Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

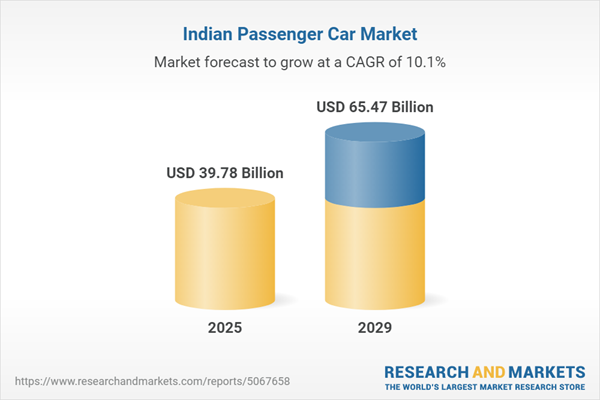

India Passenger Car Market Overview

In India, the automobile industry is crucial to both macroeconomic growth and technological development. The automobile industry depends on a number of factors, including the affordable availability of trained labor, strong R&D facilities, and steel manufacturing. After two-wheeler segments, the Indian automobile industry is being led by passenger cars. Additionally, emerging trends such as the electrification of vehicles, particularly compact passenger cars, are expected to propel market expansion in the future. Several automakers have started making significant investments in the passenger car segments of the market in order to keep up with the escalating demand. For example, Maruti Suzuki India stated in November 2022 that it intended to spend around to Rs. 7,000 crore (US$ 865.12 million) on several initiatives this year, including the construction of its new factory in Haryana and the launch of new passenger vehicles.India's economy is experiencing a slowdown due to COVID-19 disruption, which had a severe negative impact on domestic sales. Even though the Indian car industry has experienced hardship, it is beginning to recover and return to its pre-pandemic sales volume levels. The passenger car industry has already started to recover in 2022. Furthermore, the demand would increase as a result of strong purchasing in semi-urban and rural areas. Despite the challenges such as rising fuel costs, a shortfall of semiconductors, and supply chain interruptions, the sector has proven resilient.

Increasing Demand for Compact SUV in the Market

In India, sports utility vehicles have replaced hatchbacks as the dominant segment of the market for passenger cars. With a sales share of over 22%, compact SUVs have grown to become the largest category of the Passenger car market. In 2022 financial year, the top-selling sector in the Indian passenger car industry is expected to be compact SUVs, surpassing premium small cars. As sport utility vehicles (SUVs) are becoming more and more popular with consumers, the SUV market has splintered, with compact SUVs taking the lead in terms of sales and market share. 664,000 small SUVs were sold in 2022, thereby increasing the whole SUV segment's size to surpass that of hatchback vehicles. Rising utility vehicle affordability has been positively accepted by the general public, and manufacturers have met consumer demand for a competitively priced product offering.Rise in Raw Material Cost and Production Cost

The cost of raw materials for essential components, notably metals, has considerably increased in recent times. Market participants are managing advertising and marketing expenses in order to maintain the vehicle cost effectiveness and optimizing the production process to combat growing raw material prices. The Indian passenger vehicle industry is also faced with a significant problem due to the increase in gasoline prices. Additionally, the market is hampered by supply chain delays and a rise in component costs overall, and it is projected that the Indian passenger car market will grow more slowly in the initial years.Increasing Electrical Vehicle Adoption

Customers' preferences are shifting towards electric vehicles due to recent breakthroughs and government initiatives. A significant group of individuals prioritizing functionality, ergonomics, and technology, results in more investment in electric vehicles and increasing demand. The Indian EV market appears to be on the rise. Both the private and public sectors have made significant investments in this industry. The sales of electric vehicles are increasing due to their increasing features and specifications, as well as their long range. Battery electric passenger car sales have surpassed 18,000 units in the first half of 2023, according to the Federation of Automobile Dealers Associations (FADA), and they are anticipated to rise in the upcoming years.Recent Development

Tata Motors files a record amount of 158 Patents and 79 Designs in 2023, making it the Indian OEM with the most cumulative patent filings in the nation for both commercial and passenger vehicles.Tata Motors, India's top car manufacturer and the pioneer of India's EV evolution, obtained an order in 2023 to provide 1000 XPRES-T EVs to OHM E Logistics Pvt. Ltd. in Hyderabad for their electric cab transportation services.

