8 Food Diagnostics Market, by Type

8.1 Introduction

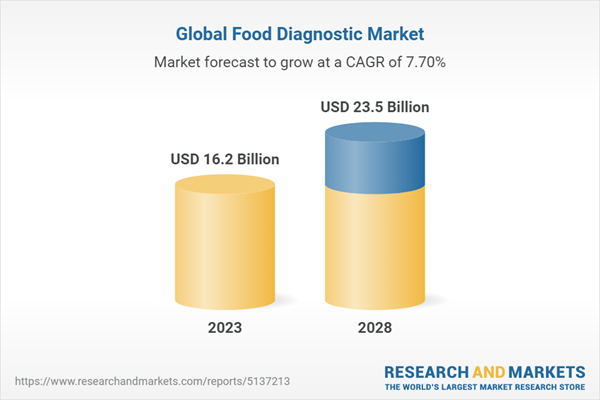

Figure 43 Food Diagnostics Market, by Type, 2023 Vs. 2028 (USD Million)

Table 35 Food Diagnostics Market, by Type, 2019-2022 (USD Million)

Table 36 Food Diagnostics Market, by Type, 2023-2028 (USD Million)

Table 37 Food Diagnostics Market, by Type, 2019-2022 (Million Units)

Table 38 Food Diagnostics Market, by Type, 2023-2028 (Million Units)

8.2 Systems

8.2.1 Demand for Higher Food Safety Standards and Rapid Technologies to Drive Market

Table 39 Food Diagnostic Systems Market, by Type, 2019-2022 (USD Million)

Table 40 Food Diagnostic Systems Market, by Type, 2023-2028 (USD Million)

Table 41 Food Diagnostic Systems Market, by Region, 2019-2022 (USD Million)

Table 42 Food Diagnostic Systems Market, by Region, 2023-2028 (USD Million)

Table 43 Food Diagnostic Systems Market, by Region, 2019-2022 (Million Units)

Table 44 Food Diagnostic Systems Market, by Region, 2023-2028 (Million Units)

8.2.2 Hybridization-Based

8.2.2.1 High Level of Accuracy and Reliability of Hybridization-Based Systems to Drive Its Demand

Table 45 Hybridization-Based Food Diagnostics Systems Market, by Region, 2019-2022 (USD Million)

Table 46 Hybridization-Based Food Diagnostics Systems Market, by Region, 2023-2028 (USD Million)

Table 47 Hybridization-Based Food Diagnostics Systems Market, by Type, 2019-2022 (USD Million)

Table 48 Hybridization-Based Food Diagnostics Systems Market, by Type, 2023-2028 (USD Million)

8.2.2.2 Polymerase Chain Reaction (Pcr)

8.2.2.2.1 Need to Provide Accurate Food Testing Results, Good Dna-Based Reproducibility, and Affordability to Drive Demand

8.2.2.3 Microarrays

8.2.2.3.1 Need to Trace GMos, Detect Pathogens, and Analyze Food Samples to Boost Demand

8.2.2.4 Gene Amplifiers

8.2.2.4.1 Rapid Detection Capabilities and Need for Reduced Decision-Making in Food Production and Safety to Boost Demand

8.2.2.5 Sequencers

8.2.2.5.1 Accuracy and Fast Results with High Sensitivity and Specificity to Fuel Demand

8.2.3 Chromatography-Based

8.2.3.1 Chromatography-Based Systems to Detect Broad Range of Analytes, Including Contaminants, Pesticides, Mycotoxins, and Flavor Compounds

Table 49 Chromatography-Based Food Diagnostic Systems Market, by Region, 2019-2022 (USD Million)

Table 50 Chromatography-Based Food Diagnostic Systems Market, by Region, 2023-2028 (USD Million)

Table 51 Chromatography-Based Food Diagnostic Systems Market, by Technology, 2019-2022 (USD Million)

Table 52 Chromatography-Based Food Diagnostic Systems Market, by Technology, 2023-2028 (USD Million)

