Explosive ordnance disposal (EOD) equipment is typically used by the military, navy, and other defense organizations to detect potential threats or for law enforcement purposes. The growing threats from terrorist and insurgent groups are forcing governments to procure EOD tools and equipment to detect and diffuse explosives quickly and effectively, which is fuelling the growth of the market.

The increasing emphasis on using UGVs and robotic explosive disposal units for EOD activities to reduce the threat to the military and law enforcement personnel is expected to generate new player opportunities. Growing investments from key players in research and development and a rising focus on improving security drive the market growth. For instance, in March 2022, 3DX-Ray launched a 3DX range of EOD bomb disposal suits. It includes both the 3DX-EOD bomb disposal suit and the 3DX-search suit. The search suit is mainly designed for personnel involved in the search for, and clearing of, suspected terrorist explosive devices. It is lightweight, provides all-around 360° protection, and is comfortable to wear, and allows virtually unrestricted movement.

Explosive Ordnance Disposal Market Trends

Military Segment will Showcase Significant Growth Due to Adoption of Unmanned Systems for EOD Operations

Technological developments in unmanned systems, especially unmanned ground vehicles (UGVs), demonstrate the potential of remotely operated capabilities in alleviating the risks to humans in hostile environments near explosive ordnances.Currently, most unexploded ordnance detection and disposal technologies are conducted manually or with EOD vehicles. Depending on the situation and the risk factor, it's destroyed, defused, or moved. But now, in a big step forward in defense research, in 2023, the European Defence Agency (EDA) has demonstrated how AI and drones can work together to find IEDs and other explosives in different scenarios. It is part of a EUR 1.55 million (USD 1.65 million) project called AIDED, which was funded by the European Commission. As part of the project, a coordination attempt is being made to ensure that the UAVs and UGVs work together to search for IEDs and mock-ups in both rural and urban settings.

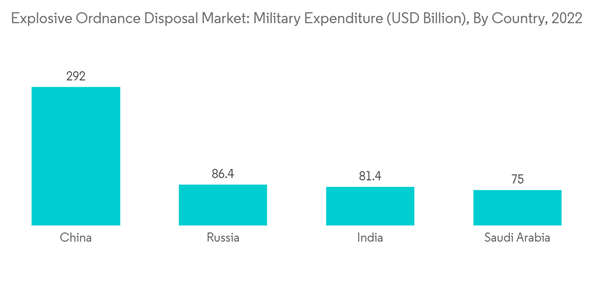

Growing adoption of unmanned systems in military operations to improve soldier’s security and rising military expenditure will boost the segment growth. Unmanned systems can perform a wide variety of tasks that range from reconnaissance and surveillance to detection and disposal of explosives. The latest EOD robots are being fitted with a wide variety of payloads, including conventional cameras, EO/IR sensors, X-ray scanners, and metal detectors, which help in detecting explosives accurately and sending the collected information to the concerned agencies. In addition, newer EOD UGVs feature high-power manipulator arms that help in disposing of the explosives. Thus, the growing emphasis on procuring unmanned systems for military operations is expected to drive the market during the forecast period.

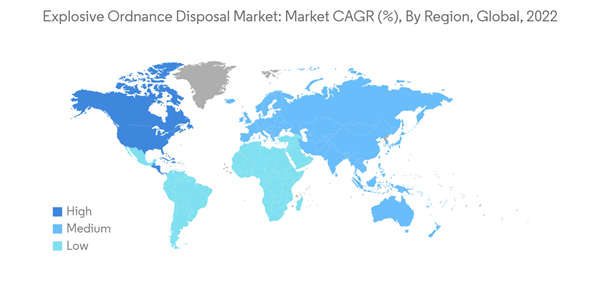

North America Will Dominate the Market During the Forecast Period

North America dominated market share due to the high demand for EOD equipment from the US. The US is focusing on modernizing its soldier protection systems for contingency operations. As a part of this modernization effort, it is procuring new EOD suits and helmets for its armed forces. For instance, in 2023, British multinational defense technology company QinetiQ received a contract from the US Navy to construct unmanned ground vehicles, the Talon and the MTRS, for bomb disposal. The order for these vehicles is estimated to be USD 10.6 million. The MTRS MK2 is designed to provide stand-off capability for the detection, identification, and disposal of Improvised Explosive Devices (IEDs) and related hazards, utilizing ground robots with payloads for IED disposal.In addition, the US Army is modernizing its robotic and autonomous capabilities with a range of autonomous systems. It aims to leverage the best of the available commercial technology, as it is critical in giving soldiers an overmatch in future contingency operations. For instance, in December 2022, the US Air Force (USAF) received its first four T7™ Explosive Ordnance Disposal (EOD) robots under a contract from L3Harris Technologies, a division of L3Harris Technologies Inc. The contract supports the Air Force’s Global EOD mission and is valued at USD 85 million over 10 years. The first four T7® robots are part of a larger contract that will provide the Air Force with 56 T7 robotic systems and support, as well as maintenance and training. All these factors are expected to propel the growth of the market in North America in the years to come.

Explosive Ordnance Disposal Industry Overview

The explosive ordnance disposal market is moderately consolidated in nature with a presence of few local and global players holding significant shares in the market L3Harris Technologies Inc., Teledyne FLIR LLC, Cobham Limited, Northrop Grumman Corporation, and Med-Eng Holdings ULC (Cadre Holdings, Inc.) are some of the prominent players in the market. Players are focusing on the incorporation of advanced materials and sensor technologies into the development of EOD systems, to make them more efficient than their competitors’ counterparts, which will help them gain new contracts in the coming years. Several players are focusing on the development of EOD robots, which are expected to become the backbone of EOD operations in the coming years. Strategic partnerships and collaborations between players are expected to help them develop advanced systems during the forecast period, thereby contributing to their collective growth in the market.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- L3Harris Technologies Inc.

- FLIR Systems, Inc.

- Med-Eng Holdings

- Northrop Grumman Corporation

- Garrett Metal Detectors

- Reamda Ltd

- Scanna MSC

- NABCO Systems LLC

- United Shield International Ltd

- Cobham PLC

- ABP

- Westminster International Ltd