Global Agricultural Micronutrients Market - Key Trends and Drivers Summarized

Why Are Agricultural Micronutrients Vital for Crop Health?

Agricultural micronutrients are essential elements required by plants in small quantities to support crucial physiological functions and promote healthy growth. These micronutrients include zinc, iron, manganese, copper, molybdenum, boron, and chlorine, among others. Although needed in trace amounts, their deficiency can lead to significant crop yield reductions and compromised quality. Micronutrients play pivotal roles in various plant processes, such as enzyme activation, photosynthesis, nitrogen fixation, and hormone regulation. For instance, zinc is crucial for the synthesis of auxin, a growth hormone, while iron is vital for chlorophyll formation and energy transfer. Ensuring an adequate supply of these micronutrients is critical for optimal crop performance, resilience against diseases, and overall agricultural productivity. Modern agricultural practices recognize the importance of balanced micronutrient management, which complements macronutrient fertilization to sustain soil fertility and maximize crop potential.How Is Technology Enhancing Micronutrient Application in Agriculture?

Technological advancements are revolutionizing the application and effectiveness of agricultural micronutrients, making their use more precise and efficient. Innovations in soil testing and plant tissue analysis allow farmers to identify specific micronutrient deficiencies accurately, enabling targeted and customized fertilization strategies. Precision agriculture technologies, such as GPS-guided equipment and variable-rate application systems, facilitate the precise delivery of micronutrients to where they are needed most, minimizing waste and environmental impact. Furthermore, advancements in chelation chemistry have led to the development of more stable and bioavailable micronutrient formulations, which enhance nutrient uptake and reduce losses due to leaching or volatilization. Foliar sprays and fertigation systems, integrated with advanced monitoring tools, provide efficient ways to apply micronutrients directly to the plant foliage or through irrigation systems, ensuring timely and uniform distribution. These technological innovations are enhancing the efficiency of micronutrient use, contributing to improved crop yields and sustainable farming practices.What Is Driving the Increased Use of Micronutrients in Farming?

The demand for agricultural micronutrients is on the rise, driven by the increasing need to improve crop yields and address soil nutrient deficiencies. As global populations grow and dietary preferences shift towards higher-quality and diverse food sources, the pressure on agricultural systems to produce more food sustainably intensifies. Micronutrient-enriched crops not only yield better but also provide enhanced nutritional value, addressing both food security and malnutrition issues. Additionally, intensive farming practices and the extensive use of high-yield crop varieties have often led to the depletion of soil micronutrients, necessitating their replenishment to maintain soil health and productivity. The growing awareness among farmers about the critical role of micronutrients in plant health and the availability of advanced diagnostic and application technologies further drive the adoption of micronutrient products. Moreover, regulatory frameworks promoting sustainable agricultural practices and the increasing focus on organic farming methods are encouraging the use of natural and efficient micronutrient solutions.What Factors Are Fueling the Growth of the Agricultural Micronutrients Market?

The growth in the agricultural micronutrients market is driven by several factors, reflecting technological advancements, evolving agricultural practices, and changing consumer preferences. One major driver is the increasing emphasis on crop yield enhancement and quality improvement to meet the growing food demand. Technological innovations in soil testing, precision application, and nutrient delivery systems are making micronutrient use more effective and efficient, encouraging their adoption among farmers. The depletion of soil nutrients due to intensive farming practices and the need to restore soil fertility are also propelling market growth. Additionally, the shift towards sustainable and organic farming practices is driving the demand for eco-friendly micronutrient solutions. Government policies and regulatory frameworks supporting sustainable agriculture and soil health management are further boosting the market. The growing awareness about the benefits of micronutrients, coupled with the rising focus on balanced nutrition and food security, is expanding the addressable market for agricultural micronutrients. As these factors converge, the agricultural micronutrients market is poised for robust growth, supported by continuous innovation and the global push for sustainable farming practices.Report Scope

The report analyzes the Agricultural Micronutrients market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Zinc, Iron, Copper, Boron, Other Types); Mode of Application (Soil, Foliar, Fertigation, Other Modes of Application); Crop Type (Fruits & Vegetables, Cereals & Grains, Oilseeds & Pulses, Other Crop Types).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Zinc segment, which is expected to reach US$2.7 Billion by 2030 with a CAGR of 7.1%. The Iron segment is also set to grow at 6.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.3 Billion in 2024, and China, forecasted to grow at an impressive 10.4% CAGR to reach $1.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Agricultural Micronutrients Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Agricultural Micronutrients Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

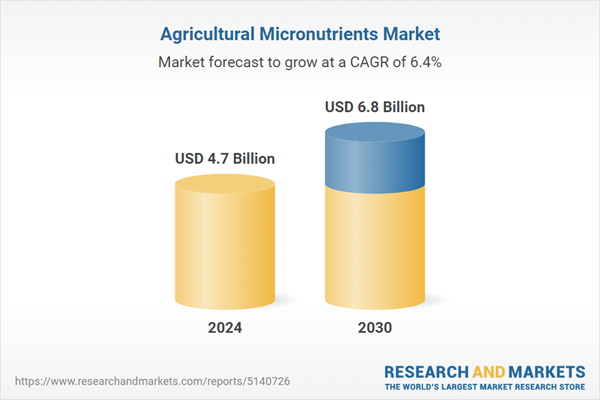

- How is the Global Agricultural Micronutrients Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as BASF SE, Coromandel International Ltd., Dow, Inc., DuPont de Nemours, Inc., Haifa Group and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 46 companies featured in this Agricultural Micronutrients market report include:

- BASF SE

- Coromandel International Ltd.

- Dow, Inc.

- DuPont de Nemours, Inc.

- Haifa Group

- Helena Agri-Enterprises, LLC

- Land O'Lakes, Inc.

- Nouryon

- Nufarm Limited

- Nutrien Ltd.

- Sapec S.A.

- The Mosaic Company

- Yara International ASA

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- BASF SE

- Coromandel International Ltd.

- Dow, Inc.

- DuPont de Nemours, Inc.

- Haifa Group

- Helena Agri-Enterprises, LLC

- Land O'Lakes, Inc.

- Nouryon

- Nufarm Limited

- Nutrien Ltd.

- Sapec S.A.

- The Mosaic Company

- Yara International ASA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 391 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4.7 Billion |

| Forecasted Market Value ( USD | $ 6.8 Billion |

| Compound Annual Growth Rate | 6.4% |

| Regions Covered | Global |