8.2.3.2 High-Performance Liquid Chromatography (HPLC)

8.2.3.2.1 Need to Analyze Residues and Contaminants, Food Additives, and Natural Ingredients to Fuel Demand

8.2.3.3 Liquid Chromatography (Lc)

8.2.3.3.1 Lc to Detect Amino Acids and Lipids in Food Products and Analyze Contaminants

8.2.3.4 Gas Chromatography (Gc)

8.2.3.4.1 Gc to Identify Current and Past Trends in Food Samples and Predict Future Trends

8.2.3.5 Other Chromatography-Based Technologies

8.2.4 Spectrometry-Based

8.2.4.1 Spectrometry-Based Systems to Provide Non-Destructive Testing, Minimal Sample Preparation, and Reduce Waste

Table 53 Spectrometry-Based Food Diagnostic Systems Market, by Region, 2019-2022 (USD Million)

Table 54 Spectrometry-Based Food Diagnostic Systems Market, by Region, 2023-2028 (USD Million)

8.2.5 Immunoassay-Based

8.2.5.1 Growing Demand for Elisa for Food Safety Analysis to Drive Immunoassay-Based Systems

Table 55 Immunoassay-Based Food Diagnostic Systems Market, by Region, 2019-2022 (USD Million)

Table 56 Immunoassay-Based Food Diagnostic Systems Market, by Region, 2023-2028 (USD Million)

8.2.6 Biosensors

8.2.6.1 Ease of Application and Simple Methodology for Performing Safety Tests to Drive Growth

Table 57 Food Diagnostic Biosensors Market, by Region, 2019-2022 (USD Million)

Table 58 Food Diagnostic Biosensors Market, by Region, 2023-2028 (USD Million)

8.2.7 Other Systems

Table 59 Other Food Diagnostic Systems Market, by Region, 2019-2022 (USD Million)

Table 60 Other Food Diagnostic Systems Market, by Region, 2023-2028 (USD Million)

8.3 Test Kits

8.3.1 Accessibility, Cost-Efficiency, and Ease of Use in Testing Kits to Drive Market

Table 61 Food Diagnostic Test Kits Market, by Region, 2019-2022 (USD Million)

Table 62 Food Diagnostic Test Kits Market, by Region, 2023-2028 (USD Million)

Table 63 Food Diagnostic Test Kits Market, by Region, 2019-2022 (Million Units)

Table 64 Food Diagnostic Test Kits Market, by Region, 2023-2028 (Million Units)

8.4 Consumables

8.4.1 Need to Maintain Sterility and Provide Precision & Efficiency in Food Diagnostics Process to Drive Market

Table 65 Food Diagnostic Consumables Market, by Type, 2019-2022 (USD Million)

Table 66 Food Diagnostic Consumables Market, by Type, 2023-2028 (USD Million)

Table 67 Food Diagnostic Consumables Market, by Region, 2019-2022 (USD Million)

Table 68 Food Diagnostic Consumables Market, by Region, 2023-2028 (USD Million)

Table 69 Food Diagnostic Consumables Market, by Region, 2019-2022 (Million Units)

Table 70 Food Diagnostic Consumables Market, by Region, 2023-2028 (Million Units)

8.4.2 Reagents

8.4.2.1 Rise in Use of Reagents Alongside Diagnostic Systems to Drive Demand for Testing Food Samples

Table 71 Food Diagnostic Reagents Market, by Region, 2019-2022 (USD Million)

Table 72 Food Diagnostic Reagents Market, by Region, 2023-2028 (USD Million)

8.4.3 Test Accessories

8.4.3.1 Need for Precision and Efficiency in Testing Processes to Drive Growth for Test Accessories

Table 73 Food Diagnostic Test Accessories Market, by Region, 2019-2022 (USD Million)

Table 74 Food Diagnostic Test Accessories Market, by Region, 2023-2028 (USD Million)

8.4.4 Disinfectants

8.4.4.1 Need to Maintain Sterile and Hygienic Environments During Food Safety Tests to Drive Demand for Disinfectants

Table 75 Food Diagnostic Disinfectants Market, by Region, 2019-2022 (USD Million)

Table 76 Food Diagnostic Disinfectants Market, by Region, 2023-2028 (USD Million)

8.4.5 Other Consumables

Table 77 Other Food Diagnostic Consumables Market, by Region, 2019-2022 (USD Million)

Table 78 Other Food Diagnostic Consumables Market, by Region, 2023-2028 (USD Million)

11 Food Diagnostics Market, by Region

11.1 Introduction

Figure 46 Food Diagnostics Market: Geographic Snapshot, 2023-2028 (USD Million)

Table 122 Food Diagnostics Market, by Region, 2019-2022 (USD Million)

