Global Motor Vehicle Insurance Market - Key Trends & Drivers Summarized

What Is Motor Vehicle Insurance and Why Is It Essential?

Motor vehicle insurance provides financial protection against physical damage or bodily injury resulting from traffic collisions and against liability that could also arise from vehicle incidents. It is essential for vehicle owners to mitigate financial risks associated with accidents, theft, and other road mishaps. Motor vehicle insurance policies vary widely, covering everything from basic third-party liability to comprehensive coverage that includes vehicle damage, theft protection, and passenger cover. This form of insurance is not only a legal requirement in many jurisdictions but also a critical component of financial planning for individuals and businesses alike, offering peace of mind and financial stability in the event of an incident.How Are Changing Regulations Impacting the Motor Vehicle Insurance Market?

The motor vehicle insurance market is heavily influenced by regulatory changes intended to increase driver safety and reduce accident-related costs. Governments worldwide are tightening regulations around mandatory insurance coverage, driving the penetration of insurance policies. Additionally, the introduction of telematics and usage-based insurance models, which allow premiums to be based on driving behavior rather than historical demographics, is changing how risks are assessed and priced. These regulatory and technological changes are encouraging more personalized insurance policies, increasing transparency and fairness in premium determination.What Trends Are Shaping Consumer Behavior in Motor Vehicle Insurance?

Consumer behavior in the motor vehicle insurance market is being shaped by increasing awareness of the financial risks associated with road usage and a greater emphasis on personalized insurance products. Modern consumers demand more flexibility, transparency, and customization in their insurance options, pushing insurers to offer tailored products that better match individual risk profiles and driving habits. The rise of digital platforms and mobile applications for managing insurance policies is also influencing consumer expectations, with more drivers preferring to interact digitally for convenience and faster service.What Drives the Growth in the Motor Vehicle Insurance Market?

The growth in the motor vehicle insurance market is driven by several factors. Increasing vehicle ownership globally, particularly in emerging economies, directly contributes to a broader customer base for insurance providers. Technological advancements that facilitate real-time data collection and risk assessment, such as telematics, are enabling more accurate and flexible insurance models. Moreover, evolving regulatory environments that mandate insurance coverage and promote road safety are significant growth drivers. The expansion of the automotive industry, coupled with increasing urbanization and the resultant rise in vehicles on the road, ensures ongoing demand for motor vehicle insurance, underpinning the market's growth trajectory.Report Scope

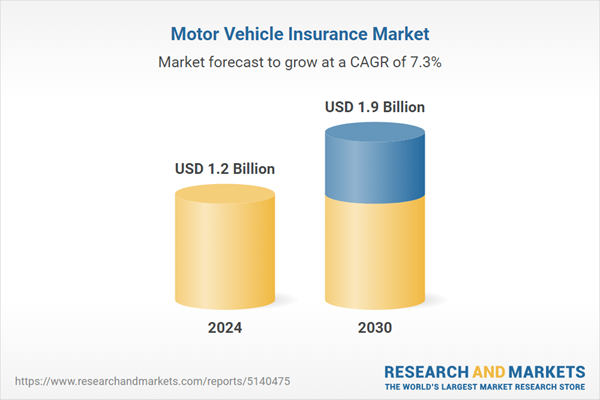

The report analyzes the Motor Vehicle Insurance market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Personal, Commercial); Distribution Channel (Agents / Brokers, Direct Response, Banks, Other Distribution Channels).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Personal Motor Vehicle Insurance segment, which is expected to reach US$1.4 Billion by 2030 with a CAGR of 7.7%. The Commercial Motor Vehicle Insurance segment is also set to grow at 6.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $322.1 Million in 2024, and China, forecasted to grow at an impressive 10.9% CAGR to reach $465.3 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Motor Vehicle Insurance Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Motor Vehicle Insurance Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Motor Vehicle Insurance Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABAX UK Ltd., Acko General Insurance, Admiral Corporation, Affinity Transport Solutions, Allianz Australia Limited and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 46 companies featured in this Motor Vehicle Insurance market report include:

- ABAX UK Ltd.

- Acko General Insurance

- Admiral Corporation

- Affinity Transport Solutions

- Allianz Australia Limited

- Allstate Insurance Company

- Alpha Direct

- Aman Takaful Insurance Co.

- AMI Insurance

- Ampler Bikes OÜ

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABAX UK Ltd.

- Acko General Insurance

- Admiral Corporation

- Affinity Transport Solutions

- Allianz Australia Limited

- Allstate Insurance Company

- Alpha Direct

- Aman Takaful Insurance Co.

- AMI Insurance

- Ampler Bikes OÜ

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 173 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.2 Billion |

| Forecasted Market Value ( USD | $ 1.9 Billion |

| Compound Annual Growth Rate | 7.3% |

| Regions Covered | Global |