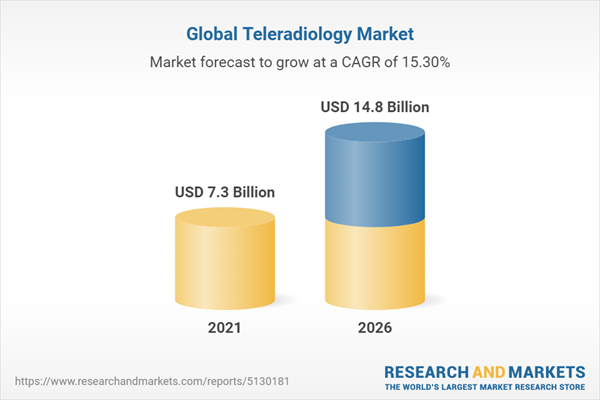

The teleradiology market is expected to reach USD 14.8 billion by 2026 from USD 7.3 billion in 2021, at a CAGR of 15.3% during the forecast period of 2021 to 2026. Due to the outbreak of coronavirus globally, there is a sudden rise in the demand for teleradiology services. The growth of this market is mainly attributed to the growth of the teleradiology market is driven by the rising geriatric population and the subsequent increase in the prevalence of associated diseases; the increasing number of advanced imaging procedures and a shortage of skilled radiologists; advancements in teleradiology the increasing adoption of cloud-based solutions. However, declining reimbursements and the increasing regulatory burden in the US are factors expected to restrain the market growth. Moreover, the increasing adoption of artificial intelligence and blockchain technology in teleradiology is expected to provide lucrative opportunities for the growth of the teleradiology market in the coming years.

CT was the largest and fastest-growing Imaging technique market in 2020

Computed tomography (CT) is used in a wide range of applications, such as cardiology, oncology, neurology, and abdomen and pelvic, and spine and musculoskeletal imaging. Factors such as the growing need for effective and early diagnosis, technological advancements, and digitalization in this field are driving the growth of the teleradiology market for this segment. According to an article published by the University College (July 2020), in the NHS, about 5 million CT scans are performed every year; in the US, more than 80 million CT scans are performed annually. The rising need to prevent exploratory surgeries and growing improvements in cancer diagnosis & treatment have increased the demand for CT scans over other imaging techniques.

Hospitals and clinics is the largest end user segment in the teleradiology market in 2020

Based on end users, the teleradiology market is segmented into hospitals and clinics; diagnostic imaging centers and laboratories; long-term care centers, nursing homes, and assisted living facilities; and other end users. The hospitals and clinics segment accounted for the largest share of in 2020. The large share of this segment can be attributed to the rising number of diagnostic imaging procedures performed in hospitals, the growing inclination of hospitals towards the automation and digitization of patient records, and the growing need to improve the quality of patient care. Moreover, a shortage of radiologists due to the COVID-19 pandemic and the rising adoption of advanced imaging modalities to improve workflow efficiency in hospitals are further expected to support the growth of this end-user segment.

North America will continue to dominate the teleradiology market in 2026

The teleradiology market is segmented into five major regions, namely, North America, Europe, Asia Pacific, Latina America, and the Middle East and Africa. In 2019, North America accounted for the largest share. The large share of North America in the global market is attributed to the rising geriatric population, high incidence of chronic diseases, a large number of diagnostic imaging procedures, increasing awareness about the benefits of early diagnosis of diseases, and the rapid adoption of technologically advanced imaging systems in this region. Due to its growing geriatric population segment and environmental conditions have favored the spread of COVID-19 which has severely affected the region and ensured enormous growth in the demand for telehealth and teleradiology. Players in this and adjacent, or even non-related, markets have focused on or collaborated for expanding the services of teleradiology.

The break-down of primary participants is as mentioned below:

- By Company Type - Tier 1: 45%, Tier 2: 30%, and Tier 3: 25%

- By Designation - C-level: 20%, Director-level: 60%, and Others: 20%

- By Region - North America: 35%, Europe: 30%, Asia Pacific: 20%, Latin America: 10%, and the Middle East & Africa: 5%

Research Coverage:

The report analyzes the teleradiology market and aims at estimating the market size and future growth potential of various market segments, based on products and service, imaging technique, end user, and region. The report also provides a competitive analysis of the key players operating in this market, along with their company profiles, product offerings, recent developments, and key market strategies.