Table 123 Food Diagnostics Market, by Region, 2023-2028 (USD Million)

Table 124 Food Diagnostics Market, by Region, 2019-2022 (Million Units)

Table 125 Food Diagnostics Market, by Region, 2023-2028 (Million Units)

11.2 North America

11.2.1 North America: Recession Impact Analysis

Figure 47 North America: Inflation Rates, by Key Country, 2017-2022

Figure 48 North America: Recession Impact Analysis, 2022 Vs. 2023

Table 126 North America: Food Diagnostics Market, by Country, 2019-2022 (USD Million)

Table 127 North America: Food Diagnostics Market, by Country, 2023-2028 (USD Million)

Table 128 North America: Food Diagnostics Market, by Country, 2019-2022 (Million Units)

Table 129 North America: Food Diagnostics Market, by Country, 2023-2028 (Million Units)

Table 130 North America: Food Diagnostics Market, by Type, 2019-2022 (USD Million)

Table 131 North America: Food Diagnostics Market, by Type, 2023-2028 (USD Million)

Table 132 North America: Food Diagnostics Market, by Type, 2019-2022 (Million Units)

Table 133 North America: Food Diagnostics Market, by Type, 2023-2028 (Million Units)

Table 134 North America: Food Diagnostic Systems Market, by Type, 2019-2022 (USD Million)

Table 135 North America: Food Diagnostic Systems Market, by Type, 2023-2028 (USD Million)

Table 136 North America: Food Diagnostic Consumables Market, by Type, 2019-2022 (USD Million)

Table 137 North America: Food Diagnostic Consumables Market, by Type, 2023-2028 (USD Million)

Table 138 North America: Food Diagnostics Market, by Site, 2019-2022 (USD Million)

Table 139 North America: Food Diagnostics Market, by Site, 2023-2028 (USD Million)

Table 140 North America: Food Diagnostics Market, by Testing Type, 2019-2022 (USD Million)

Table 141 North America: Food Diagnostics Market, by Testing Type, 2023-2028 (USD Million)

Table 142 North America: Food Diagnostics Market, by Safety Testing Type, 2019-2022 (USD Million)

Table 143 North America: Food Diagnostics Market, by Safety Testing Type, 2023-2028 (USD Million)

Table 144 North America: Food Diagnostics Market, by Quality Testing Type, 2019-2022 (USD Million)

Table 145 North America: Food Diagnostics Market, by Quality Testing Type, 2023-2028 (USD Million)

Table 146 North America: Food Diagnostics Market, by Food Tested, 2019-2022 (USD Million)

Table 147 North America: Food Diagnostics Market, by Food Tested, 2023-2028 (USD Million)

11.2.2 US

11.2.2.1 Stringent Food Safety Regulations and Technological Advancements in Us to Drive Market

Table 148 US: Food Diagnostics Market, by Type, 2019-2022 (USD Million)

Table 149 US: Food Diagnostics Market, by Type, 2023-2028 (USD Million)

Table 150 US: Food Diagnostic Systems Market, by Type, 2019-2022 (USD Million)

Table 151 US: Food Diagnostic Systems Market, by Type, 2023-2028 (USD Million)

11.2.3 Canada

11.2.3.1 Growing Food Industry and Government Initiatives to Prevent Potential Food Risks in Canada to Propel Market Growth

Table 152 Canada: Food Diagnostics Market, by Type, 2019-2022 (USD Million)

Table 153 Canada: Food Diagnostics Market, by Type, 2023-2028 (USD Million)

Table 154 Canada: Food Diagnostic Systems Market, by Type, 2019-2022 (USD Million)

Table 155 Canada: Food Diagnostic Systems Market, by Type, 2023-2028 (USD Million)

11.2.4 Mexico

11.2.4.1 Strong Agricultural Trade Partnership with Us to Lead to Increased Demand for Better Food Diagnostics Systems in Mexico

Figure 49 Top 10 Commodities Imported by Mexico from Us, 2022 (USD Billion)

Table 156 Mexico: Food Diagnostics Market, by Type, 2019-2022 (USD Million)

Table 157 Mexico: Food Diagnostics Market, by Type, 2023-2028 (USD Million)

Table 158 Mexico: Food Diagnostic Systems Market, by Type, 2019-2022 (USD Million)

Table 159 Mexico: Food Diagnostic Systems Market, by Type, 2023-2028 (USD Million)