Tata Motors and Uber, the top ridesharing service in India, inked a memorandum of understanding in 2023 to integrate 25,000 XPRES-T EVs into Uber's premium category service.

In order to fulfil its commitments to sustainable mobility, Tata Motors introduced Re.Wi.Re - Recycle with Respect, its first Registered Vehicle Scrapping Facility (RVSF), in Jaipur, Rajasthan, in 2023.

The adoption of electric vehicles (EVs) in the nation will be aided by a partnership between Tata Motors and ICICI Bank in 2023 which provides financing for EV dealers for faster purchase.

Mahindra Research Valley (MRV) has been awarded 210 patents in 2023, more than any other Indian Original Equipment Manufacturer (OEM) in the previous six quarters.

Mahindra & Mahindra Ltd. (M&M Ltd.) declared in 2022 that the Maharashtra Government's industrial promotion scheme for Electric Vehicles had approved their investment of Rs. 10,000 Crore (about USD 1.2 Billion) for electric vehicles.

In 2022, Tech Mahindra declared that they have joined forces with the open EV coalition MIH (Mobility in Harmony) Consortium, which was founded by Foxconn and fosters cooperation in the mobility sector.

In 2022, Mahindra & Mahindra's new design centre of excellence, Mahindra Advanced Design Europe (M.A.D.E), will open and be used to build the company's range of electric vehicle products.

To increase Hyundai's brand recognition in rural regions, Hyundai Motor India Ltd. announced in 2023 a novel corporate relationship with ITC Agro Business Division (ABD).

Market Segmentation

The India passenger car market is segmented based on vehicle type, by propulsion, by transmission type, by price segment, by region, and Top 10 Cities. On the basis of vehicle type, the market is segmented into Sedan, SUV, MPV, Hatchback. Based on the propulsion, it is further segmented into Petrol, Diesel, CNG, Hybrid, Electric. Based on the Transmission Type, the market is segmented into Automatic and Manual. Based on Price Segment, the market is segmented into Ultra Budget, Budget, and Premium. Furthermore, the market is also divided into region-wise, mainly north, west, south and east.Company Insights

In 2023, Tata Motors is expected to introduce the Altroz iCNG, India's first two-cylinder CNG technology, in an effort to revolutionize the CNG market.The Mahindra Company released its first electric SUV, the XUV400. According to the Indian Driving Cycle (MIDC), this vehicle can go 456 km on a single full charge. It also boasts the highest functional safety for an India-made EV, created in accordance with ISO requirements.

Hyundai Motor India Ltd. announced the introduction of the GRAND i10 NIOS Corporate Edition in May 2022.

Company Profiles

Some of the major players which are leading in India Passenger Car Market are Maruti Suzuki India Limited, Hyundai Motor India Limited, Mahindra & Mahindra Ltd, Honda Cars India Ltd., Tata Motors Limited, Toyota Kirloskar Motor Pvt Ltd., Ford India Private Limited, Volkswagen India Private Limited, Mitsubishi Motor India Private Limited, FCA India Private Limited.Report Scope:

In this report, India Passenger Car Market has been segmented into following categories, in addition to the industry trends which have also been detailed below:India Passenger Car Market, By Vehicle Type:

- Sedan

- SUV

- MPV

- Hatchback

India Passenger Car Market, By Propulsion:

- Petrol

- Diesel

- CNG

- Hybrid

- Electric

India Passenger Car Market, By Transmission Type:

- Automatic

- Manual

India Passenger Car Market, By Price Segment:

- Ultra Budget

- Budget

- Premium

India Passenger Car Market, By Region:

- North

- South

- West

- East

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in India Passenger Car Market

Available Customizations:

With the given market data, the publisher offers customizations according to a company’s specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Maruti Suzuki India Limited

- Hyundai Motor India Limited

- Mahindra & Mahindra Limited

- Honda Cars India Ltd.

- Tata Motors Limited

- Toyota Kirloskar Motor Pvt Ltd.

- Ford India Private Limited

- Volkswagen India Private Limited

- Mitsubishi Motor India Private Limited

- FCA India Private Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 73 |

| Published | August 2023 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 39.78 Billion |

| Forecasted Market Value ( USD | $ 65.47 Billion |

| Compound Annual Growth Rate | 10.1% |

| Regions Covered | India |

| No. of Companies Mentioned | 10 |