The increase in the per capita income levels of the middle-class population in the region is enabling them to opt for charter services for tours and travel. This encourages charter service providers to expand their fleets to cover new routes in response to the rising demand and serve a larger market.

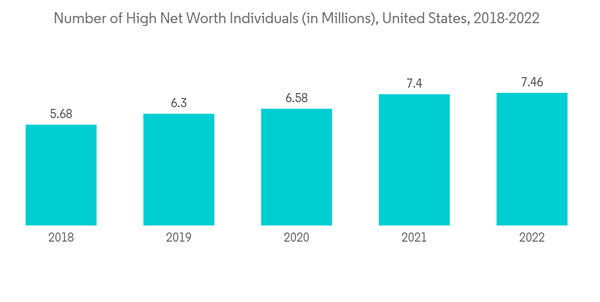

The emerging aviation emission norms and the diversified requirement of the clientele to personalize their travel experience have bolstered the demand for newer-generation aircraft. Also, the presence of a large high net-worth individual (HNWI) clientele in North America has positively affected the market's demand-side dynamics. At the same time, the associated ownership benefits, in terms of evolving fractional ownership or private jet card programs, have been a decisive factor in promoting market growth in the region. According to the Global Wealth Report 2022, the United States ranked highest, with over 140,000 ultra-high-net-worth individuals (with wealth above USD 50 million) in 2021, followed by China with 32,710 individuals.

Furthermore, the growth in interest in aircraft rental and the advent of membership programs in the charter jet service industry are expected to provide profitable prospects for the leading players in the market. At the same time, the high cost of services and the absence of skilled pilots hamper the market's growth.

North America Charter Jet Services Market Trends

Large Jet Segment Will Showcase Remarkable Growth During the Forecast Period

The large jet segment is projected to grow significantly during the forecast period. The large jets have large and spacious cabins with ample space for passengers to work, relax, and sleep and a very generous luggage capacity. Large jets are the epitome of comfort and performance for long-haul charter flights. These jets travel faster and longer than their smaller counterparts, with speeds of as high as 530 mph and middle ranges of around 4,000 miles. The main advantages of owning a large private jet are its flexibility and convenience. The travel plans can be tailored to suit the traveler's schedule, and there’s no need to worry about the hassles and delays of commercial air travel.Although large, they are still compact enough to operate out of airports not accessible by many major airlines. Amenities available on large jets often include a private lavatory, stereo DVD, satellite phone, external baggage compartments, fax, and a full galley. Additionally, onboard flight attendants improve the in-flight experience by providing additional safety and comfort while assisting with gourmet catering and entertainment. For instance, in May 2021, Dassault Aviation announced an all-new Falcon jet that delivered high comfort, versatility, and technology.

United States is Anticipated to Dominate the Market During the Forecast Period

The United States is anticipated to dominate the market during the forecast period. The growth is due to many high-net-worth individuals (HNWIs), increasing demand for newer-generation aircraft, and the evolution of new aircraft ownership models. Furthermore, to fulfill the needs of consumers in this region, air charter operations have undertaken a fleet-modernization initiative, which has resulted in the dispersal of several contracts for procuring new business jets. For instance, XOJET Aviation, a leading charter service provider based in the United States, deploys solutions to offer an asset-light alternative to full jet ownership and the rigid, non-refundable jet card and fractional jet ownership models. The company operates a fleet of 116 owned aircraft and 1,500 partner operator aircraft to provide a distinguished level of service even while booking single seats on shared flights.Also, Honeywell International Inc.’s 31st annual Global Business Aviation Outlook published in 2022 forecasted up to 8,500 new business jet deliveries worth USD 274 billion in ten years, up by 15% in deliveries and spending from the same 10-year forecast a year ago. Thus, the growing demand for jets for various applications such as business travel and leisure purposes drives the growth of the market across the country.

North America Charter Jet Services Industry Overview

The North America charter jet services market is fragmented, with several players holding significant shares in the market. Some of the key players in the market are NetJets IP, LLC., XOJET Aviation, Gama Aviation PLC, Delta Airlines, Inc., and PrivateFly. There were around 964 registered aircraft charter operators in the United States alone. While some operate on selected routes, some use a vast fleet and support national and international travel. The market is highly dependent on technological advancement and product innovation; hence, mid-size to smaller companies are increasing their market presence by securing new membership contracts and tapping new markets by operating on new routes.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.