Golf Cart Market Analysis:

- Major Market Drivers: The golf cart market growth is currently driven by the surge in popularity of golf among aging demographics promoting leisureactivities. Furthermore, increasing disposable incomes have made it more accessible to engage in golf, which is fueling the market growth. The growing network of golf courses and resorts across the world also drives the need for golf carts. Moreover, electric golf carts are also expected to rise in popularity due to the push for ecological methods of transportation, which is boosting the market growth. In line with this, key manufacturers are also implementing cutting-edge technology to enhance the riding experience through gadgets such as global positioning system (GPS-enabled) carts. Furthermore, the ability to utilize golf carts beyond golf courses, such as for pick-up and drop-off facilities and on-campus transportation in hospitals, is contributing to the golf cart market share.

- Key Market Trends: Due to environmental causes and regulatory needs, electric and solar-powered golf carts are one of the witnessing a considerable demand in the market, which is one of primary golf cart trends. Manufacturers are striving to advance these through novel developments such as automated systems and high-profile safety systems. In line with this, customization and personalization are also available in the market, offering precise requirements of every customer. Furthermore, the shift towards lighter, stronger, and more durable materials that make the vehicle more hard-wearing and dependable is another growth-inducing factor for the market. Apart from this, the usage of the Internet of Things (IoT) smart cart technology is rapidly expanding, which is providing a profitable solution to fleet homeowners and managers, which is further supporting the golf cart demand.

- Geographical Trends: North America, with its largest number of golf courses and a well-known golfing tradition in the United States, emerges as the market leader. The region’s prosperous population and significant expenditures on recreational activities support the expansion. Europe, where the UK, Germany, and France demonstrate large demand for golfing, is the dominant continent in terms of volume. This is further fueled by golf’s ripe popularity and its synergy with tourism in countries with favorable weather conditions. As per the golf cart market report, Asia Pacific emerges as the fastest-growing market due to rapid urbanization and rich disposable incomes and interest in golf in China, Japan, and South Korea. The Middle East and Africa also have considerable potential for market expansion, buoyed by tourism and new golf courses and resorts.

- Competitive Landscape: The competitive landscape of the market is characterized by the presence of key golf cart companies, such as Club Car (Ingersoll Rand Inc.), E-Z-GO (Textron), Garia Inc., JH Global Services Inc., Maini Materials Movement Pvt. Ltd., Marshell Green Power, Speedways Electric, Suzhou Eagle Electric Vehicle Manufacturing Co. Ltd., Tomberlin (Columbia Vehicle Group Inc.), etc.

- Challenges and Opportunities: The golf cart market faces several challenges, including the high initial cost of advanced models, which can limit adoption, particularly in emerging economies. Maintenance and operational costs also pose concerns for users. However, these challenges present opportunities for market players to innovate and offer cost-effective solutions. The shift towards electric and solar-powered carts provides a significant opportunity for growth, aligning with global sustainability goals. Expanding applications beyond golf courses, such as in hospitality, healthcare, and urban mobility, can drive the golf cart industry.

Golf Cart Market Trends:

Rising Popularity of Golf as a Recreational Activity

One of the major factors driving the global golf cart market is the burgeoning popularity of golf as a leisure pursuit among people of all age groups around the world. The growing number of individuals having leisure fun with golf has simultaneously increased the number of golf carts demanded to ensure easy and comfortable locomotion around golf courses. According to industry reports, there are about 8,800 Golf Courses and Country Clubs businesses in the US as of 2023. This is a decrease of -1.7% compared to 2022, yet the overall tendency here is pointing upward. Additionally, this trend is most evident in regions where the sport is relaxing and affordable due to increased disposal revenue and awareness of the health advantages of playing. The golf cart is ultra-advanced and equipped with high-tech gadgets, making the journey across various fields and plains much quicker and more swath than walk-behind wheels.Increasing Adoption of Golf Carts for Non-Golfing Applications

Apart from a traditional application at golf carts, the vehicles are actively used for transportation in many other scenarios not related to the game. For instance, residential areas, airports, shopping complexes, and various industrial areas and facilities involve golf carts in their vehicle fleets to ensure fast and safe interlocution transportation. It becomes possible due to the modern electric specimens’ low size and high adaptability, which make both moving in small locations comfortable and environmentally friendly. Moreover, the current focus on sustainable development leads many organizations to substitute traditional vehicles with electric golf buggies to reduce carbon emissions, which is further accelerating the golf cart market outlook.Shift towards Electric Golf Carts

