The COVID-19 pandemic had a significant impact on the growth of the market. Diagnostic and surgical companies were impacted by the lockdown measures within the country, which also decreased public mobility in China, resulting in fewer surgical procedures. According to the study published in September 2022 by Obesity Surgery, the number of bariatric surgeons and institutions increased more than threefold from 2010. In 2010, 2019, and 2020, surgeons in IFSO-APC societies performed 18,280, 66,010, and 49,553 bariatric/metabolic surgeries, respectively. However, due to the COVID-19 pandemic, restriction policies significantly reduced access to procedures in Southeast Asian countries. Thus, many COVID-19-positive patients and their significant impact on healthcare systems across the country resulted in a decline in the number of bariatric procedures performed, adversely impacting market growth in 2020 and slightly in 2021. However, analysis shows that the market gained traction after the pandemic and is expected to reach its pre-pandemic levels.

The major factors attributed to the growth of the Chinese bariatric surgery market are increased obesity levels among the Chinese population and a rising prevalence rate of Type 2 diabetes and heart diseases. People with more fatty tissues in their bodies are highly likely to be affected by diabetes. Hence, these patients take certain measures to prevent obesity through bariatric surgeries. For instance, according to the updates from August 2021 by the International Diabetes Federation, an estimated 1.08 billion people aged 20 to 79 in China had diabetes in 2021, by far the highest number in any country. The country had about 336 million children and adolescents up to 19 years old with type 1 diabetes (T1DM). Some major risk factors for T1DM include a family history of diabetes, genetics, infections, and other environmental influences. Hence, the high burden of diabetes linked to obesity and the increasing prevalence of risk factors associated with obesity are expected to fuel growth in the bariatric surgery market in China over the forecast period.

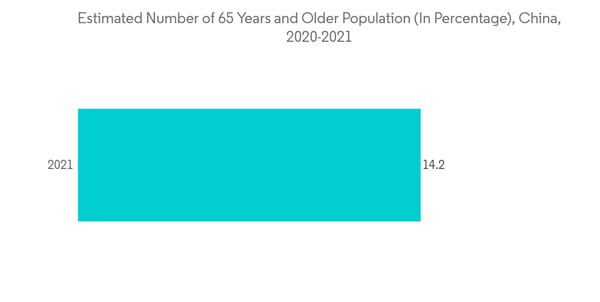

Moreover, according to the study published in June 2021 by Frontiers in Endocrinology in China, over one in seven individuals meet the criteria for overall obesity and one in three for abdominal obesity. Age-standardized rates of overall and abdominal obesity were 14.4% and 32.7% in women, respectively, and 16.0% and 36.6% in men. Obesity varied considerably across socio-demographic subgroups. Older women were at higher risk for obesity than women aged 65-75 versus 35-44 years (1.29 for overall obesity and 1.76 for abdominal obesity), while older men were not. As a result, the market for bariatric surgery is anticipated to grow over the forecast period due to the rising prevalence of obesity and the increased need for surgical procedures.

However, the high cost of surgery is expected to hinder the growth of the market over the forecast period.

China Bariatric Surgery Market Trends

The Stapling Devices Segment is Expected to Hold a Major Market Share in the China Bariatric Surgery Market

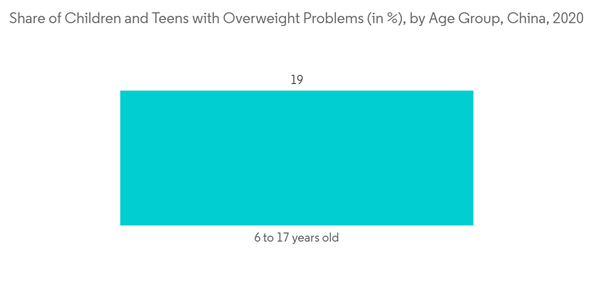

The stapling devices segment is expected to show a comparatively higher growth rate over the forecast period than other devices used in bariatric surgeries. It is one of the most commonly used devices. It tends to result in greater and more consistent weight loss among patients and a more significant reduction in obesity-related health problems.According to a study published in the Global Health Journal in September 2022, obesity has become a severe public health problem. China has the world's largest number of people with obesity or overweight. More than 50% of adults and about 20% of children and adolescents in China are overweight or obese. Over the past 20 years, China has made many efforts in obesity intervention while obesity rates continued rising. Thus, owing to the increasing prevalence of obesity, which results in more surgeries, the segment is expected to show significant growth during the forecast period.

Moreover, as per the NBS (China) and MOH (China) data updated in October 2021, the total expenditure on health care in China reached over 7.2 trillion RMB (about 999 billion USD) in 2020. The figure included government spending, collective spending, and private out-of-pocket spending on health care. These are expected to increase the adoption of advanced medical devices in surgeries, including surgical staplers, in the country.

Thus, due to the abovementioned factors, the stapling devices segment is expected to grow during the forecast period.

The Gastric Balloons Segment is Expected to Record a High CAGR During the Forecast Period

A gastric balloon, also referred to as an intragastric balloon (IGB) or a stomach balloon, is an inflatable medical tool that is momentarily inserted into the stomach to aid in weight loss. The introduction of new products, increased patient awareness, collaboration with bariatric surgery centers, and manufacturing optimization to increase operating leverage are some of the factors driving the demand for gastric balloons in the bariatric surgery market within China.As per the press release by the Beijing Friendship Hospital, in March 2021, the first gastric balloon, the 'Spheria intragastric balloon,' was successfully implanted into the stomach of a patient in China. The Spheria intragastric balloon was developed and manufactured by Changzhou Zhishan Medical Technology Co. Ltd. It is the first completely non-invasive weight loss medical device in the country that does not require endoscopy, anesthesia, or surgery. Currently, according to the update by the company, in November 2021, the clinical trial for esibsic (the effectiveness and safety of the intragastric balloon system in China) was underway. Such instances are expected to boost the growth of the market segment over the forecast period.

Moreover, according to the clinicaltrials.gov update, as of December 2022, there are currently eight clinical trials going on for gastric balloons in China. Thus, increasing research and development in the country is expected to boost the growth of the segment during the forecast period. Due to the abovementioned factors, the gastric balloon segment is expected to grow during the forecast period.

China Bariatric Surgery Market Competitor Analysis

The China bariatric surgery market is consolidated and competitive. Manufacturers are innovating new non-invasive technologies to reduce patients’ time in hospitals, decreasing the chances of infection and saving costs. Additionally, smaller players are implementing strategies, such as acquisitions, to expand their product portfolio and gain roots in the industry. Some of the major players in the market are Cousin Biotech, Reach Surgical, Olympus Corporation, and ReShape Lifesciences Inc., among others.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Cousin Biotech

- Reach Surgical

- Olympus Corporation

- ReShape Lifesciences Inc.

- Changzhou Haiers Medical Devices Co. Ltd

- TransEnterix Inc.

- Precision (Changzhou)Medical Instruments Co. Ltd