Reasons to Buy the Report

This report will enrich established firms as well as new entrants/smaller firms to gauge the pulse of the market, which, in turn, would help them garner a greater share of the market. Firms purchasing the report could use one or a combination of the below-mentioned strategies to strengthen their positions in the market.

This report provides insights on:

- Market Penetration: Comprehensive information on the product portfolios of the top players in the teleradiology market. The report analyzes this market by type, indication, end user, and region

- Market Development: Comprehensive information on the lucrative emerging markets, by products and services, imaging technique, end user, and region

- Market Diversification: Exhaustive information about the product portfolios, growing geographies, recent developments, and investments in the teleradiology market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, and capabilities of the leading players in the teleradiology market

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Market Definition

1.2.1 Inclusions & Exclusions

1.2.2 Markets Covered

Figure 1 Teleradiology Market

1.2.3 Years Considered for the Study

1.3 Currency

Table 1 Standard Currency Conversion Rates

1.4 Limitations

1.5 Stakeholders

1.6 Summary of Changes

2 Research Methodology

2.1 Research Approach

Figure 2 Teleradiology Market: Research Methodology Steps

Figure 3 Research Design

2.1.1 Secondary Data

2.1.1.1 Key Data from Secondary Sources

2.1.2 Primary Data

Figure 4 Primary Sources

2.1.2.1 Key Data from Primary Sources

2.1.2.2 Key Industry Insights

Figure 5 Breakdown of Primary Interviews: by Company Type, Designation, and Region

2.2 Market Size Estimation

Figure 6 Market Size Estimation: Revenue Share Analysis

Figure 7 Market Size Estimation: Parent Market

Figure 8 CAGR Projections: Supply-Side Analysis

Figure 9 Top-Down Approach

Figure 10 CAGR Projections from the Analysis of Drivers, Restraints, Opportunities, and Challenges of the Teleradiology Market (2021-2026)

2.3 Assessment of the Impact of COVID-19 on the Economic Scenario in the Teleradiology Market

2.4 Market Breakdown & Data Triangulation

Figure 11 Market Data Triangulation Methodology

2.5 Assumptions for the Study

3 Executive Summary

Figure 12 Teleradiology Market, by Product & Service, 2021 Vs. 2026 (USD Million)

Figure 13 Teleradiology Market, by Imaging Technique, 2020 Vs. 2026 (USD Million)

Figure 14 Teleradiology Market, by End-user, 2021 Vs. 2026 (USD Million)

Figure 15 Geographical Snapshot of the Teleradiology Market

4 Premium Insights

4.1 Teleradiology Market Overview

Figure 16 Shortage of Skilled Radiologists & the Increasing Adoption of Cloud-Based Solutions Are Key Factors Driving the Market Growth

4.2 Asia-Pacific: Teleradiology Market, by Product & Service and Country (2020)

Figure 17 the Teleradiology Services Segment Accounted for the Largest Share of the Teleradiology Market in 2020

4.3 Teleradiology Market: Geographic Growth Opportunities

Figure 18 China to Register the Highest Growth Rate During the Forecast Period

4.4 Regional Mix: Teleradiology Market (2021−2026)

Figure 19 North America Will Continue to Dominate the Teleradiology Market During the Forecast Period

4.5 Teleradiology Market: Developing Vs. Developed Markets

Figure 20 Developing Markets to Register Higher Growth Rates During the Forecast Period

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

Figure 21 Teleradiology Market: Drivers, Restraints, Opportunities, and Challenges

5.2.1 Market Drivers

5.2.1.1 Rising Geriatric Population and the Subsequent Increase in Age-Associated Diseases

Table 2 Age-Related Diseases and Associated Imaging Systems

5.2.1.2 Growing Number of Advanced Imaging Procedures and a Shortage of Skilled Radiologists

5.2.1.3 Advancements in Teleradiology Solutions

Table 3 Technological Advancements in Teleradiology Systems

5.2.1.4 Rising Demand for Cloud-Based Solutions

5.2.2 Restraints

5.2.2.1 Limited Access to High-Speed Internet in Rural Areas

5.2.2.2 Declining Reimbursements and Increasing Regulatory Burden in the US

Table 4 Medicare Reimbursement Trends, by Imaging Modality, 2007-2019

5.2.3 Opportunities

5.2.3.1 Adoption of Artificial Intelligence (Ai) in Teleradiology

5.2.3.2 Use of Blockchain in Teleradiology

5.2.3.3 High Growth Opportunities in Emerging Countries

5.2.4 Challenges

5.2.4.1 Data Breach and Cybersecurity Risks

5.3 Industry Trends

5.3.1 Growing Adoption of Telehealth Solutions

5.3.2 Demand for Subspecialty Services

5.4 Pricing Analysis

Table 5 Pricing Analysis of Teleradiology Services Per Scan by Imaging Technique in the US, 2020 (USD)