A key trend influencing the development of the global golf cart market is the growing popularity of electric models instead of gasoline ones. This shift is driven by a range of factors, including increased environmental consciousness, stricter emission legislation, and advancements in electric transport. Unlike their gasoline counterparts, electric golf buggies allow for lower ownership and upkeep costs, produce less noise pollution, and result in zero carbon emissions. Moreover, the advancement of battery technology has allowed these vehicles to be able to travel longer distances without recharging, making them ideal for journeys around a golf course or any other use. The trend towards driving customer purchases and various regulatory mandates for sustainable and environmentally friendly products has further increased the demand for electric golf buggies. Apart from this, recently, Bintelli, a South Carolina-based manufacturer and distributor of electric golf carts, announced plans to invest more than $4 million to establish an assembly and distribution center at the Orleans Industrial Development Park. The source projects the Bintelli company to create approximately 67 jobs by 2024.Golf Cart Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on the product type, application, and seating capacity.Breakup by Product Type:

- Electric Golf Cart

- Gasoline Golf Cart

- Solar Golf Cart

Electric golf cart accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the product type. This includes electric golf cart, gasoline golf cart, and solar golf cart. According to the report, electric golf cart represented the largest segment.The electric golf cart segment is driven by several key factors, such as the increasing emphasis on environmental sustainability is propelling the adoption of electric golf carts. As concerns about climate change and air pollution continue to escalate, consumers and businesses alike are seeking greener transportation solutions. Electric golf carts, with their zero-emission operation and reduced carbon footprint compared to gasoline-powered counterparts, align closely with these sustainability goals, making them an attractive choice for environmentally conscious buyers. Secondly, the rising cost of fuel and the desire for cost-effective transportation options are driving the demand for electric golf carts. With fluctuating gasoline prices and the long-term trend of increasing fuel costs, electric vehicles offer a more economical alternative, as they typically have lower operating expenses and require less maintenance than traditional gasoline-powered carts. This cost savings appeal to both individual golfers and golf course operators looking to reduce overhead expenses. Additionally, the advancements in battery technology and the increasing availability of charging infrastructure are boosting the viability and appeal of electric golf carts.

Breakup by Application:

- Golf Course

- Personal Services

- Commercial Services

Golf course accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the application. This includes golf course, personal services, and commercial services. According to the report, golf course represented the largest segment.The golf course segment is driven by several key factors, such as the increasing demand for golf as a recreational activity among individuals of all ages is a significant driver. As more people seek leisure activities that promote outdoor engagement and socialization, the demand for well-maintained and accessible golf courses rises. This demand prompts golf course operators to invest in enhancing the quality and amenities of their facilities to attract and retain players. Additionally, the growing trend of golf tourism contributes to the expansion of the golf course segment. Golf enthusiasts travel to various destinations globally to experience different courses, landscapes, and playing conditions, driving the need for diverse and attractive golfing facilities. Golf courses situated in tourist destinations capitalize on this trend by offering unique experiences and services tailored to visitors, thereby stimulating growth in the segment. Furthermore, the increasing focus on sustainability and environmental conservation plays a crucial role in shaping the golf course segment.

Breakup by Seating Capacity:

- Small (2-4 Seater)

- Medium (6-8 Seater)

- Large (Above 8 Seats)

The small (2-4-seater) segment is primarily propelled by the increasing demand for compact and maneuverable vehicles suitable for personal transportation within golf courses, residential communities, and recreational facilities. These smaller carts offer agility and ease of navigation in tight spaces, making them ideal for individual golfers, small families, or couples looking for convenient transportation options. Furthermore, the emphasis on eco-friendliness and cost-effectiveness favors the adoption of electric-powered small golf carts, which have lower maintenance requirements and operating costs compared to traditional gasoline models.

In contrast, the medium (6-8-seater) segment is driven by the growing demand for larger capacity vehicles capable of accommodating groups of golfers, tourists, or event attendees. These medium-sized carts offer enhanced passenger capacity and cargo space, making them suitable for transporting larger groups within golf courses, resorts, theme parks, and other recreational venues. Additionally, the versatility of medium golf carts extends beyond recreational use to include applications in hospitality, tourism, and commercial settings, where they serve as efficient transportation solutions for guests, staff, and equipment.

