Key Highlights

- The diagnostic imaging market was adversely impacted by the COVID-19 pandemic owing to the cancellations in elective procedures, including diagnosis of various diseases. For instance, per a research article published in October 2021, the total imaging volumes were 159,107 in 2020 in Aseer Region in Saudi Arabia, accounting for a 22.7% overall reduction compared to the previous year. The research also concluded that according to modality type, the highest decreases were reported in nuclear medicine, ultrasound, magnetic resonance imaging (MRI), and mammography, by 100%, 76%, 74%, and 66%, respectively. However, as the COVID-19 restrictions were lifted and diagnostic services resumed, the market has been recovering well over the last two years.

- The studied market is majorly influenced by factors such as the increasing chronic disease burden in the country along with the rising geriatric population and increased adoption of advanced medical technologies in medical imaging.

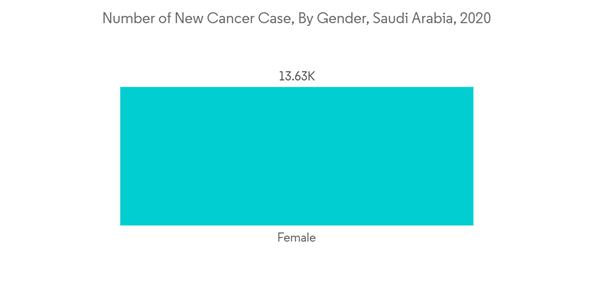

- In Saudi Arabia, cancer is one of the leading causes of mortality and a significant contributor to rising healthcare costs. The most common cancers in Saudi Arabia are breast, colorectal, prostate, brain, lymphoma, kidney, and thyroid respectively. According to Globocan, the country's total number of cancer cases was 27,885 in 2020 and is expected to reach 60,429 by 2040. As per the same source, in 2020, around 4,807 and 3,842 new cancer cases were reported in the United Arab Emirates (UAE) and Kuwait, respectively. Hence, the rising prevalence of cancer is estimated to boost the demand for disease diagnosis and further drive market growth.

- Moreover, the elderly population is prone to chronic diseases, and with the rise in this population, the importance of diagnostic imaging is expected to increase in the country. According to a research article published in December 2021, older people aged 65 years or above represented 3.2% of the total population in 2020 in Saudi Arabia. The aging population is estimated to reach its peak by 2050. Hence, the increasing geriatric population will likely demand advanced healthcare services, contributing to market growth.

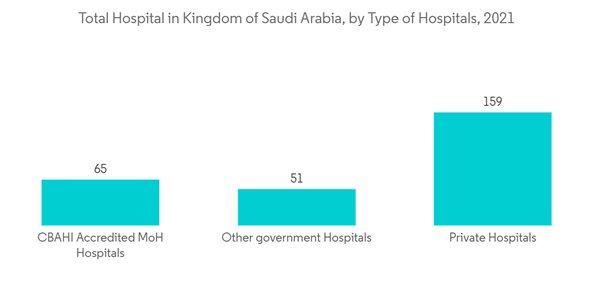

- Besides, there is a demand for advanced technologies in the country, leading the major players to develop hybrid imaging systems. In Saudi Arabia, several hospitals have deployed image archiving and communication systems (PACS), and much of the research on PACS has been done in Riyadh.

- According to a March 2021 report, Saudi Arabian physicians and radiologists had overwhelmingly positive views of the PACS system. The study carried out in Riyadh, Saudi Arabia, positively affected users' work and raised their satisfaction. Therefore, it is anticipated that physicians' positive view of PACS toward imaging modalities will open up new opportunities for diagnostic imaging in the nation and propel the expansion of the investigated market.

- However, the high cost of diagnostic imaging equipment is expected to hinder the market growth.

Saudi Arabia Diagnostic Imaging Market Trends

Oncology is Expected to Hold a Significant Market Share Over the Forecast Period

- The growing burden of cancer in the country, such as breast cancer, colorectal cancer, prostate cancer, and many others, along with the launch of new products, is expected to boost segment growth.

- For instance, as per Globocan, the country was dominated by breast cancer with 29% cases, followed by thyroid cancer with 14.3% cases, and colorectum cancer with 9.2% cases in 2020. Therefore, the huge incidence of cancer cases is projected to boost the demand for diagnostic imaging for detecting early signs of cancer, thus augmenting the market growth.

- In addition, the adoption of key strategies by market players and government healthcare organizations, such as partnerships and product launches to speed up cancer diagnosis in the country, is propelling segment growth.

- For instance, in February 2022, Microsoft Arabia and Roche entered into a partnership to activate artificial intelligence (AI) in the early diagnosis of cancerous diseases. The latest advanced technologies and AI will enable the diagnosis of cases that have not yet shown symptoms so that patients can receive the necessary medical support in the early stages of the disease.

- Moreover, in October 2022, the Kingdom's Ministry of Health, in collaboration with Saudi Telecom Company, launched one of the first Middle East oncology e-platform at the Seha Virtual Hospital's headquarters. The e-platform is projected to assist healthcare professionals in early cancer diagnosis, thereby boosting the market growth during the forecast period.

- Furthermore, the launch of campaigns for creating awareness regarding cancer in the country is estimated to increase the demand for cancer diagnostic modalities, thereby augmenting market growth. For instance, in October 2021, the Ministry of Health (MOH) launched an awareness campaign on early screening of breast cancer, which is the most common cancer among Saudi women. The awareness campaign is projected to boost cancer diagnostic imaging in the market during the forecast period.

Strategic Initiatives Undertaken by Market Players in Saudi Arabia is also contributing to the market growth

- Various strategic initiatives undertaken by market players, such as partnerships and investments in Saudi Arabia, contribute to market growth.

- Various international and local companies collaborated to open joint venture diagnostic companies in the country. For instance, in July 2022, Arabian International Healthcare Holding Co., known as Tibbiyah, entered a joint venture agreement with European Unilabs diagnostics AB to form and operate a limited liability firm under the name of Saudi European Diagnostics Company (SEDC). The joint venture SEDC aims to expand diagnostic imaging services in the country, which is expected to propel market growth during the forecast period.

- Furthermore, in October 2022, Integrated Diagnostics Holdings (IDH) entered a Joint Venture (JV) agreement with Al Makhbaryoun Al Arab (Biolab) and Izhoor Holding Medical Company (Izhoor) to launch a new diagnostic venture in Saudi Arabia. The strategic partnership will assist IDH in further expanding its geographic reach and patient base by gaining access to the Saudi Arabian healthcare industry.

- Thus, the rising strategic initiatives by various key players to expand diagnostic imaging products and services are projected to augment the market growth during the forecast period.

Saudi Arabia Diagnostic Imaging Industry Overview

The Saudi Arabia diagnostic imaging market is slightly fragmented in nature due to the presence of many companies operating globally as well as regionally. The competitive landscape includes an analysis of a few international and local companies that hold market shares and are well known. Some market players are Fujifilm Holdings Corporation, Canon Medical Systems Corporation, General Electric Company (GE Healthcare), Koninklijke Philips NV, Agfa Healthcare NV, Siemens Healthineers, Stryker Corporation, Shimadzu Corporation, Fonar Corporation, Esaote SpA among others.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- General Electric Company (GE Healthcare)

- Agfa Healthcare NV

- Koninklijke Philips N.V.

- Esaote SpA

- Canon Medical Systems Corporation

- Siemens Healthineers

- FUJIFILM Holdings Corporation

- Stryker Corporation

- Fonar Corporation

- Shimadzu Corporation