Almonds are widely used as ingredients in manufactured goods, including cereal and granola bars, as snacks, in in-home baking, and at food service outlets. The growing popularity of almonds is, in part, attributed to the rise of plant-based milk, such as almond milk. Almond milk is considered the healthier alternative to regular milk, especially for the lactose-intolerant population, offering consumers a low-fat, high-protein option. Almond milk has become a staple for many supermarkets and coffee shops.

Besides, new branded products and innovative uses of almonds in ice cream, confectioneries, and baked goods have been introduced. For instance, in 2023, Blue Diamond Growers launched a new product called Thin Dipped Almonds, which is available in two flavors, namely double dark chocolate and dark chocolate sea salt caramel. It is cholesterol-free, high in vitamin E, and contains no artificial flavors or colors. In addition, nut flour is expanding as an alternative to regular wheat flour in the gluten-free market, increasing the potential for market growth during the study period.

Almond Market Trends

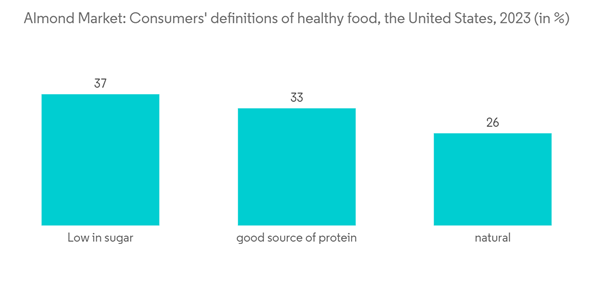

Inclination Toward Healthy Snacking Options

The increased preference for healthy and nutritious snack foods is driving the demand for almonds owing to their several health benefits. A large epidemiological study of health professionals found that tree nuts, including almonds, eaten twice or more weekly, can reduce the risk of total cardiovascular disease by 13% and coronary heart diseases by 15%. Changing dietary patterns and high disposable income increase the demand for on-the-go healthy snacking options containing almonds, fueling the market growth. Manufacturers are launching innovative and health-oriented products consisting of almonds, either as a whole or as an ingredient, as a business expansion strategy in the healthy snack segment. For instance, in March 2021, PepsiCo introduced Hilo Life, a low-carb snack brand in North America, using defatted almond flour as a base ingredient. According to the company, the product contains less fat and more protein than traditional almond flour. These products are gaining popularity, especially among vegans and health-conscious consumers, propelling the market growth.North America is Leading the Market in Terms of Production

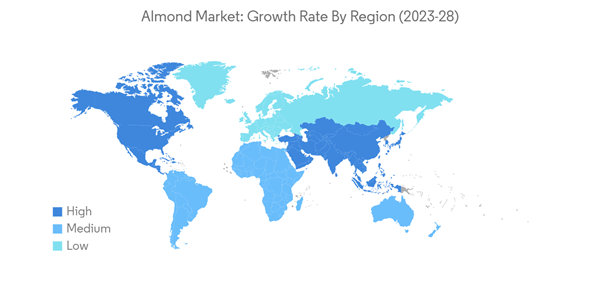

Due to extensive production, consumption, and exports, North America has the largest share of the almond market. The United States continues to capture the largest market share for almonds. According to FAO, the United States is the primary producer of almonds, followed by Spain, Iran, and Australia. The favorable climate with fertile soil and abundant sunshine and the required equipment to be used during growth, harvesting, processing, and packaging in the country favor the enhanced production of almonds.In the United States, the majority of almonds are consumed as ingredients in manufactured goods, as snacks, in in-home baking, and at food service outlets. The expanding consumer palate for international cuisines supports the market growth. Innovative uses for almonds in processing the not-yet-ripe kernels of green almonds further drive the market. These almonds are harvested early, and chefs at gourmet restaurants use the liquid kernels to add a delicate taste to high-end dishes. The rise of the vegan population also expands the demand for almonds in gluten-free and non-dairy packaged products.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.