Table 6 Pricing Analysis of Key Imaging Scans, by Region, 2020 (USD)

5.5 Value Chain Analysis

Figure 22 Value Chain Analysis

5.6 Ecosystem Analysis

5.7 Supply Chain Analysis

Figure 23 Supply Chain Analysis

5.8 Porter's Five Forces Analysis

Table 7 Teleradiology Market: Porter's Five Forces Analysis

5.8.1 Bargaining Power of Buyers

5.8.2 Bargaining Power of Suppliers

5.8.3 Threat of New Entrants

5.8.4 Threat of Substitutes

5.8.5 Intensity of Competitive Rivalry

5.9 Regulatory Analysis

Table 8 Key Regulations & Standards Governing Teleradiology Solutions

5.10 Impact of COVID-19 on the Teleradiology Market

6 Teleradiology Market, by Product & Service

6.1 Introduction

Figure 24 Software Segment to Register the Highest Growth During the Forecast Period

Table 9 Teleradiology Market, by Product & Service, 2019-2026 (USD Million)

6.2 Teleradiology Services

6.2.1 Rising Demand for Emergency & Consulting Services to Drive the Market Growth for this Segment

Table 10 Services Offered by Key Market Players

Table 11 Teleradiology Services Market, by Country, 2019-2026 (USD Million)

6.3 Software

Table 12 Teleradiology Software Market, by Type, 2019-2026 (USD Million)

Table 13 Teleradiology Software Market, by Country, 2019-2026 (USD Million)

6.3.1 Picture Archiving & Communication Systems (Pacs)

6.3.1.1 Frequent Need for Upgrades & Improvements in Software Applications to Drive the Growth of the Pacs Segment

Table 14 Pacs Software Offered by Key Market Players

Table 15 Pacs Market, by Country, 2019-2026 (USD Million)

6.3.2 Radiology Information Systems (Ris)

6.3.2.1 Ris is Often Used with Pacs and Vna

Table 16 Ris Software Offered by Key Market Players

Table 17 Ris Market, by Country, 2019-2026 (USD Million)

6.4 Hardware

6.4.1 Faster Data Exchange & Better Interoperability Are Factors Driving the Demand for Hardware Devices

Table 18 Teleradiology Hardware Market, by Country, 2019-2026 (USD Million)

7 Teleradiology Market, by Imaging Technique

7.1 Introduction

Figure 25 Ct Segment Will Continue to Dominate the Teleradiology Market During the Forecast Period

Table 19 Teleradiology Market, by Imaging Technique, 2019-2026 (USD Million)

7.2 Computed Tomography

7.2.1 Increasing Incidence of Cvd is Driving the Demand for Ct Scans

Table 20 Teleradiology Market for Computed Tomography, by Country, 2019-2026 (USD Million)

7.3 Magnetic Resonance Imaging (Mri)

7.3.1 Increasing Prevalence of Neurological Disorders to Drive the Market Growth

Table 21 Teleradiology Market for Magnetic Resonance Imaging, by Country, 2019-2026 (USD Million)

7.4 Ultrasound

7.4.1 Increasing Prevalence of Target Diseases & the Development of Poc Ultrasound Systems to Support the Market Growth

Table 22 Teleradiology Market for Ultrasound Imaging, by Country, 2019-2026 (USD Million)

7.5 X-Ray

7.5.1 High Usage in Primary Diagnosis Has Increased the Demand for X-Ray Imaging Technology

Table 23 Teleradiology Market for X-Ray Imaging, by Country, 2019-2026 (USD Million)

7.6 Mammography

7.6.1 Increasing Incidence of Breast Cancer Among Women to Drive the Growth of this Segment

Table 24 Teleradiology Market for Mammography Imaging, by Country, 2019-2026 (USD Million)

7.7 Nuclear Imaging

7.7.1 Rising Prevalence of Cancer to Support the Growth of this Segment

Table 25 Teleradiology Market for Nuclear Imaging, by Country, 2019-2026 (USD Million)

