Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

It is also a key component in the production of industrial chemicals, explosives, and household cleaning agents. Furthermore, with rapid urbanization and infrastructure development, ammonia's application in construction materials is gaining prominence. It plays a central role in the production of resins, adhesives, laminates, and synthetic panels used in modern construction. This broad spectrum of applications continues to solidify ammonia’s importance in both established and emerging sectors.

Key Market Drivers

Growing Demand of Ammonia in Agriculture Industry

Ammonia plays a crucial role in the agriculture sector, particularly in the production of nitrogen-based fertilizers like urea, ammonium nitrate, and ammonium sulfate. As global crop output continues to rise - with primary crop production reaching 9.9 billion tonnes in 2023 - ammonia remains integral to supporting soil fertility and boosting yields. Nitrogen, derived from ammonia, is vital for photosynthesis, protein synthesis, and plant development. The push toward precision agriculture and advanced farming techniques further increases reliance on ammonia-based inputs. Enhanced crop productivity, rising food demand, and technological innovation in fertilizer application are key contributors to sustained ammonia consumption in global agriculture.Key Market Challenges

Lack in Availability of Raw Materials

Ammonia production is highly dependent on fossil fuels, particularly natural gas, which accounts for a large portion of its energy and feedstock inputs. Volatility in raw material availability and pricing poses a significant challenge for producers. Disruptions in natural gas supply chains, geopolitical instability, and trade restrictions can lead to production slowdowns and rising costs. These issues are especially critical for the fertilizer sector, where ammonia is an indispensable input. Fluctuations in raw material costs also create pricing uncertainty and affect profit margins, making it difficult for manufacturers to plan long-term strategies. In some markets, elevated input costs have led to fertilizer shortages and price hikes, compounding pressure on end-users.Key Market Trends

Growing Interest in Green Ammonia

Green ammonia is gaining attention as a sustainable and carbon-free alternative to conventionally produced ammonia. By using renewable energy sources and electrolysis instead of fossil fuels, green ammonia significantly reduces greenhouse gas emissions. It holds considerable potential in decarbonizing sectors like power generation and maritime shipping, where cleaner fuel alternatives are urgently needed. Additionally, in agriculture, green ammonia can support the transition toward lower-emission fertilizer production. As global regulations tighten around carbon emissions, industries are increasingly looking to green ammonia to align with environmental goals. Its adoption reflects a larger movement toward sustainability and energy transition across the chemical and energy sectors.Key Market Players

- BASF SE

- Casale SA

- CF Industries Holdings, Inc.

- Chambal Fertilisers and Chemicals Ltd

- Csbp Ltd.

- EuroChem Group AG

- Koch Fertilizer, LLC.

- Nutrien Ltd

- Rashtriya Chemicals and Fertilizers Limited

- SABIC

Report Scope:

In this report, the Global Ammonia Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Ammonia Market, By Form:

- Liquid

- Gas

- Powder

Ammonia Market, By End User:

- Agriculture

- Textiles

- Mining

- Pharmaceutical

- Refrigeration

- Others

Ammonia Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Ammonia Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- BASF SE

- Casale SA

- CF Industries Holdings, Inc.

- Chambal Fertilisers and Chemicals Ltd

- Csbp Ltd.

- EuroChem Group AG

- Koch Fertilizer, LLC.

- Nutrien Ltd

- Rashtriya Chemicals and Fertilizers Limited

- SABIC

Table Information

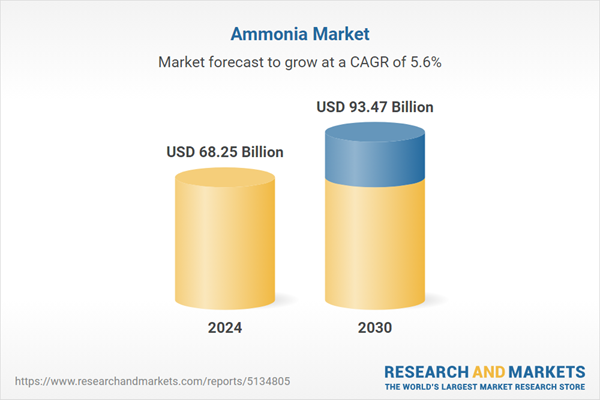

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | June 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 68.25 Billion |

| Forecasted Market Value ( USD | $ 93.47 Billion |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |