Global Synthetic and Bio-Based Butadiene Market - Key Trends and Drivers Summarized

What Is Butadiene and Why Is It So Important in Industrial Applications?

Butadiene is a crucial chemical compound in the petrochemical industry, widely used as a building block for the production of synthetic rubber and plastics. It is a colorless gas at room temperature and highly reactive, making it a key ingredient in the manufacturing of products like tires, automotive parts, adhesives, and latex. Traditionally, butadiene has been produced through the steam cracking of hydrocarbons like naphtha, a process that yields synthetic butadiene as a byproduct. This synthetic version has powered the growth of industries such as automotive and construction, where butadiene-derived polymers and rubbers are in high demand. However, despite its extensive utility, synthetic butadiene production is associated with significant environmental concerns, including reliance on non-renewable fossil fuels and the emission of greenhouse gases. The demand for sustainable alternatives is driving the development of bio-based butadiene, which can be derived from renewable resources such as biomass, sugars, and plant-based feedstocks. This shift towards bio-based alternatives is part of a broader trend aimed at reducing the environmental footprint of key industrial chemicals while maintaining the high performance required by end-user applications.How Does Synthetic Butadiene Compare to Bio-Based Butadiene in Production and Applications?

Synthetic butadiene production has been the dominant method for decades due to its efficiency, well-established supply chain, and ability to meet the high demands of industries like automotive and electronics. The steam cracking process used for its production not only generates large quantities of butadiene but also produces other valuable petrochemicals, making it a cost-effective method for manufacturers. However, this process is energy-intensive and heavily dependent on fossil fuels, which contributes to its carbon footprint. In contrast, bio-based butadiene is produced from renewable feedstocks such as corn, sugarcane, and biomass, using fermentation or catalytic processes. These bio-based methods offer a more environmentally friendly alternative, as they reduce reliance on non-renewable resources and minimize greenhouse gas emissions. Despite these benefits, bio-based butadiene is still in its developmental stages and faces challenges in terms of scalability and cost competitiveness when compared to its synthetic counterpart. The properties and performance of bio-based butadiene are comparable to synthetic versions, making it suitable for the same wide range of applications, such as in the production of synthetic rubber for tires, automotive seals, and other elastomeric products. However, the major difference lies in the sustainability factor, with bio-based butadiene being a more attractive option for companies seeking to lower their environmental impact.What Are the Recent Technological Advancements in Synthetic and Bio-Based Butadiene?

The production of both synthetic and bio-based butadiene is seeing significant technological advancements aimed at improving efficiency, sustainability, and cost-effectiveness. In the realm of synthetic butadiene, improvements in catalyst technology have allowed for more efficient steam cracking processes, reducing energy consumption and increasing yield. Advanced separation techniques are also being explored to enhance the purity of butadiene, further optimizing production. On the bio-based front, innovation is being driven by biotechnology and green chemistry. Scientists are developing new bio-catalytic processes that convert plant-based feedstocks into butadiene through fermentation, using genetically engineered microorganisms. These methods are being refined to increase the yield and make the production process more commercially viable. Another exciting development is the use of waste biomass, such as agricultural byproducts, to produce bio-based butadiene. This not only reduces the environmental impact but also offers a circular economy solution by turning waste into valuable chemicals. Additionally, collaborative research between industries and academic institutions is paving the way for hybrid technologies that combine bio-based and synthetic methods, ensuring a more flexible and resilient supply chain. As these technologies mature, they will likely contribute to reducing the overall carbon footprint of butadiene production, making both synthetic and bio-based butadiene more sustainable options for industries worldwide.What Factors Are Driving the Growth of the Synthetic and Bio-Based Butadiene Market?

The growth in the synthetic and bio-based butadiene market is driven by several factors, including rising demand in the automotive and tire industries, advancements in green chemistry, and growing environmental regulations. The automotive sector, which consumes a significant portion of butadiene for the production of synthetic rubber used in tires and other components, continues to expand as emerging economies increase their vehicle production and ownership. This, in turn, fuels the demand for both synthetic and bio-based butadiene. At the same time, the tire industry is pushing for more sustainable materials to align with consumer preferences for eco-friendly products, thus increasing interest in bio-based butadiene. In addition, stringent environmental regulations aimed at reducing carbon emissions and reliance on fossil fuels are encouraging the chemical industry to invest in sustainable alternatives. Governments and international bodies are promoting bio-based chemicals through subsidies, tax breaks, and research grants, further accelerating the market for bio-based butadiene. Technological advancements in the production of bio-based butadiene, such as the use of genetically modified organisms and efficient catalytic processes, are also key drivers of growth, making these alternatives more commercially viable. The shift towards a circular economy, where waste materials are repurposed into valuable chemicals, is another major factor boosting the bio-based butadiene market. As industries strive to meet sustainability goals, the demand for renewable feedstocks and green production processes will continue to grow, driving further innovation and expansion in both synthetic and bio-based butadiene markets.Report Scope

The report analyzes the Synthetic and Bio-Based Butadiene market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Product Type (Synthetic, Bio-Based); Application (Butadiene Rubber, SB Rubber, SB Latex, ABS, Adiponitrile, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Butadiene Rubber Application segment, which is expected to reach US$8.4 Billion by 2030 with a CAGR of 4.5%. The SB Rubber Application segment is also set to grow at 4.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $5.7 Billion in 2024, and China, forecasted to grow at an impressive 6.4% CAGR to reach $5.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Synthetic and Bio-Based Butadiene Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Synthetic and Bio-Based Butadiene Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Synthetic and Bio-Based Butadiene Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as BASF SE, Dow, Inc., DuPont de Nemours, Inc., Eni SpA, Evonik Industries AG and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 21 companies featured in this Synthetic and Bio-Based Butadiene market report include:

- BASF SE

- Dow, Inc.

- DuPont de Nemours, Inc.

- Eni SpA

- Evonik Industries AG

- Exxon Mobil Corporation

- INEOS Group

- LyondellBasell Industries NV

- Nizhnekamskneftekhim

- Repsol SA

- Royal Dutch Shell PLC

- SABIC (Saudi Basic Industries Corporation)

- TPC Group

- Yeochun NCC Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- BASF SE

- Dow, Inc.

- DuPont de Nemours, Inc.

- Eni SpA

- Evonik Industries AG

- Exxon Mobil Corporation

- INEOS Group

- LyondellBasell Industries NV

- Nizhnekamskneftekhim

- Repsol SA

- Royal Dutch Shell PLC

- SABIC (Saudi Basic Industries Corporation)

- TPC Group

- Yeochun NCC Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 184 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

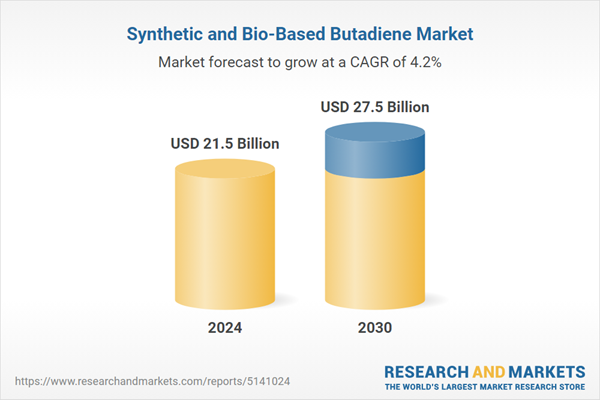

| Estimated Market Value ( USD | $ 21.5 Billion |

| Forecasted Market Value ( USD | $ 27.5 Billion |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Global |