Global Novel Drug Delivery Systems (NDDS) Market - Key Trends and Drivers Summarized

Novel Drug Delivery Systems (NDDS) refer to innovative methods for delivering medication to patients in a manner that increases the efficacy, safety, and patient compliance with the treatment regimen. These systems are designed to target the delivery of drugs directly to a specific site in the body, control the rate of drug release, and maximize the therapeutic index while minimizing side effects. NDDS encompasses a variety of delivery platforms including liposomes, nanoparticles, microneedles, and drug-eluting stents, among others. These technologies enable controlled and sustained release of medications, potentially reducing dosage frequency and improving patient outcomes. This field is particularly significant in the treatment of chronic diseases, cancer, and for the delivery of vaccines.The development of NDDS continues to grow as researchers and pharmaceutical companies aim to overcome the limitations of conventional drug delivery methods. One of the key challenges in traditional pharmacotherapy is achieving optimal therapeutic levels of a drug without causing adverse effects, a task that NDDS aims to simplify through advanced formulation and engineering techniques. Enhanced permeability and retention (EPR) effect of nanoparticles, for example, allows for targeted drug delivery to tumor cells, minimizing the impact on healthy tissues and reducing side effects in cancer treatments. Moreover, the application of biodegradable materials in NDDS promotes safer and more effective drug delivery mechanisms, aligning with the growing demand for sustainable medical practices. Additionally, the integration of digital technology into drug delivery systems, such as smart pills equipped with sensors, provides real-time data on drug release and patient adherence, which can be critical for treatments requiring precise dosages.

The growth in the Novel Drug Delivery Systems market is driven by several factors including technological advancements in material science and biotechnology, increasing prevalence of chronic diseases, and a more informed consumer base demanding better and more tailored healthcare solutions. Advancements in nanotechnology and molecular biology have been particularly instrumental in developing more efficient drug delivery systems. These innovations allow drugs to be encapsulated in biocompatible materials that can bypass the body's natural barriers and release drugs at a controlled rate directly at the disease site. Additionally, the rising incidence of chronic conditions such as diabetes and heart disease fuels the demand for more efficient and convenient drug delivery methods, encouraging further investment in NDDS research and development. Lastly, as patients become more engaged in their health care decisions, there is a growing demand for drug delivery systems that are not only effective but also non-invasive and convenient, steering the market towards sustained growth and innovation.

Report Scope

The report analyzes the Novel Drug Delivery Systems (NDDS) market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Segment (Nanoparticles, Embolization Particles).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Rest of Europe; Asia-Pacific; Rest of World.

Key Insights:

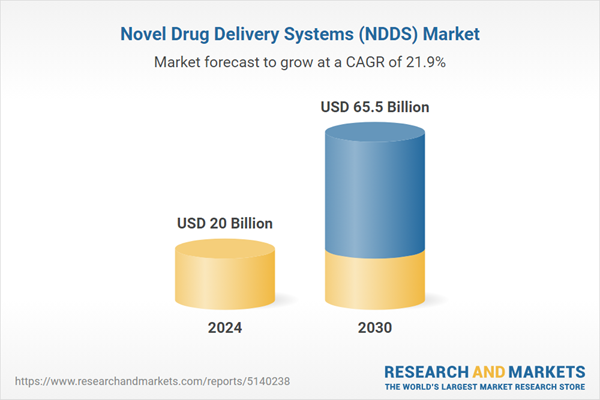

- Market Growth: Understand the significant growth trajectory of the Nanoparticles segment, which is expected to reach US$51.9 Billion by 2030 with a CAGR of 21.4%. The Embolization Particles segment is also set to grow at 24% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $7 Billion in 2024, and China, forecasted to grow at an impressive 26.5% CAGR to reach $7.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Novel Drug Delivery Systems (NDDS) Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Novel Drug Delivery Systems (NDDS) Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Novel Drug Delivery Systems (NDDS) Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Alexza Pharmaceuticals, Ademtech SA, Acerus Pharmaceuticals Corporation, Adocia, Aerogen and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 238 companies featured in this Novel Drug Delivery Systems (NDDS) market report include:

- Alexza Pharmaceuticals

- Ademtech SA

- Acerus Pharmaceuticals Corporation

- Adocia

- Aerogen

- Aktivax, Inc.

- 2C Tech

- Acuitas Therapeutics

- Applied Nanoparticles

- Apogee Technology, Inc.

- 20Med Therapeutics

- AnTolRx Inc.

- Adipo Therapeutic

- AcelRx Pharmaceuticals

- Advanced NanoTherapies Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Alexza Pharmaceuticals

- Ademtech SA

- Acerus Pharmaceuticals Corporation

- Adocia

- Aerogen

- Aktivax, Inc.

- 2C Tech

- Acuitas Therapeutics

- Applied Nanoparticles

- Apogee Technology, Inc.

- 20Med Therapeutics

- AnTolRx Inc.

- Adipo Therapeutic

- AcelRx Pharmaceuticals

- Advanced NanoTherapies Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 492 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 20 Billion |

| Forecasted Market Value ( USD | $ 65.5 Billion |

| Compound Annual Growth Rate | 21.9% |

| Regions Covered | Global |