7.8 Fluoroscopy

7.8.1 High Radiation Dose - a Major Drawback Associated with Fluoroscopy Procedures

Table 26 Teleradiology Market for Fluoroscopy Imaging, by Country, 2019-2026 (USD Million)

8 Teleradiology Market, by End-user

8.1 Introduction

Figure 26 Hospitals and Clinics Are the Major End-users of Teleradiology Solutions

Table 27 Teleradiology Market, by End-user, 2019-2026 (USD Million)

8.2 Hospitals and Clinics

8.2.1 Large Hospitals Have Been Early Adopters of Teleradiology Solutions

Table 28 Teleradiology Market for Hospitals and Clinics, by Country, 2019-2026 (USD Million)

8.3 Diagnostic Imaging Centers and Laboratories

8.3.1 Growing Number of Private Imaging Centers to Support the Market Growth

Table 29 Teleradiology Market for Diagnostic Imaging Centers and Laboratories, by Country, 2019-2026 (USD Million)

8.4 Long-Term Care Centers, Nursing Homes, & Assisted Living Facilities

8.4.1 Gradual Shift of Patient Care from Inpatient to Outpatient Settings to Drive the Growth of this End-User Segment

Table 30 Teleradiology Market for Long-Term Care Centers, Nursing Homes, & Assisted Living Facilities, by Country, 2019-2026 (USD Million)

8.5 Other End-users

Table 31 Teleradiology Market for Other End-users, by Country, 2019-2026 (USD Million)

9 Teleradiology Market, by Region

9.1 Introduction

Figure 27 Geographic Growth Opportunities

Table 32 Teleradiology Market, by Region, 2019-2026 (USD Million)

9.2 North America

Figure 28 North America: Teleradiology Market Snapshot

Table 33 North America: Teleradiology Market, by Country, 2019-2026 (USD Million)

Table 34 North America: Teleradiology Market, by Product & Service, 2019-2026 (USD Million)

Table 35 North America: Teleradiology Software Market, by Type, 2019-2026 (USD Million)

Table 36 North America: Teleradiology Market, by Imaging Technique, 2019-2026 (USD Million)

Table 37 North America: Teleradiology Market, by End-user, 2019-2026 (USD Million)

9.2.1 US

9.2.1.1 the US Dominates the North American Teleradiology Market

Table 38 Us: Major Indicators of Market Growth

Table 39 Us: Teleradiology Market, by Product & Service, 2019-2026 (USD Million)

Table 40 Us: Teleradiology Software Market, by Type, 2019-2026 (USD Million)

Table 41 Us: Teleradiology Market, by Imaging Technique, 2019-2026 (USD Million)

Table 42 Us: Teleradiology Market, by End-user, 2019-2026 (USD Million)

9.2.2 Canada

9.2.2.1 Presence of a Large Number of Diagnostic Imaging Centers in Canada to Drive the Market Growth

Table 43 Canada: Teleradiology Market, by Product & Service, 2019-2026 (USD Million)

Table 44 Canada: Teleradiology Software Market, by Type, 2019-2026 (USD Million)

Table 45 Canada: Teleradiology Market, by Imaging Technique, 2019-2026 (USD Million)

Table 46 Canada: Teleradiology Market, by End-user, 2019-2026 (USD Million)

9.3 Europe

Figure 29 Europe: Cancer Prevalence, by Country, 2012-2030

Table 47 Europe: Teleradiology Market, by Country, 2019-2026 (USD Million)

Table 48 Europe: Teleradiology Market, by Product & Service, 2019-2026 (USD Million)

Table 49 Europe: Teleradiology Software Market, by Type, 2019-2026 (USD Million)

Table 50 Europe: Teleradiology Market, by Imaging Technique, 2019-2026 (USD Million)

Table 51 Europe: Teleradiology Market, by End-user, 2019-2026 (USD Million)

9.3.1 Germany

9.3.1.1 High Healthcare Spending to Support the Adoption of Teleradiology Solutions in Germany

Table 52 Increase in Disease Incidence in Germany

Table 53 Germany: Teleradiology Market, by Product & Service, 2019-2026 (USD Million)

Table 54 Germany: Teleradiology Software Market, by Type, 2019-2026 (USD Million)

Table 55 Germany: Teleradiology Market, by Imaging Technique, 2019-2026 (USD Million)

Table 56 Germany: Teleradiology Market, by End-user, 2019-2026 (USD Million)

9.3.2 UK

9.3.2.1 Increasing Government Healthcare Expenditure and Rising Adoption of Teleradiology Services to Drive Market Growth in the UK

Table 57 Uk: Teleradiology Market, by Product & Service, 2019-2026 (USD Million)

Table 58 Uk: Teleradiology Software Market, by Type, 2019-2026 (USD Million)

Table 59 Uk: Teleradiology Market, by Imaging Technique, 2019-2026 (USD Million)

Table 60 Uk: Teleradiology Market, by End-user, 2019-2026 (USD Million)

9.3.3 France

9.3.3.1 COVID-19 Has Significantly Increased the Demand for Teleradiology Solutions in the Country

Table 61 France: Teleradiology Market, by Product & Service, 2019-2026 (USD Million)

Table 62 France: Teleradiology Software Market, by Type, 2019-2026 (USD Million)

Table 63 France: Teleradiology Market, by Imaging Technique, 2019-2026 (USD Million)

Table 64 France: Teleradiology Market, by End-user, 2019-2026 (USD Million)

9.3.4 Italy

9.3.4.1 the Growing Burden of Several Diseases and a Shortage of Radiologists to Support the Market for Teleradiology Services in Italy

Table 65 Italy: Teleradiology Market, by Product & Service, 2019-2026 (USD Million)

Table 66 Italy: Teleradiology Software Market, by Type, 2019-2026 (USD Million)

Table 67 Italy: Teleradiology Market, by Imaging Technique, 2019-2026 (USD Million)

Table 68 Italy: Teleradiology Market, by End-user, 2019-2026 (USD Million)

9.3.5 Spain

9.3.5.1 Growing Awareness About Teleradiology Technologies Among Healthcare Professionals to Support the Market Growth in Spain

Table 69 Spain: Teleradiology Market, by Product & Service, 2019-2026 (USD Million)

Table 70 Spain: Teleradiology Software Market, by Type, 2019-2026 (USD Million)

Table 71 Spain: Teleradiology Market, by Imaging Technique, 2019-2026 (USD Million)

Table 72 Spain: Teleradiology Market, by End-user, 2019-2026 (USD Million)

9.3.6 Rest of Europe

Table 73 RoE: Teleradiology Market, by Product & Service, 2019-2026 (USD Million)

Table 74 RoE: Teleradiology Software Market, by Type, 2019-2026 (USD Million)

Table 75 RoE: Teleradiology Market, by Imaging Technique, 2019-2026 (USD Million)

Table 76 RoE: Teleradiology Market, by End-user, 2019-2026 (USD Million)

9.4 Asia-Pacific

Figure 30 Asia-Pacific: Cancer Prevalence, 2012-2030

Figure 31 Asia-Pacific: Teleradiology Market Snapshot

Table 77 Asia-Pacific: Teleradiology Market, by Country, 2019-2026 (USD Million)

Table 78 Asia-Pacific: Teleradiology Market, by Product & Service, 2019-2026 (USD Million)

Table 79 Asia-Pacific: Teleradiology Software Market, by Type, 2019-2026 (USD Million)

Table 80 Asia-Pacific: Teleradiology Market, by Imaging Technique, 2019-2026 (USD Million)

Table 81 Asia-Pacific: Teleradiology Market, by End-user, 2019-2026 (USD Million)

9.4.1 China

9.4.1.1 Government Initiatives in the Form of Healthcare Reforms & Investments to Drive the Market Growth in China

Table 82 China: Teleradiology Market, by Product & Service, 2019-2026 (USD Million)

Table 83 China: Teleradiology Software Market, by Type, 2019-2026 (USD Million)

Table 84 China: Teleradiology Market, by Imaging Technique, 2019-2026 (USD Million)

Table 85 China: Teleradiology Market, by End-user, 2019-2026 (USD Million)

9.4.2 Japan

9.4.2.1 High Adoption of Advanced Technologies in Japan to Support the Market Growth for Teleradiology Solutions

Table 86 Japan: Teleradiology Market, by Product & Service, 2019-2026 (USD Million)

Table 87 Japan: Teleradiology Software Market, by Type, 2019-2026 (USD Million)

Table 88 Japan: Teleradiology Market, by Imaging Technique, 2019-2026 (USD Million)

Table 89 Japan: Teleradiology Market, by End-user, 2019-2026 (USD Million)

9.4.3 India

9.4.3.1 Rising Healthcare Needs in Remote Locations and the Robust Expansion of Healthcare Infrastructure to Drive the Market Growth in India

Table 90 India: Teleradiology Market, by Product & Service, 2019-2026 (USD Million)

Table 91 India: Teleradiology Software Market, by Type, 2019-2026 (USD Million)

Table 92 India: Teleradiology Market, by Imaging Technique, 2019-2026 (USD Million)

Table 93 India: Teleradiology Market, by End-user, 2019-2026 (USD Million)

9.4.4 Rest of Asia-Pacific (Roapac)

Table 94 Roapac: Teleradiology Market, by Product & Service, 2019-2026 (USD Million)

Table 95 Roapac: Teleradiology Software Market, by Type, 2019-2026 (USD Million)

Table 96 Roapac: Teleradiology Market, by Imaging Technique, 2019-2026 (USD Million)

Table 97 Roapac: Teleradiology Market, by End-user, 2019-2026 (USD Million)

9.5 Latin America (Latam)

Table 98 Latin America: Teleradiology Market, by Country, 2019-2026 (USD Million)

Table 99 Latin America: Teleradiology Market, by Product & Service, 2019-2026 (USD Million)

Table 100 Latin America: Teleradiology Software Market, by Type, 2019-2026 (USD Million)

Table 101 Latin America: Teleradiology Market, by Imaging Technique, 2019-2026 (USD Million)

Table 102 Latin America: Teleradiology Market, by End-user, 2019-2026 (USD Million)

9.5.1 Brazil

9.5.1.1 High Incidence of Chronic Diseases Drive the Demand for Teleradiology Services in the Country

Table 103 Brazil: Teleradiology Market, by Product & Service, 2019-2026 (USD Million)

Table 104 Brazil: Teleradiology Software Market, by Type, 2019-2026 (USD Million)

Table 105 Brazil: Teleradiology Market, by Imaging Technique, 2019-2026 (USD Million)

Table 106 Brazil: Teleradiology Market, by End-user, 2019-2026 (USD Million)

9.5.2 Mexico

9.5.2.1 Rising Adoption of Digital Healthcare to Drive the Growth of the Teleradiology Market in Mexico

Table 107 Mexico: Teleradiology Market, by Product & Service, 2019-2026 (USD Million)

Table 108 Mexico: Teleradiology Software Market, by Type, 2019-2026 (USD Million)

Table 109 Mexico: Teleradiology Market, by Imaging Technique, 2019-2026 (USD Million)

Table 110 Mexico: Teleradiology Market, by End-user, 2019-2026 (USD Million)

9.5.3 Rest of Latin America

Table 111 Rolatam: Teleradiology Market, by Product & Service, 2019-2026 (USD Million)

Table 112 Rolatam: Teleradiology Software Market, by Type, 2019-2026 (USD Million)

Table 113 Rolatam: Teleradiology Market, by Imaging Technique, 2019-2026 (USD Million)

Table 114 Rolatam: Teleradiology Market, by End-user, 2019-2026 (USD Million)

9.6 Middle East & Africa (Mea)

9.6.1 Developments in Healthcare Infrastructure to Drive the Market Growth for Teleradiology Solutions in the MEA Region

Table 115 Middle East & Africa: Teleradiology Market, by Product & Service, 2019-2026 (USD Million)

Table 116 Middle East & Africa: Teleradiology Software Market, by Type, 2019-2026 (USD Million)

Table 117 Middle East & Africa: Teleradiology Market, by Imaging Technique, 2019-2026 (USD Million)

Table 118 Middle East & Africa: Teleradiology Market, by End-user, 2019-2026 (USD Million)

10 Competitive Landscape

10.1 Overview

10.2 Key Player Strategies/Right to Win

Figure 32 Market Evaluation Framework: Partnerships, Agreements, & Collaborations Were the Most Widely Adopted Strategies

10.3 Competitive Leadership Mapping

10.3.1 Stars

10.3.2 Emerging Leaders

10.3.3 Pervasive

10.3.4 Emerging Companies

Figure 33 Teleradiology Market: Competitive Leadership Mapping, 2020

10.4 Company Evaluation Quadrant for Start-Ups/Smes (2020)

10.4.1 Progressive Companies

10.4.2 Starting Blocks

10.4.3 Responsive Companies

10.4.4 Dynamic Companies

Figure 34 Teleradiology Market: Company Evaluation Quadrant for Start-Ups/Smes, 2020

10.5 Competitive Benchmarking

Table 119 Footprint of Companies in the Teleradiology Market

10.6 Company Product & Imaging Technique Footprint

Table 120 Product and Imaging Technique Footprint Analysis of Top Players in the Teleradiology Market

10.7 Market Ranking Analysis

Figure 35 Teleradiology Market Ranking Analysis, by Player, 2020

10.8 Competitive Situations & Trends

10.8.1 Product Launches

Table 121 Key Product Launches

10.8.2 Deals

Table 122 Key Partnerships, Agreements, Collaborations, and Acquisitions

11 Company Profiles

11.1 Key Players

(Business Overview, Products Offered, Recent Developments, and Analyst's View (Key Strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

11.1.2 GE Healthcare

Table 124 GE Healthcare: Business Overview

Figure 37 GE Healthcare: Company Snapshot (2020)

11.1.3 Medica Group plc.

Table 125 Medica Group plc.: Business Overview

Figure 38 Medica Group plc.: Company Snapshot (2020)

11.1.4 Services Offered

11.1.5 Cerner Corporation

Table 126 Cerner Corporation: Business Overview

Figure 39 Cerner Corporation: Company Snapshot (2020)

11.1.6 Mckesson Corporation

Table 127 Mckesson Corporation: Business Overview

Figure 40 Mckesson Corporation: Company Snapshot (2020)

11.2 Other Players

11.2.1 Agfa Healthcare

Table 128 Agfa Healthcare: Business Overview

Figure 41 Agfa Healthcare: Company Snapshot (2020)

11.2.2 Siemens Healthineers

Table 129 Siemens Healthineers: Business Overview

Figure 42 Siemens Healthineers: Company Snapshot (2020)

11.2.3 Fujifilm Holdings Corporation

Table 130 Fujifilm Holdings Corporation: Business Overview

Figure 43 Fujifilm Holdings Corporation: Company Snapshot (2020)

11.2.4 4Ways Healthcare

Table 131 4Ways Healthcare Ltd.: Business Overview

11.2.5 Teleradiology Solutions

Table 132 Teleradiology Solutions: Business Overview

11.2.6 Onrad, Inc.

Table 133 Onrad, Inc: Business Overview

11.2.7 Ramsoft, Inc.

Table 134 Ramsoft, Inc.: Business Overview

11.2.8 Novarad Corporation

Table 135 Novarad Corporation: Business Overview

11.2.9 Telediagnostic Solutions Pvt. Ltd.

Table 136 Telediagnostic Solutions Pvt. Ltd.: Business Overview

11.2.10 Statrad LLC

Table 137 Statrad LLC: Business Overview

11.2.11 Medweb LLC

Table 138 Medweb LLC.: Business Overview

11.2.12 Nautilus Medical

Table 139 Nautilus Medical: Business Overview

11.2.13 Mirada Medical

Table 140 Mirada Medical Ltd.: Business Overview

11.2.14 Telerad Tech

Table 141 Telerad Tech: Business Overview

11.2.15 Usarad Holdings, Inc.

Table 142 Usarad Holdings, Inc.: Business Overview

*Details on Business Overview, Products Offered, Recent Developments, and Analyst's View (Key Strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) Might Not be Captured in Case of Unlisted Companies.

12 Appendix

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: The Subscription Portal

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

Companies Mentioned

- 4Ways Healthcare

- Agfa Healthcare

- Cerner Corporation

- Fujifilm Holdings Corporation

- GE Healthcare

- Mckesson Corporation

- Medica Group plc.

- Medweb LLC

- Mirada Medical

- Nautilus Medical

- Novarad Corporation

- Onrad, Inc.

- Ramsoft, Inc.

- Services Offered

- Siemens Healthineers

- Statrad LLC

- Telediagnostic Solutions Pvt. Ltd.

- Telerad Tech

- Teleradiology Solutions

- Usarad Holdings, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 220 |

| Published | January 2022 |

| Forecast Period | 2021 - 2026 |

| Estimated Market Value ( USD | $ 7.3 Billion |

| Forecasted Market Value ( USD | $ 14.8 Billion |

| Compound Annual Growth Rate | 15.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 20 |