Global Quantum Sensors Market - Key Trends & Drivers Summarized

What Makes Quantum Sensors a Game-Changer in Precision Measurement?

Quantum sensors leverage the principles of quantum mechanics to achieve extraordinarily precise and sensitive measurements of various physical phenomena. These devices harness quantum states and properties, such as superposition and entanglement, to detect changes in magnetic fields, gravity, temperature, and time with unmatched accuracy. Their superior performance over classical sensors makes them indispensable in applications where extreme precision is critical, such as in detecting minute gravitational changes for scientific research or monitoring geological activities with high fidelity.Where Are Quantum Sensors Making an Impact?

Quantum sensors find applications in a wide array of industries, enhancing their functionality and operational efficiency. In the healthcare sector, these sensors are revolutionizing imaging technologies by providing more precise and less invasive diagnostic tools. Environmental monitoring benefits from quantum sensors through their ability to detect subtle environmental changes, offering crucial data for climate research and disaster preparedness. Furthermore, their use in navigation systems presents a robust alternative to GPS, especially in environments like underground or underwater, where traditional satellite navigation is ineffective.What Technological Innovations Are Driving Quantum Sensor Development?

Technological innovations are at the core of the rapid development in the quantum sensors market. Breakthroughs in quantum computing and the engineering of quantum materials have enabled the production of smaller, more efficient, and economically viable sensors. Techniques such as employing nitrogen-vacancy centers in diamonds have made quantum sensors operable at room temperatures, broadening their practical applications. Moreover, the integration of these sensors with advanced computational technologies like AI enhances their data processing capabilities, making quantum sensors more versatile and powerful tools in data analysis and interpretation.What Are the Key Drivers of Growth in the Quantum Sensors Market?

The growth in the quantum sensors market is driven by several factors, including the relentless advancement in quantum technologies, escalating demands for precision in sectors like scientific research and industrial manufacturing, and the proliferation of applications across various industries. As quantum sensors become more refined and affordable, their adoption across diverse fields is increasing. The demand for precise, secure data processing in areas such as national defense, telecommunications, and critical infrastructure is further boosting market expansion. Additionally, consumer trends towards adopting advanced, reliable technology solutions accelerate market growth. Investments from both governmental and private entities in quantum technology underscore its importance and potential, promising extensive growth and widespread application in the near future.Report Scope

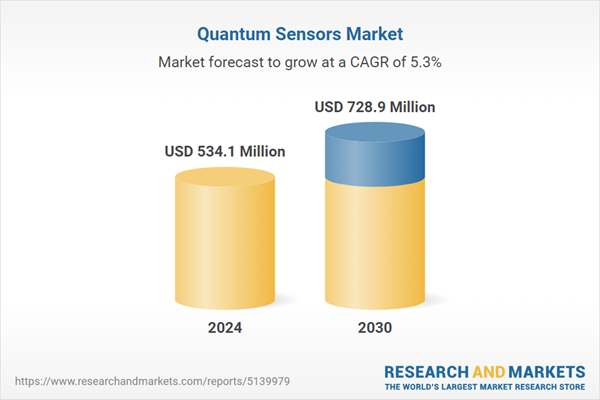

The report analyzes the Quantum Sensors market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Product (Atomic Clocks, Magnetic Sensors, PAR Quantum Sensors, Gravity Sensors, Other Products); Application (Military & Defense, Automotive, Oil & Gas, Agriculture, Other Applications).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Rest of Europe; Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Atomic Clocks segment, which is expected to reach US$213.7 Million by 2030 with a CAGR of 5.7%. The Magnetic Sensors segment is also set to grow at 6.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $138.3 Million in 2024, and China, forecasted to grow at an impressive 6.1% CAGR to reach $100.8 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Quantum Sensors Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Quantum Sensors Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Quantum Sensors Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Campbell Scientific, Inc., Fraunhofer Institute for Applied Optics and Precision Mechanics IOF, METER Group, Inc., M Squared Lasers Limited, Alter Technology TUV Nord, S.A.U. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 56 companies featured in this Quantum Sensors market report include:

- Campbell Scientific, Inc.

- Fraunhofer Institute for Applied Optics and Precision Mechanics IOF

- METER Group, Inc.

- M Squared Lasers Limited

- Alter Technology TUV Nord, S.A.U.

- Apogee Instruments, Inc.

- Delta-T Devices Ltd.

- Heinz Walz GmbH

- Kipp & Zonen B.V.

- ColdQuanta, Inc.

- Impedans

- INFOWORKS

- Electronics and Telecommunications Research Institute (ETRI)

- Gem Systems

- Comptus Environmental Sensors

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Campbell Scientific, Inc.

- Fraunhofer Institute for Applied Optics and Precision Mechanics IOF

- METER Group, Inc.

- M Squared Lasers Limited

- Alter Technology TUV Nord, S.A.U.

- Apogee Instruments, Inc.

- Delta-T Devices Ltd.

- Heinz Walz GmbH

- Kipp & Zonen B.V.

- ColdQuanta, Inc.

- Impedans

- INFOWORKS

- Electronics and Telecommunications Research Institute (ETRI)

- Gem Systems

- Comptus Environmental Sensors

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 257 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 534.1 Million |

| Forecasted Market Value ( USD | $ 728.9 Million |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | Global |