- Hospitals

- Blood Banks & Transfusion Centre

- Home Care Settings

- Others

Blood Warmer Devices Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Blood Warmer Devices Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Vyaire Medical, Inc.

- Stryker Corporation

- Estill Medical Technologies, Inc.

- The Surgical Company PTM

- Life Warmer Inc.

- MEQU

- Smisson-Cartledge Biomedical

- Gentherm Medical LLC

- Belmont Medical Technologies Ltd.

- 3M Co.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 188 |

| Published | August 2025 |

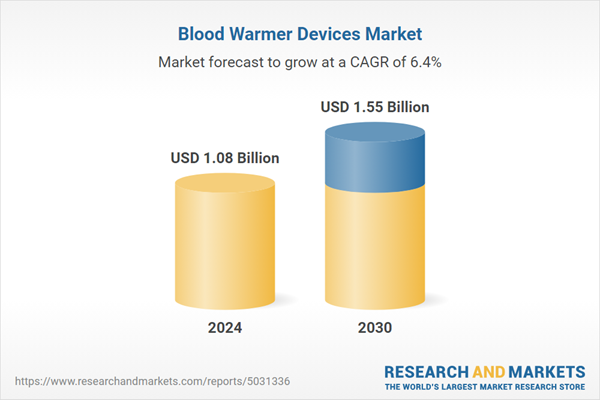

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.08 Billion |

| Forecasted Market Value ( USD | $ 1.55 Billion |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |