Growing Concerns over Duplicate Consumer Electronics Products and Automotive Components fuel the North America Authentication and Brand Protection Market

The Consumer Electronics and Automotive industries in developed and developing countries have witnessed unprecedented growth over the years; the demand for these products continues to grow annually. With this, the demand for components used in consumer electronics and automotive is also growing, prompting a rise in the supply of counterfeit products. Smartphones, tablets, and laptops are among the most popular consumer electronics. The grey market for electronic and automotive components is witnessing a boom because of the high demand for vehicles and electronics. The grey market for consumer electronics and other equipment is booming in highly taxed countries; dealers import these products directly from low-taxed countries and sell them at lower prices, promoting competition against legitimate local and international OEMs. Such an emerging grey market for consumer electronics and automotive parts fuels the demand for genuine products. The automotive component industry is vast, with a significant number of players operating worldwide. Owing to soaring demand for new brands of vehicles, the need for auto parts has upsurged in manufacturing plants, which, in turn, has spurred the market of forged parts. The rampant use of counterfeit products has been associated with several vehicle breakdowns and accidents in the past, tarnishing the image of vehicle manufacturers. Therefore, OEMs, aftermarket players, wholesalers, and dealers seek authorized and genuine auto parts to reduce such mishaps. Thus, end users are now becoming aware of the cons of duplicate products, which is resulting in the soaring demand for authenticating products. Thus, the rising demand for authenticated products is compelling OEMs to adopt product authentication solutions, boosting the authentication and brand protection market. Many OEMs are procuring high volumes of authentication labels.North America Authentication and Brand Protection Market Overview

The US, Canada, and Mexico, major North American countries, have many manufacturers and product developers. The demand for authentication and brand protection products from manufacturers is substantially higher in the region owing to the availability of a large number of counterfeit products. Additionally, various product manufacturers in the US spend substantial amounts on maintaining the confidentiality of sensitive information about their products and safeguarding the valuation of their brands. Besides, US-manufactured products have significant visibility across different countries worldwide. All these factors necessitate authentication products to protect the brand and company image.Manufacturers in the US have easy access to bar codes and software that can be used to protect their products from forgery. The demand for overt authentication solutions is considerably high among end users, and the same trend is expected to continue over the years owing to rapid growth of industries in the region.

On the other hand, the manufacturing sector is slowly growing in Canada and Mexico, and there is a lower demand for advanced solutions and products from manufacturing facilities, compared to the US. Hence, these countries present a noticeable scope for the expansion of the authentication and brand protection solutions market.

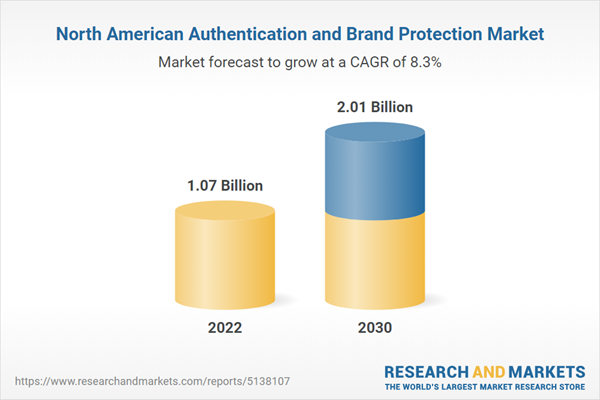

North America Authentication and Brand Protection Market Revenue and Forecast to 2030 (US$ Million)

North America Authentication and Brand Protection Market Segmentation

The North America authentication and brand protection market is segmented based on component, technology, application, and country. Based on component, the North America authentication and brand protection market is segmented into overt, covert, forensic, and digital. The overt segment held the largest market share in 2022.Based on technology, the North America authentication and brand protection market is segmented into security printing & tamper proof labels, security inks & coatings, OVDS and holograms, unique codes, bar codes, RFID, authentication ICS, and others. The bar codes segment held the largest market share in 2022.

Based on application, the North America authentication and brand protection market is segmented into consumer electronics, automotive, medical, chemical, food & beverage, tobacco, and others. The food & beverage segment held the largest market share in 2022.

Based on country, the North America authentication and brand protection market is segmented into the US, Canada, Mexico. The US dominated the North America authentication and brand protection market share in 2022.

3M Co, Alpvision SA, Applied DNA Sciences, Authentic Vision, Authentix, Avery Dennison Corporation, De La Rue Plc, Eastman Kodak Co, EDGYN SAS, and Giesecke Devrient GmbH are some of the leading players operating in the North America authentication and brand protection market.

Reasons to Buy

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the North America authentication and brand protection market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the North America authentication and brand protection market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth North America market trends and outlook coupled with the factors driving the North America authentication and brand protection market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution

Table of Contents

Companies Mentioned

- 3M Co

- Alpvision SA

- Applied DNA Sciences

- Authentic Vision

- Authentix

- Avery Dennison Corporation

- De La Rue Plc

- Eastman Kodak Co

- Giesecke Devrient GmbH

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 114 |

| Published | November 2023 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value in 2022 | 1.07 Billion |

| Forecasted Market Value by 2030 | 2.01 Billion |

| Compound Annual Growth Rate | 8.3% |

| Regions Covered | North America |

| No. of Companies Mentioned | 9 |