11.3 Europe

Figure 50 Europe: Food Diagnostics Market Snapshot

11.3.1 Europe: Recession Impact Analysis

Figure 51 Europe: Country-Level Inflation Data, 2017-2022

Figure 52 Europe: Recession Impact Analysis, 2022 Vs. 2023

Table 160 Europe: Food Diagnostics Market, by Country, 2019-2022 (USD Million)

Table 161 Europe: Food Diagnostics Market, by Country, 2023-2028 (USD Million)

Table 162 Europe: Food Diagnostics Market, by Country, 2019-2022 (Million Units)

Table 163 Europe: Food Diagnostics Market, by Country, 2023-2028 (Million Units)

Table 164 Europe: Food Diagnostics Market, by Type, 2019-2022 (USD Million)

Table 165 Europe: Food Diagnostics Market, by Type, 2023-2028 (USD Million)

Table 166 Europe: Food Diagnostics Market, by Type, 2019-2022 (Million Units)

Table 167 Europe: Food Diagnostics Market, by Type, 2023-2028 (Million Units)

Table 168 Europe: Food Diagnostic Systems Market, by Type, 2019-2022 (USD Million)

Table 169 Europe: Food Diagnostic Systems Market, by Type, 2023-2028 (USD Million)

Table 170 Europe: Food Diagnostic Consumables Market, by Type, 2019-2022 (USD Million)

Table 171 Europe: Food Diagnostic Consumables Market, by Type, 2023-2028 (USD Million)

Table 172 Europe: Food Diagnostics Market, by Site, 2019-2022 (USD Million)

Table 173 Europe: Food Diagnostics Market, by Site, 2023-2028 (USD Million)

Table 174 Europe: Food Diagnostics Market, by Testing Type, 2019-2022 (USD Million)

Table 175 Europe: Food Diagnostics Market, by Testing Type, 2023-2028 (USD Million)

Table 176 Europe: Food Diagnostics Market, by Safety Testing Type, 2019-2022 (USD Million)

Table 177 Europe: Food Diagnostics Market, by Safety Testing Type, 2023-2028 (USD Million)

Table 178 Europe: Food Diagnostics Market, by Quality Testing Type, 2019-2022 (USD Million)

Table 179 Europe: Food Diagnostics Market, by Quality Testing Type, 2023-2028 (USD Million)

Table 180 Europe: Food Diagnostics Market, by Food Tested, 2019-2022 (USD Million)

Table 181 Europe: Food Diagnostics Market, by Food Tested, 2023-2028 (USD Million)

11.3.2 Germany

11.3.2.1 Multiple Foodborne Illness Outbreaks and Environmental Factors to Fuel Market Growth in Germany

Table 182 Germany: Food Diagnostics Market, by Type, 2019-2022 (USD Million)

Table 183 Germany: Food Diagnostics Market, by Type, 2023-2028 (USD Million)

Table 184 Germany: Food Diagnostic Systems Market, by Type, 2019-2022 (USD Million)

Table 185 Germany: Food Diagnostic Systems Market, by Type, 2023-2028 (USD Million)

11.3.3 UK

11.3.3.1 Government Commitment to Food Safety and Combating Food Crime to Drive UK's Food Diagnostics Market

Table 186 UK: Food Diagnostics Market, by Type, 2019-2022 (USD Million)

Table 187 UK: Food Diagnostics Market, by Type, 2023-2028 (USD Million)

Table 188 UK: Food Diagnostic Systems Market, by Type, 2019-2022 (USD Million)

Table 189 UK: Food Diagnostic Systems Market, by Type, 2023-2028 (USD Million)

11.3.4 France

11.3.4.1 Food Recall Incidents and Consumer Awareness to Drive Surge in French Food Diagnostics Market

Table 190 France: Food Diagnostics Market, by Type, 2019-2022 (USD Million)

Table 191 France: Food Diagnostics Market, by Type, 2023-2028 (USD Million)

Table 192 France: Food Diagnostic Systems Market, by Type, 2019-2022 (USD Million)

Table 193 France: Food Diagnostic Systems Market, by Type, 2023-2028 (USD Million)

11.3.5 Italy

11.3.5.1 Substantial Investments and Stringent Regulations to Propel Growth of Food Diagnostics Market in Italy

Table 194 Italy: Food Diagnostics Market, by Type, 2019-2022 (USD Million)

Table 195 Italy: Food Diagnostics Market, by Type, 2023-2028 (USD Million)

Table 196 Italy: Food Diagnostic Systems Market, by Type, 2019-2022 (USD Million)

Table 197 Italy: Food Diagnostic Systems Market, by Type, 2023-2028 (USD Million)

11.3.6 Spain

11.3.6.1 Rise in Salmonella and Yersinia Outbreaks in Spain to Drive Food Diagnostics Market

Table 198 Spain: Food Diagnostics Market, by Type, 2019-2022 (USD Million)

Table 199 Spain: Food Diagnostics Market, by Type, 2023-2028 (USD Million)

Table 200 Spain: Food Diagnostic Systems Market, by Type, 2019-2022 (USD Million)

Table 201 Spain: Food Diagnostic Systems Market, by Type, 2023-2028 (USD Million)

11.3.7 Poland

11.3.7.1 Rise in Poultry Production and Exports to Drive Poland's Food Diagnostics Market

Table 202 Poland: Food Diagnostics Market, by Type, 2019-2022 (USD Million)

Table 203 Poland: Food Diagnostics Market, by Type, 2023-2028 (USD Million)

Table 204 Poland: Food Diagnostic Systems Market, by Type, 2019-2022 (USD Million)

Table 205 Poland: Food Diagnostic Systems Market, by Type, 2023-2028 (USD Million)

11.3.8 Rest of Europe

Table 206 Rest of Europe: Food Diagnostics Market, by Type, 2019-2022 (USD Million)

Table 207 Rest of Europe: Food Diagnostics Market, by Type, 2023-2028 (USD Million)

Table 208 Rest of Europe: Food Diagnostic Systems Market, by Type, 2019-2022 (USD Million)

Table 209 Rest of Europe: Food Diagnostic Systems Market, by Type, 2023-2028 (USD Million)

11.4 Asia-Pacific

Figure 53 Asia-Pacific: Food Diagnostics Market Snapshot

11.4.1 Asia-Pacific: Recession Impact Analysis

Figure 54 Asia-Pacific: Inflation Rates, by Key Country, 2017-2022

Figure 55 Asia-Pacific: Recession Impact Analysis, 2022 Vs. 2023

Table 210 Asia-Pacific: Food Diagnostics Market, by Country, 2019-2022 (USD Million)

Table 211 Asia-Pacific: Food Diagnostics Market, by Country, 2023-2028 (USD Million)

Table 212 Asia-Pacific: Food Diagnostics Market, by Country, 2019-2022 (Million Units)

Table 213 Asia-Pacific: Food Diagnostics Market, by Country, 2023-2028 (Million Units)

Table 214 Asia-Pacific: Food Diagnostics Market, by Type, 2019-2022 (USD Million)

Table 215 Asia-Pacific: Food Diagnostics Market, by Type, 2023-2028 (USD Million)

Table 216 Asia-Pacific: Food Diagnostics Market, by Type, 2019-2022 (Million Units)

Table 217 Asia-Pacific: Food Diagnostics Market, by Type, 2023-2028 (Million Units)

Table 218 Asia-Pacific: Food Diagnostic Systems Market, by Type, 2019-2022 (USD Million)

Table 219 Asia-Pacific: Food Diagnostic Systems Market, by Type, 2023-2028 (USD Million)

Table 220 Asia-Pacific: Food Diagnostic Consumables Market, by Type, 2019-2022 (USD Million)

Table 221 Asia-Pacific: Food Diagnostic Consumables Market, by Type, 2023-2028 (USD Million)

Table 222 Asia-Pacific: Food Diagnostics Market, by Site, 2019-2022 (USD Million)

Table 223 Asia-Pacific: Food Diagnostics Market, by Site, 2023-2028 (USD Million)

Table 224 Asia-Pacific: Food Diagnostics Market, by Testing Type, 2019-2022 (USD Million)

Table 225 Asia-Pacific: Food Diagnostics Market, by Testing Type, 2023-2028 (USD Million)

Table 226 Asia-Pacific: Food Diagnostics Market, by Safety Testing Type, 2019-2022 (USD Million)

Table 227 Asia-Pacific: Food Diagnostics Market, by Safety Testing Type, 2023-2028 (USD Million)

Table 228 Asia-Pacific: Food Diagnostics Market, by Quality Testing Type, 2019-2022 (USD Million)

Table 229 Asia-Pacific: Food Diagnostics Market, by Quality Testing Type, 2023-2028 (USD Million)

Table 230 Asia-Pacific: Food Diagnostics Market, by Food Tested, 2019-2022 (USD Million)

Table 231 Asia-Pacific: Food Diagnostics Market, by Food Tested, 2023-2028 (USD Million)

11.4.2 China

11.4.2.1 Shift from Wet Markets to Supermarkets or Ecommerce Channels to Cause Food Diagnostics to Play Major Role in China

Table 232 China: Food Diagnostics Market, by Type, 2019-2022 (USD Million)

Table 233 China: Food Diagnostics Market, by Type, 2023-2028 (USD Million)

Table 234 China: Food Diagnostic Systems Market, by Type, 2019-2022 (USD Million)

Table 235 China: Food Diagnostic Systems Market, by Type, 2023-2028 (USD Million)

11.4.3 India

11.4.3.1 Export Rejections and Government Initiatives to Drive Growth of Food Diagnostics Market in India

Table 236 India: Food Diagnostics Market, by Type, 2019-2022 (USD Million)

Table 237 India: Food Diagnostics Market, by Type, 2023-2028 (USD Million)

Table 238 India: Food Diagnostic Systems Market, by Type, 2019-2022 (USD Million)

Table 239 India: Food Diagnostic Systems Market, by Type, 2023-2028 (USD Million)

11.4.4 Japan

11.4.4.1 Safety Concerns in Seafood Industry to Propel Adoption of Food Diagnostics

Table 240 Japan: Food Diagnostics Market, by Type, 2019-2022 (USD Million)

Table 241 Japan: Food Diagnostics Market, by Type, 2023-2028 (USD Million)

Table 242 Japan: Food Diagnostic Systems Market, by Type, 2019-2022 (USD Million)

Table 243 Japan: Food Diagnostic Systems Market, by Type, 2023-2028 (USD Million)

11.4.5 Australia & New Zealand

11.4.5.1 Allergen Mitigation and Proactive Initiatives to Drive Food Diagnostics Market in Australia and New Zealand

Table 244 Australia & New Zealand: Food Diagnostics Market, by Type, 2019-2022 (USD Million)

Table 245 Australia & New Zealand: Food Diagnostics Market, by Type, 2023-2028 (USD Million)

Table 246 Australia & New Zealand: Food Diagnostic Systems Market, by Type, 2019-2022 (USD Million)

Table 247 Australia & New Zealand: Food Diagnostic Systems Market, by Type, 2023-2028 (USD Million)

11.4.6 South Korea

11.4.6.1 Heavy Reliance on Food Imports to Augment South Korea's Food Diagnostics Adoption

Table 248 South Korea: Food Diagnostics Market, by Type, 2019-2022 (USD Million)

Table 249 South Korea: Food Diagnostics Market, by Type, 2023-2028 (USD Million)

Table 250 South Korea: Food Diagnostic Systems Market, by Type, 2019-2022 (USD Million)

Table 251 South Korea: Food Diagnostic Systems Market, by Type, 2023-2028 (USD Million)

11.4.7 Rest of Asia-Pacific

Table 252 Rest of Asia-Pacific: Food Diagnostics Market, by Type, 2019-2022 (USD Million)

Table 253 Rest of Asia-Pacific: Food Diagnostics Market, by Type, 2023-2028 (USD Million)

Table 254 Rest of Asia-Pacific: Food Diagnostic Systems Market, by Type, 2019-2022 (USD Million)

Table 255 Rest of Asia-Pacific: Food Diagnostic Systems Market, by Type, 2023-2028 (USD Million)

11.5 South America

11.5.1 South America: Recession Impact Analysis

Figure 56 South America: Inflation Rates, by Key Country, 2017-2022

Figure 57 South America: Recession Impact Analysis, 2022 Vs. 2023

Table 256 South America: Food Diagnostics Market, by Country, 2019-2022 (USD Million)

Table 257 South America: Food Diagnostics Market, by Country, 2023-2028 (USD Million)

Table 258 South America: Food Diagnostics Market, by Country, 2019-2022 (Million Units)

Table 259 South America: Food Diagnostics Market, by Country, 2023-2028 (Million Units)

Table 260 South America: Food Diagnostics Market, by Type, 2019-2022 (USD Million)

Table 261 South America: Food Diagnostics Market, by Type, 2023-2028 (USD Million)

Table 262 South America: Food Diagnostics Market, by Type, 2019-2022 (Million Units)

Table 263 South America: Food Diagnostics Market, by Type, 2023-2028 (Million Units)

Table 264 South America: Food Diagnostic Systems Market, by Type, 2019-2022 (USD Million)

Table 265 South America: Food Diagnostic Systems Market, by Type, 2023-2028 (USD Million)

Table 266 South America: Food Diagnostic Consumables Market, by Type, 2019-2022 (USD Million)

Table 267 South America: Food Diagnostic Consumables Market, by Type, 2023-2028 (USD Million)

Table 268 South America: Food Diagnostics Market, by Site, 2019-2022 (USD Million)

False

Table 270 South America: Food Diagnostics Market, by Testing Type, 2019-2022 (USD Million)

Table 271 South America: Food Diagnostics Market, by Testing Type, 2023-2028 (USD Million)

Table 272 South America: Food Diagnostics Market, by Safety Testing Type, 2019-2022 (USD Million)

Table 273 South America: Food Diagnostics Market, by Safety Testing Type, 2023-2028 (USD Million)

Table 274 South America: Food Diagnostics Market, by Quality Testing Type, 2019-2022 (USD Million)

Table 275 South America: Food Diagnostics Market, by Quality Testing Type, 2023-2028 (USD Million)

Table 276 South America: Food Diagnostics Market, by Food Tested, 2019-2022 (USD Million)

Table 277 South America: Food Diagnostics Market, by Food Tested, 2023-2028 (USD Million)

11.5.2 Brazil

11.5.2.1 International Trade Disputes and Global Food Safety Standards to Drive Growth of Food Diagnostics Market in Brazil

Table 278 Brazil: Food Diagnostics Market, by Type, 2019-2022 (USD Million)

Table 279 Brazil: Food Diagnostics Market, by Type, 2023-2028 (USD Million)

Table 280 Brazil: Food Diagnostic Systems Market, by Type, 2019-2022 (USD Million)

Table 281 Brazil: Food Diagnostic Systems Market, by Type, 2023-2028 (USD Million)

11.5.3 Argentina

11.5.3.1 Rise in Foodborne Illnesses to Lead to Increase in Food Testing Practices and Diagnostics in Argentina

Table 282 Argentina: Food Diagnostics Market, by Type, 2019-2022 (USD Million)

Table 283 Argentina: Food Diagnostics Market, by Type, 2023-2028 (USD Million)

Table 284 Argentina: Food Diagnostic Systems Market, by Type, 2019-2022 (USD Million)

Table 285 Argentina: Food Diagnostic Systems Market, by Type, 2023-2028 (USD Million)

11.5.4 Rest of South America

Table 286 Rest of South America: Food Diagnostics Market, by Type, 2019-2022 (USD Million)

Table 287 Rest of South America: Food Diagnostics Market, by Type, 2023-2028 (USD Million)

Table 288 Rest of South America: Food Diagnostic Systems Market, by Type, 2019-2022 (USD Million)

Table 289 Rest of South America: Food Diagnostic Systems Market, by Type, 2023-2028 (USD Million)

11.6 Middle East

11.6.1 Reliance in Food Imports and Growth in Exports to Fuel Food Diagnostics Market in the Middle East

Table 290 Middle East: Food Diagnostics Market, by Type, 2019-2022 (USD Million)

Table 291 Middle East: Food Diagnostics Market, by Type, 2023-2028 (USD Million)

Table 292 Middle East: Food Diagnostics Market, by Type, 2019-2022 (Million Units)

Table 293 Middle East: Food Diagnostics Market, by Type, 2023-2028 (Million Units)

Table 294 Middle East: Food Diagnostic Systems Market, by Type, 2019-2022 (USD Million)

Table 295 Middle East: Food Diagnostic Systems Market, by Type, 2023-2028 (USD Million)

Table 296 Middle East: Food Diagnostic Consumables Market, by Type, 2019-2022 (USD Million)

Table 297 Middle East: Food Diagnostic Consumables Market, by Type, 2023-2028 (USD Million)

Table 298 Middle East: Food Diagnostics Market, by Site, 2019-2022 (USD Million)

Table 299 Middle East: Food Diagnostics Market, by Site, 2023-2028 (USD Million)