Furthermore, the large (above 8 seats) segment is fueled by the increasing need for shuttle and transportation services in mega-resorts, airports, industrial complexes, and urban centers. These large-capacity carts are designed to accommodate sizable groups of passengers, making them indispensable for mass transit and logistics purposes. With features such as spacious seating arrangements, robust construction, and advanced safety systems, large golf carts offer reliable and comfortable transportation for passengers over extended distances. Furthermore, the shift towards electric-powered models in the large segment aligns with sustainability goals and regulatory requirements, driving the adoption of eco-friendly transportation solutions in various commercial and public sectors.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest golf cart market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.The North American golf cart market is driven by several key factors, each contributing to its growth and development, such as the increasing popularity of golf as a recreational activity among individuals of all ages is a significant driver. As golf continues to be a widely enjoyed pastime in North America, there's a growing demand for golf carts to enhance the playing experience on golf courses across the region. Additionally, the rising trend of using golf carts for transportation purposes in various non-golfing applications is fueling market growth. Beyond golf courses, golf carts are increasingly utilized in residential communities, retirement villages, and resort areas for convenient and eco-friendly mobility solutions, thereby expanding the market's reach and scope. Moreover, the emphasis on environmental sustainability is driving the shift towards electric golf carts in North America. With increasing concerns about carbon emissions and environmental impact, there's a growing preference for electric-powered vehicles, including golf carts, as a greener alternative to gasoline models.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the golf cart include Club Car (Ingersoll Rand Inc.), E-Z-GO (Textron), Garia Inc., JH Global Services Inc., Maini Materials Movement Pvt. Ltd., Marshell Green Power, Speedways Electric, Suzhou Eagle Electric Vehicle Manufacturing Co. Ltd., Tomberlin (Columbia Vehicle Group Inc.), etc.

- In the global golf cart market, key players are actively engaged in strategic initiatives to maintain and enhance their market positions. These initiatives include product innovation, expansion of distribution channels, strategic partnerships, and mergers and acquisitions. To stay competitive, players are focusing on developing technologically advanced golf carts with features such as GPS navigation systems, onboard diagnostics, and improved battery technologies to meet evolving consumer preferences and regulatory requirements. Additionally, companies are expanding their distribution networks to reach new markets and capitalize on emerging opportunities, particularly in regions with a growing interest in golf and recreational activities. Strategic partnerships and collaborations are also common among key players, allowing them to leverage each other's strengths in areas such as research and development (R&D), manufacturing capabilities, and market access. Furthermore, mergers and acquisitions are prevalent strategies for players looking to consolidate their market presence, expand their product portfolios, and achieve economies of scale. By actively pursuing these strategic initiatives, key players in the global golf cart market aim to sustain growth, strengthen their competitive positions, and capitalize on emerging trends and opportunities in the industry.

Key Questions Answered in This Report

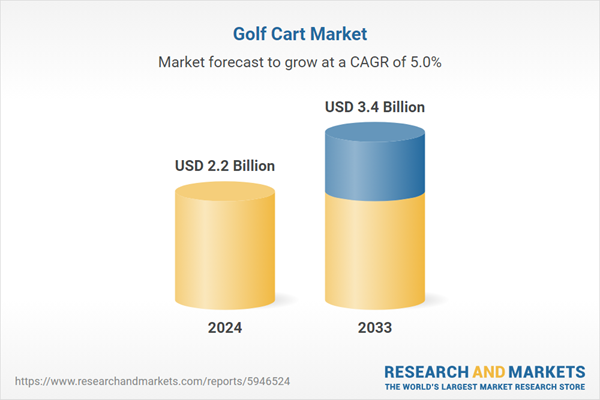

1. What was the size of the global golf cart market in 2024?2. What is the expected growth rate of the global golf cart market during 2025-2033?

3. What are the key factors driving the global golf cart market?

4. What has been the impact of COVID-19 on the global golf cart market?

5. What is the breakup of the global golf cart market based on the product type?

6. What is the breakup of the global golf cart market based on the application?

7. What are the key regions in the global golf cart market?

8. Who are the key players/companies in the global golf cart market?

Table of Contents

Companies Mentioned

- Club Car (Ingersoll Rand Inc.)

- E-Z-GO (Textron)

- Garia Inc.

- JH Global Services Inc.

- Maini Materials Movement Pvt. Ltd.

- Marshell Green Power

- Speedways Electric

- Suzhou Eagle Electric Vehicle Manufacturing Co. Ltd.

- Tomberlin (Columbia Vehicle Group Inc.)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 142 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 2.2 Billion |

| Forecasted Market Value ( USD | $ 3.4 Billion |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |