Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The construction market encompasses the economic sector primarily concerned with the planning, development, and execution of infrastructure projects, residential and commercial buildings, and other related structures. It involves a complex network of stakeholders, including contractors, architects, engineers, suppliers, and laborers, collaborating to bring projects from concept to completion. Key activities within this market include site preparation, foundation laying, building construction, and infrastructure development such as roads, bridges, and utilities.

Key Market Drivers

Real Estate Expansion

Real estate development constitutes another significant driver of the UAE construction market, reflecting the nation's dynamic property sector and demographic trends. With a rapidly growing population and increasing urbanization, there is a continuous demand for residential, commercial, and mixed-use developments across key emirates such as Dubai and Abu Dhabi. Over 40,000 residential units are expected to be delivered in Dubai in 2025 alone, driven by real estate expansion and rising demand from expatriates and high-net-worth individuals relocating to the UAE.The UAE's real estate sector is characterized by iconic projects like the Burj Khalifa and Palm Jumeirah, which have not only transformed the skyline but also attracted global investment and tourism. These landmark developments exemplify the country's ambition to create vibrant urban hubs that cater to diverse lifestyles and business needs.

The UAE government's proactive policies, including foreign ownership rights and investor-friendly regulations, have bolstered confidence in the real estate market. This has led to sustained investment inflows, supporting ongoing construction activities and driving innovation in architectural design, sustainable building practices, and smart city technologies.

Looking ahead, future trends in the UAE real estate market are likely to emphasize sustainability, affordability, and community-centric living. Initiatives such as the development of affordable housing projects and mixed-use neighborhoods aim to meet the evolving needs of residents and investors while fostering inclusive growth and social cohesion.

Key Market Challenges

Cost Overruns and Project Delays

Cost overruns and project delays represent persistent challenges in the UAE construction market, impacting both public and private sector projects. Despite advances in technology and project management practices, many construction projects in the UAE face budgetary constraints and scheduling setbacks, often due to various factors.One primary cause of cost overruns is the volatility of material prices and supply chain disruptions. The UAE, heavily reliant on imported construction materials, is vulnerable to fluctuations in global commodity markets, currency exchange rates, and geopolitical tensions. Sudden spikes in material costs can significantly inflate project budgets, affecting profitability and investor confidence.

labor shortages and productivity issues contribute to project delays. The UAE construction sector relies heavily on foreign labor, and fluctuations in immigration policies, labor market dynamics, and worker welfare standards can disrupt project timelines. Issues such as delays in obtaining necessary permits, bureaucratic red tape, and complex regulatory requirements further exacerbate construction challenges, leading to prolonged project delivery times.

The high expectations for quality and innovation in UAE construction projects often necessitate specialized skills and expertise. Shortages in qualified professionals, engineers, and technical specialists can hinder project execution and delay critical decision-making processes, impacting overall project efficiency and profitability.

Key Market Trends

Digital Transformation and Building Information Modeling (BIM)

Digital transformation is revolutionizing the UAE construction market, with an increasing emphasis on leveraging technology to improve efficiency, collaboration, and project outcomes. One key trend driving this transformation is the adoption of Building Information Modeling (BIM). BIM is a digital representation of the physical and functional characteristics of a building or infrastructure project, offering a collaborative platform for stakeholders to plan, design, construct, and manage projects more effectively.In the UAE, government initiatives and industry mandates are promoting BIM adoption across major construction projects. For instance, Dubai Municipality requires all buildings over 40 floors or 300,000 square feet to use BIM for design and construction phases. This mandate aims to enhance project coordination, reduce errors, optimize resources, and improve project delivery timelines.

BIM facilitates enhanced project visualization, clash detection, and virtual construction simulations, enabling stakeholders to identify and resolve potential issues before construction begins. This proactive approach minimizes costly rework, improves project scheduling accuracy, and enhances overall project quality. Additionally, BIM supports sustainable construction practices by enabling energy analysis, lifecycle assessment, and efficient building operations management.

Beyond BIM, other digital technologies such as Internet of Things (IoT), artificial intelligence (AI), and drone technology are transforming construction operations in the UAE. IoT sensors monitor construction site conditions in real-time, AI algorithms optimize project scheduling and resource allocation, and drones conduct aerial surveys and inspections with greater accuracy and efficiency.

Key Market Players

- Al Naboodah Construction Group (ANCG)

- China State Construction Engrg. Corp.

- Lennar Corporation

- Al Habtoor Group

- Skanska AB

- STRABAG SE

- Fluor Corporation

- Bechtel Corporation

Report Scope:

In this report, the UAE Construction Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:UAE Construction Market, By Industry Type:

- Industrial

- Commercial

- Infrastructure

- Residential

UAE Construction Market, By End User:

- Private

- Public

UAE Construction Market, By Region:

- Dubai

- Abu Dhabi

- Sharjah

- Rest of UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the UAE Construction Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Al Naboodah Construction Group (ANCG)

- China State Construction Engrg. Corp.

- Lennar Corporation

- Al Habtoor Group

- Skanska AB

- STRABAG SE

- Fluor Corporation

- Bechtel Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 89 |

| Published | July 2025 |

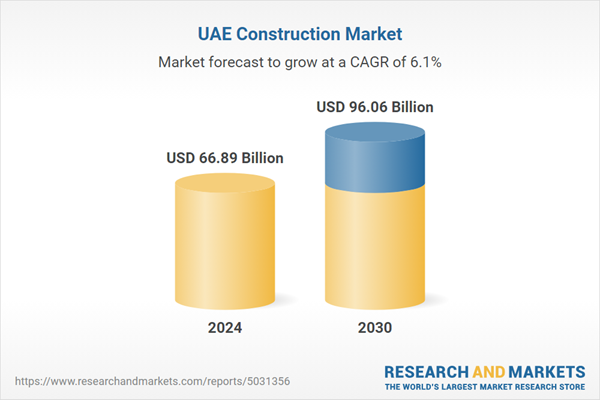

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 66.89 Billion |

| Forecasted Market Value ( USD | $ 96.06 Billion |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | United Arab Emirates |

| No. of Companies Mentioned | 8 |