Table 300 Middle East: Food Diagnostics Market, by Testing Type, 2019-2022 (USD Million)

Table 301 Middle East: Food Diagnostics Market, by Testing Type, 2023-2028 (USD Million)

Table 302 Middle East: Food Diagnostics Market, by Safety Testing Type, 2019-2022 (USD Million)

Table 303 Middle East: Food Diagnostics Market, by Safety Testing Type, 2023-2028 (USD Million)

Table 304 Middle East: Food Diagnostics Market, by Quality Testing Type, 2019-2022 (USD Million)

Table 305 Middle East: Food Diagnostics Market, by Quality Testing Type, 2023-2028 (USD Million)

Table 306 Middle East: Food Diagnostics Market, by Food Tested, 2019-2022 (USD Million)

Table 307 Middle East: Food Diagnostics Market, by Food Tested, 2023-2028 (USD Million)

11.7 Africa

11.7.1 Africa: Recession Impact Analysis

Figure 58 Africa: Inflation Rates, by Key Country, 2018-2022

Figure 59 Africa: Recession Impact Analysis, 2022 Vs. 2023

Table 308 Africa: Food Diagnostics Market, by Country, 2019-2022 (USD Million)

Table 309 Africa: Food Diagnostics Market, by Country, 2023-2028 (USD Million)

Table 310 Africa: Food Diagnostics Market, by Country, 2019-2022 (Million Units)

Table 311 Africa: Food Diagnostics Market, by Country, 2023-2028 (Million Units)

Table 312 Africa: Food Diagnostics Market, by Type, 2019-2022 (USD Million)

Table 313 Africa: Food Diagnostics Market, by Type, 2023-2028 (USD Million)

Table 314 Africa: Food Diagnostics Market, by Type, 2019-2022 (Million Units)

Table 315 Africa: Food Diagnostics Market, by Type, 2023-2028 (Million Units)

Table 316 Africa: Food Diagnostic Systems Market, by Type, 2019-2022 (USD Million)

Table 317 Africa: Food Diagnostic Systems Market, by Type, 2023-2028 (USD Million)

Table 318 Africa: Food Diagnostic Consumables Market, by Type, 2019-2022 (USD Million)

Table 319 Africa: Food Diagnostic Consumables Market, by Type, 2023-2028 (USD Million)

Table 320 Africa: Food Diagnostics Market, by Site, 2019-2022 (USD Million)

Table 321 Africa: Food Diagnostics Market, by Site, 2023-2028 (USD Million)

Table 322 Africa: Food Diagnostics Market, by Testing Type, 2019-2022 (USD Million)

Table 323 Africa: Food Diagnostics Market, by Testing Type, 2023-2028 (USD Million)

Table 324 Africa: Food Diagnostics Market, by Safety Testing Type, 2019-2022 (USD Million)

Table 325 Africa: Food Diagnostics Market, by Safety Testing Type, 2023-2028 (USD Million)

Table 326 Africa: Food Diagnostics Market, by Quality Testing Type, 2019-2022 (USD Million)

Table 327 Africa: Food Diagnostics Market, by Quality Testing Type, 2023-2028 (USD Million)

Table 328 Africa: Food Diagnostics Market, by Food Tested, 2019-2022 (USD Million)

Table 329 Africa: Food Diagnostics Market, by Food Tested, 2023-2028 (USD Million)

11.7.2 South Africa

11.7.2.1 History of Listeriosis Outbreak to Drive Surge of South African Food Diagnostics Market

Table 330 South Africa: Food Diagnostics Market, by Type, 2019-2022 (USD Million)

Table 331 South Africa: Food Diagnostics Market, by Type, 2023-2028 (USD Million)

Table 332 South Africa: Food Diagnostic Systems Market, by Type, 2019-2022 (USD Million)

Table 333 South Africa: Food Diagnostic Systems Market, by Type, 2023-2028 (USD Million)

11.7.3 Rest of Africa

Table 334 Rest of Africa: Food Diagnostics Market, by Type, 2019-2022 (USD Million)

Table 335 Rest of Africa: Food Diagnostics Market, by Type, 2023-2028 (USD Million)

Table 336 Rest of Africa: Food Diagnostic Systems Market, by Type, 2019-2022 (USD Million)

Table 337 Rest of Africa: Food Diagnostic Systems Market, by Type, 2023-2028 (USD Million)