Automotive manufacturers are increasingly integrating power electronics components like inverters, converters, and battery management systems to enhance vehicle performance and reduce emissions. Simultaneously, the rise of solar and wind energy installations is accelerating the deployment of power electronic inverters and controllers to ensure grid stability and energy optimization. Technological advancements in wide bandgap semiconductors (such as SiC and GaN), compact ICs, and intelligent power modules are boosting system efficiency, reliability, and thermal performance. Furthermore, ongoing investments in 5G infrastructure, smart grids, and industrial IoT are contributing to increased adoption of power electronics in telecommunications and factory automation.

Low voltage segment to account for largest market share during the forecast period

The low voltage segment is estimated to account for the largest market share during the forecast period due to its widespread use in consumer electronics and automotive applications, rapid adoption in industrial automation and IoT devices, and increasing demand for compact, energy-efficient power management solutions. Widespread use in consumer electronics and automotive applications drives consistent, high-volume demand for low-voltage components like power ICs and converters, which are essential for battery-powered devices such as smartphones, laptops, and onboard vehicle systems in electric and hybrid vehicles. As global demand for these devices continues to rise, so does the consumption of low-voltage power electronics.Additionally, the rapid adoption of industrial automation and IoT technologies requires low-voltage solutions to ensure safe and efficient operation of smart sensors, controllers, actuators, and connected devices. These components play a critical role in enabling real-time control, communication, and energy optimization across manufacturing and industrial environments. Furthermore, the rising demand for compact and energy-efficient power management solutions supports the integration of low-voltage power electronics in space-constrained and portable applications. With increasing emphasis on energy savings and sustainability, industries across the board are driving the demand for low-voltage systems, solidifying their dominant position in the power electronics market.

Power modules segment projected to register highest CAGR during forecast period

The power modules segment is expected to witness the highest CAGR during the forecast period due to the rising adoption of electric vehicles (EVs) and renewable energy systems, increasing demand for compact and high-efficiency power solutions, and advancements in wide bandgap semiconductor materials like SiC and GaN. Rising EV and renewable energy adoption is significantly boosting demand for power modules, as they are critical for managing high power loads in electric drivetrains, battery management systems, and solar/wind inverters. Their high efficiency, thermal stability, and reliability make them ideal for these applications.The increasing demand for compact and efficient power solutions across industries, particularly in automotive, industrial automation, and telecommunications, is driving the adoption of power modules, which integrate multiple power components into a single, streamlined package. This integration helps minimize power loss, reduce space requirements, and enhance overall system performance. Furthermore, advancements in wide bandgap materials such as silicon carbide (SiC) and gallium nitride (GaN) are transforming power module capabilities by enabling higher voltage tolerance, faster switching speeds, and improved energy efficiency compared to conventional silicon-based modules. These innovations make power modules increasingly attractive for high-performance and high-frequency applications, accelerating their adoption and driving strong growth in the power electronics market during the forecast period.

North America to register second-highest CAGR during forecast period

North America is anticipated to experience the second-highest CAGR during the forecast period, driven by robust developments in electric vehicle (EV) and charging infrastructure, growing uptake of renewable energy systems, and accelerating investments in industrial automation and smart grid technologies. Technological developments in EVs and charging infrastructure are driving the demand for inverters, converters, and battery management systems to a great extent, which are key to improving vehicle performance, optimizing energy conversion, and achieving charging efficiency.At the same time, increasing adoption of renewable energy systems, especially solar and wind, has generated demand for power converters and grid integration technologies that support efficient, stable, and smooth energy transmission between regional grids. In addition, North America is witnessing robust investments in industrial automation and power grid modernization.

These trends are fueling broader adoption of advanced power management solutions to monitor in real-time, achieve energy efficiency, and balance loads. The installation of smart grid technologies and automated industrial systems is heavily dependent on high-performance, efficient power electronics, which contribute to the growth of the regional market. Overall, these factors contribute to making North America a key growth hub for the power electronics market during the forecast period.

