The market was negatively impacted by COVID-19 in 2020. Currently. The market has reached pre-pandemic levels.

Key Highlights

- Over the medium term, increasing consumption of petroleum products is expected to boost the demand for the Norway oil and gas downstream market during the forecast period.

- On the other hand, the rising number of EVs and the government has also pushed towards decreasing dependence on oil and gas, further leading to market stagnation.

- Nevertheless, the increasing need to decrease the sulfur content in the oil to comply with the EU guidelines has led to the requirement for better desulfurization plants all over Europe. A further requirement in reducing sulfur content is expected to act as an opportunity for the market players in the country.

Norway Oil & Gas Downstream Market Trends

Refining Capacity to Remain Stagnant

- The refining capacity in the country has remained stagnant in the 2015 - 2021 period at 342 thousand barrels per day. This is because no new refining capacity is added to the country from investments.

- Norway has only one major refining facility: the almost 240,000-b/d Mongstad plant, operated by Equinor. Most of the output from the refinery is exported, and Norway is an important supplier of gasoline and diesel fuel to the European Union. In June 2021, the 120,000 b/d Slagen refineries were closed down by Exxon.

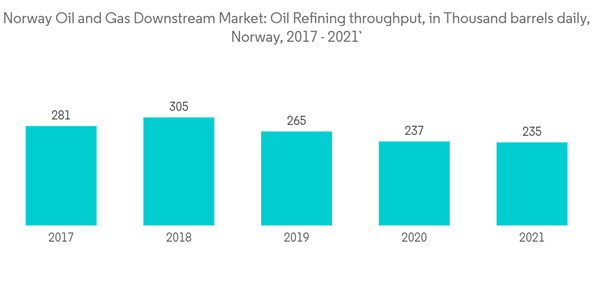

- The refining throughput in the country has decreased by 17.4%, to 235 thousand barrels per day (kb/d), in 2021, from 281 kb/d, in 2017. The decrease in throughput is due to the falling demand for refined products.

- Therefore, the refining capacity in the country is expected to remain stagnant in the forecast period as there is very little new investment in the market.

Increasing use of EVs to restrain the market

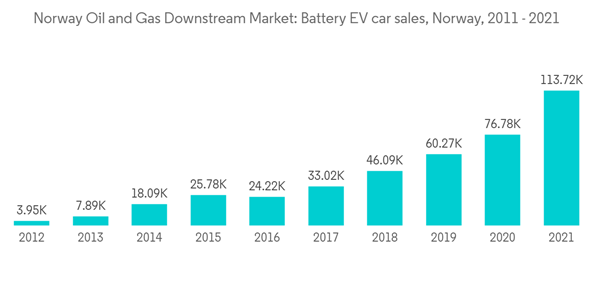

- Norway has one of the largest markets for electric vehicles, and the market is growing steadily. The country is set to achieve 100% EV sales before 2025. As internal combustion engines use refined products such as gasoline, the rise in the number of EVs is expected to impact the demand for refined products, restraining the market for the downstream sector during the forecast period.

- The sales of battery EV sales increased vastly during the period of 2011-2021. In 2021, sales of EV cars reached 113,715.

- By February 2022, there were more than 470.000 registered battery electric cars (BEVs) in Norway. Battery electric vehicles held a 64 % market share in 2021. Additionally, As of February 2022, we have more than 470.000 EVs and 4.600 cars that can fast-charge at the same time.

- The transition speed is closely related to policy instruments and various incentives. The incentives for EVs in Norway include No purchase/import tax on EVs, exemption from 25% VAT on the purchase, and reduced road tax, among others.

- In Norway, 9,727 electric cars were newly registered in October 2022, giving them a market share of 77.5% of the country's new passenger car registrations. In addition, there were 1,126 plug-in hybrids.

- Due to this, the Norway EV market is expected to grow steadily, reducing gasoline demand and restraining the market's growth during the forecast period.

Norway Oil & Gas Downstream Market Competitor Analysis

The Norway oil and gas downstream market is consolidated. Some of the major companies (in no particular order) include EquinorASA, Royal Dutch Shell PLC, Aker BP AS, Total S.A and Exxon Mobil CorporationAdditional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Exxon Mobil Corporation

- Equinor ASA

- Royal Dutch Shell PLC

- Aker BP AS

- Total S.A

- Lundin Energy Norway

- Wintershall Dea AG