Owing to the COVID-19 pandemic, nationwide lockdowns around the globe, disruptions in manufacturing activities and supply chains, and production halts negatively impacted the market. However, conditions started recovering in 2021, which is expected to restore the market’s growth trajectory during the forecast period.

- The major factors driving the market’s growth include the high consumption of andalusite in refractory product manufacturing.

- On the flip side, inconsistent supply and price of andalusite are likely to hinder the market.

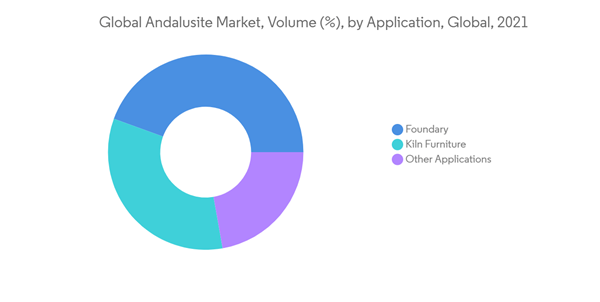

- The refractories application is expected to dominate the market for andalusite during the forecast period.

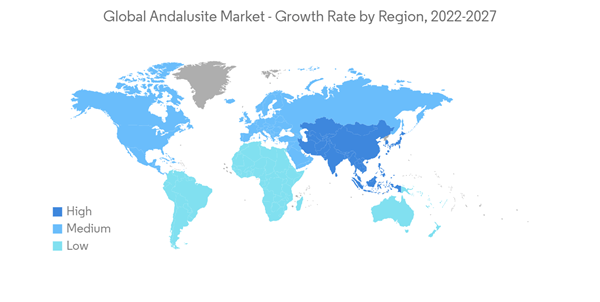

- The Asia-Pacific region is predicted to hold the largest share of the andalusite market globally, owing to the region’s high demand for steel and iron.

Key Market Trends

Demand from Refractories Segment to Boost the Andalusite Market

- Andalusite is an alumino-silicate raw material utilized widely in the production of refractory linings. Refractory materials ought to be truly and synthetically stable at high temperatures and impervious to thermal shocks. Andalusite has low porosity, stable volume, high virtue, and high thermal shock resistance, which makes it suitable for refractory applications.

- Thus, refractories made with andalusite can be utilized viably under rough conditions. For the most part, andalusite shapes under low-tension and high-temperature conditions and changes over to sillimanite or kyanite in the diverse temperature-pressure system.

- The increasing utilization of andalusite in refractories for end-use industries like metallurgy is driving the market growth. Developing applications of steel in the automotive industry also rely upon refractories.

- In the steel industry, internal linings are required in furnaces used in making iron and steel, vessels used for holding and transporting metal and slag; furnaces used for heating steel before further processing, and in the stacks or flues through which hot gases are conducted.

- According to the World Steel Association, the global steel production reached about 1950.5 ton in 2021, registering an increase of 3.7% compared to 1880.4 ton in 2020. This demand in the market is expected to boost demand for refractories and andalusite.

- Furthermore, andalusite-based products are very popular in Europe and Asia-Pacific for producing fired and unfired refractories.

- All the aforementioned factors are expected to drive the andalusite market during the forecast period.

Asia-Pacific to be the Largest Market for Andalusite

- Steel is a significant material utilized in shipbuilding and vehicle production as well as building and construction. Thus, the increasing demand for andalusite from the steel industry is expected to result from the development and framework improvements in these end-user industries.

- China is the largest producer of steel in the world. In 2021, the country's annual crude steel production capacity stood at 1,032.8 ton, registering more than 50% of global production. This huge demand for steel in the country projects market opportunities for refractories.

- According to the ITC Trade Map, China is the second-largest importer after Germany, and the imported value of the mineral commodities “andalusite, kyanite, and sillimanite” stood at USD 15.97 million in 2020 as compared to USD 13.05 million in 2019, recording an increase of 22%, which was suggestive of increasing demand from the region.

- Furthermore, China is experiencing massive growth in its construction sector. According to the National Bureau of Statistics of China, in 2021, the construction output in China was valued at approximately CNY 29.31 trillion. Thus, it is likely to provide huge demand for the market studied.

- Moreover, India is likely to witness an investment of around USD 1.3 trillion in housing over the next seven years, during which it is likely to witness the construction of 60 million new homes. The rate of availability of affordable housing is expected to rise by around 70% in 2024.

- Furthermore, Asia-Pacific has the largest automotive manufacturing hub, which accounts for more than 60% of global production. According to OICA, in 2021, the region’s total production stood at 46.73 million units, an increase of 6% compared to 2020, thus augmenting the market studied.

- Thus, the abovementioned sectors are the major end-user industries of the product. Rising demand from various industries is expected to drive the market studied in the region during the forecast period.

Competitive Landscape

The andalusite market is consolidated. Some of the key players in the market (not in any particular order) include Andalucita SA, LKAB Minerals, Andalusite Resources, Resco Products, and Recursos Latinos SA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Andalucita SA

- Andalusite Resources

- Imerys Refractory Minerals

- Keyhan Payesh Alvand

- LKAB Minerals

- Picobello Andalucita

- Recursos Latinos SA

- Resco Products

- Xinjiang Xinrong Yilong Andalusite Co. Ltd