Extensive primary interviews were conducted with key industry experts in the power electronics market to determine and verify the market size for various segments and subsegments gathered through secondary research. The breakdown of primary participants for the report is shown below.

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type - Tier 1 - 55%, Tier 2 - 25%, and Tier 3 - 20%

- By Designation - Directors - 50%, Managers - 30%, and Others - 20%

- By Region - Asia Pacific - 45%, Europe - 30%, North America - 20%, and RoW - 5%

The study includes an in-depth competitive analysis of these key players in the power electronics market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report segments the power electronics market and forecasts its size by device type (Power Discrete, Power Module, Power ICs), material (Silicon, Silicon Carbide, Gallium Nitride), and vertical (ICT, Consumer Electronics, Industrial, Automotive & Transportation, Aerospace & Defense, Other Verticals). It also discusses the market’s drivers, restraints, opportunities, and challenges. It gives a detailed view of the market across four main regions (North America, Europe, Asia Pacific, and RoW). The report includes a value chain analysis of the key players and their competitive analysis in the power electronics ecosystem.Key Benefits of Buying the Report:

- Analysis of key drivers (Widespread adoption of renewable power sources, Rapid development of electric vehicles, Growing demand for energy-efficient power electronics in consumer electronics industry and enterprises), restraints (High cost of designing and complexities associated with integrating multiple functionalities into single chip), opportunities (Emergence of wide bandgap semiconductors, Growing adoption of SiC power switches), challenges (Difficulties in designing and packaging SiC power devices)

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product launches in the power electronics market

- Market Development: Comprehensive information about lucrative markets - the report analyses the power electronics market across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the power electronics market

- Competitive Assessment: In-depth assessment of market shares and growth strategies of leading players, such as Infineon Technologies AG (Germany), Texas Instruments Incorporated (US), Semiconductor Components Industries, LLC (US), STMicroelectronics (Switzerland), Analog Devices, Inc. (US), NXP Semiconductors (Netherlands), ROHM Co., LTD. (Japan), Mitsubishi Electric Corporation (Japan), Wolfspeed, Inc. (US), Transphorm Inc. (US), Qorvo, Inc. (US), Renesas Electronics Corporation (Japan), TOSHIBA CORPORATION (Japan), Fuji Electric Co., Ltd. (Japan), and Vishay Intertechnology, Inc. (US).

Table of Contents

Companies Mentioned

- Infineon Technologies AG

- Semiconductor Components Industries, LLC

- Stmicroelectronics

- Texas Instruments Incorporated

- Analog Devices, Inc.

- Mitsubishi Electric Corporation

- Vishay Intertechnology, Inc.

- Fuji Electric Co. Ltd.

- Toshiba Corporation

- Renesas Electronics Corporation

- ABB

- Littelfuse, Inc.

- Nxp Semiconductors

- Microchip Technology Inc.

- Rohm Co. Ltd.

- Semikron

- Transphorm Inc.

- Qorvo, Inc.

- Wolfspeed, Inc.

- Euclid Techlabs

- Navitas Semiconductor

- Efficient Power Conversion Corporation

- Powdec

- Ganpower

- Nexgen Power

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 266 |

| Published | August 2025 |

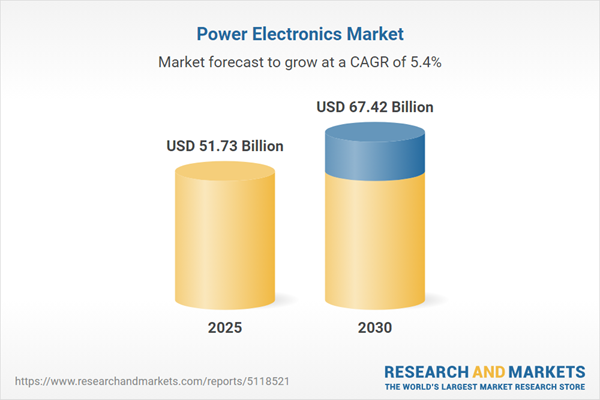

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 51.73 Billion |

| Forecasted Market Value ( USD | $ 67.42 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |