Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

According to the Road Transport Department (JPJ Malaysia), as of end-2023, there were over 13.6 million registered two-wheelers in Malaysia. According to the Malaysian Automotive Association (MAA), In 2023, over 580,000 new two-wheelers were sold, a 2.5% increase from 2022.

These vehicles are more maneuverable, consume less fuel, and cost less to maintain, making them ideal for city travel. Government initiatives to promote efficient transportation options and support for green mobility are contributing to the sector’s expansion. Demand is also rising in semi-urban areas where two-wheelers offer a practical solution for both personal and commercial use.

Consumer preferences are shifting toward smart, connected, and lightweight vehicles, supported by improved design, digital instrument clusters, and better engine performance. Electric two-wheelers are emerging as a viable alternative, especially in cities with better charging infrastructure. Young consumers are increasingly drawn to stylish and tech-savvy models that combine performance and aesthetics. Leasing and subscription models are also gaining ground as consumers seek more flexible ownership options. Two-wheelers are no longer limited to budget-conscious segments but are finding appeal across lifestyle, sport, and delivery use cases.

Market Drivers

Growing Urbanization and Traffic Congestion

Rapid urban growth in Malaysian cities has increased daily commuting challenges, with severe congestion on roads being a major issue. According to the Institute of Road Safety Research (MIROS, 2023), more than 60% of motorcycle users in Malaysia use them for daily commuting, especially in urban and semi-urban areas. Two-wheelers offer a practical and efficient solution for navigating through heavy traffic. They reduce travel time, fuel usage, and parking difficulties, making them an attractive option for urban dwellers. Rising middle-class populations in metropolitan areas further drive demand for affordable personal mobility.The increasing use of motorcycles for ride-hailing and courier services in urban areas also supports market expansion. As cities expand vertically and horizontally, the demand for agile transportation options that can move quickly through dense traffic will continue to grow. Consumers in both residential and commercial zones favor two-wheelers for short- to mid-range travel. This trend contributes to a steady and sustained increase in sales of both motorcycles and scooters, reinforcing their importance in Malaysia’s broader urban mobility ecosystem.

Key Market Challenges

Limited Charging Infrastructure for EVs

Despite growing interest in electric two-wheelers, Malaysia faces significant limitations in EV charging infrastructure. Most charging facilities are concentrated in select urban zones, leaving large parts of the country under-equipped. This discourages potential buyers who are concerned about charging accessibility during daily use. Home charging remains a challenge for residents in high-rise apartments or shared housing. Limited interoperability between charging stations, lack of fast-charging options, and insufficient government-mandated charging standards further compound the issue.The current pace of infrastructure development does not match the rising number of electric vehicles entering the market. Private sector participation in setting up charging networks is growing, but without unified regulations and incentives, progress remains slow. Until charging becomes more widespread, consumers may hesitate to fully transition to electric two-wheelers. This infrastructure gap poses a major hurdle to achieving mass electrification goals and limits the full potential of the EV segment.

Key Market Trends

Growing Popularity of Electric Two-Wheelers

Electric two-wheelers are steadily gaining popularity in Malaysia due to rising fuel prices, environmental concerns, and growing government support for electrification. Consumers are increasingly exploring battery-powered scooters and motorcycles for short-distance travel in urban areas. Improvements in battery technology, such as enhanced range and faster charging, are addressing initial consumer concerns. Manufacturers are introducing a wide range of electric models across various price points and styles to attract both daily commuters and tech-savvy youth.The integration of digital dashboards, GPS, and app connectivity adds value and appeal to modern buyers. Pilot programs by municipal authorities and ride-sharing companies are further familiarizing the public with electric mobility. While infrastructure challenges persist, the early momentum and positive sentiment are strong indicators of long-term growth. As awareness and accessibility improve, electric two-wheelers are expected to transition from being a novelty to a mainstream mobility solution in the country.

Key Market Players

- Harley-Davidson, Inc.

- Honda Motor Co., Ltd.

- Kawasaki Motors Corp.

- KSR Group

- Modenas

- Piaggio & C. S.p.A.

- Sanyang Motor Co., Ltd.

- Suzuki Malaysia Sdn. Bhd.

- Triumph Motorcycles Malaysia

- Yamaha Motor Co., Ltd.

Report Scope:

In this report, the Malaysia Two-Wheeler Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Malaysia Two-Wheeler Market, By Vehicle Type:

- Motorcycle

- Scooter/Moped

Malaysia Two-Wheeler Market, By Propulsion:

- Internal Combustion Engine

- Electric Vehicles

Malaysia Two-Wheeler Market, By End Use:

- Personal

- Commercial

Malaysia Two-Wheeler Market, By Region:

- Northern

- Southern

- Central

- East Coast

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Malaysia Two-Wheeler Market.Available Customizations:

With the given market data, the publisher offers customizations according to the company’s specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Harley-Davidson, Inc.

- Honda Motor Co., Ltd.

- Kawasaki Motors Corp.

- KSR Group

- Modenas

- Piaggio & C. S.p.A.

- Sanyang Motor Co., Ltd.

- Suzuki Malaysia Sdn. Bhd.

- Triumph Motorcycles Malaysia

- Yamaha Motor Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | August 2025 |

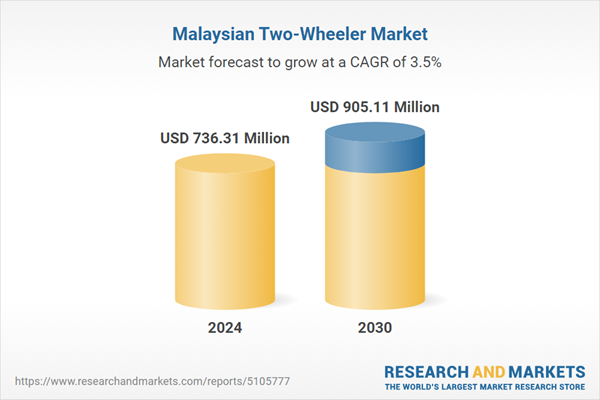

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 736.31 Million |

| Forecasted Market Value ( USD | $ 905.11 Million |

| Compound Annual Growth Rate | 3.5% |

| Regions Covered | Malaysia |

| No. of Companies Mentioned | 10 |