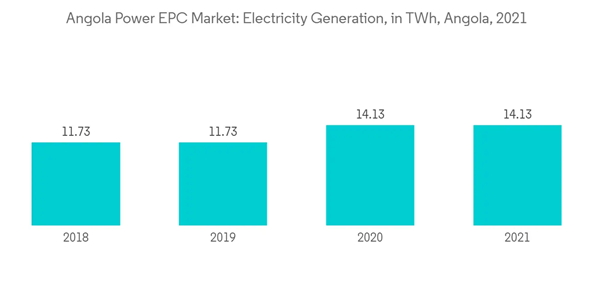

The market was negatively impacted by COVID-19 in 2020. However, it has now reached pre-pandemic levels.

Key Highlights

- Over the medium term, ambitious government plans and targets for rapid urbanization, which are expected to require more power and a transmission network, are expected to drive the Angola power EPC market during the forecast period.

- On the other hand, lower private participation and underdeveloped grid infrastructure are expected to restrain the studied market during the forecast period.

- Nevertheless, Angola holds great potential for the renewable energy sector. The country has been planning to diversify its power generation from coal and oil to renewable. Thus, this is expected to provide a great opportunity for the power EPC market.

Angola Power EPC Market Trends

Hydropower Generation to Witness Significant Growth

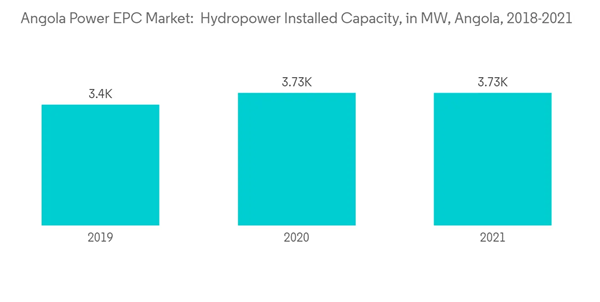

- Angola's hydropower potential is among the highest in Africa, estimated at 18.2 GW. The government aims to substantially grow its hydropower generation capacity from around 3,729 MW in 2021 to 9,000 MW by 2025.

- The country has exceptional hydro resources, with 159 sites identified in previous studies as having potential for large hydropower plants, in addition to those already under construction or decided upon.

- The Angolan government is also planning to open up the energy market for private investors in the near future, especially for smaller hydropower projects. The Angolan government is investing in a 343 km long transmission line connecting the north and south grids and transferring approximately 1,000 MW of primarily low-cost hydropower. It will become operational in 2023.

- The government is also planning to develop the hydropower industry by integrating hydropower plants with natural gas-fired power plants. This integration is assumed to enable a secure and competitive system, even during drought.

- In August 2022, Luachimo Hydroelectric Dam, a USD 212 million Chinese-financed project located in Angola's Lunda Norte province, was to begin operation. The approval tests of the equipment for the preparation of the start-up of the first two turbines have begun, according to the director of the project for the rehabilitation and expansion of the infrastructure. The first two turbines, each with the capacity to produce 17 megawatts of electricity, have been installed. The assembly of the other two, each with the same capacity, is over 60% complete.

- Thus, the great potential of hydropower, combined with the government efforts to develop the hydropower industry, is expected to provide hydropower power generation an excellent capability during the forecast period.

Ambitious Government Plans to Drive the Market

- Available generation capacity in Angola has grown significantly over the past years; however, power demand is still suppressed. Suppressed demand results in frequent power supply cuts and widespread use of generators for auto-consumption, with a greater incidence in the humid months due to air conditioning.

- To meet these challenges, the Angolan government has developed a series of policies and laws in the past years to define the main objectives and orientations of the energy and electric sectors. Angola's government now aims to adequately electrify every provincial and municipal capital and bring basic energy services to the country's population.

- The growth of generation capacity and the expansion of the grid, as well as the mobilization of private capital, are the long-term strategic axes established in the policy and strategy for National Energy Security, with an impact on the long-term development of the country and on the diversification of the national economy.

- In 2021, A memorandum of understanding for the collaborative building of the 600 MW Baynes Dam hydroelectric facility was signed by Namibia and Angola. Each nation would produce 300 MW of electricity in turn.

- Governments in Angola hope to reach a 60% electrification rate by 2025. As of 2021, the national rate was 45.9%, with significantly lower rates in rural areas. In the near term, Angola has ambitious but unsupported plans to develop renewable energy. By 2025, it plans to connect more than 800 megawatts to the grid.

- Electricity generation in Angola reached around 14.13 terawatt hours in 2021. Hydropower accounted for almost entirely the renewable-energy-generated electricity produced in the country.

- The government of Angola is developing small-scale off-grid projects that use fossil fuels and renewable energy sources. The transmission network of Angola is composed of three primary grid systems (northern, central, and southern) and solitary grids in the east. The provinces of Luanda, Uige, Bengo, Zaire, Malange, Kwanza Norte, and Kwanza Sul are covered by the northern grid's 400 kV and 220 kV lines. Benguela to Huambo and Bie 220kV lines are part of the central network.

- Therefore, such government initiatives are expected to drive the power EPC market during the forecast period.

Angola Power EPC Market Competitor Analysis

The Angola power EPC market is moderately fragmented. Some of the key players (in no particular order) include Isolux Corsan SA, Gesto-Energia SA, Anglo Belgian Corporation, AEE Power Corporation, and Siemens AG.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- EPC Developers

- Original Equipment Manufacturers