Global Orthopedic Medical Imaging Systems Market - Key Trends & Drivers Summarized

Orthopedic medical imaging systems are essential tools in diagnosing and treating a wide range of musculoskeletal disorders, injuries, and conditions. These systems include various imaging modalities such as X-rays, MRI (Magnetic Resonance Imaging), CT (Computed Tomography) scans, and ultrasound. Each modality offers unique insights into the musculoskeletal system, enabling healthcare professionals to examine bone structures, joint alignments, soft tissue conditions, and overall musculoskeletal health in detail. For instance, X-rays are typically used for identifying fractures and bone abnormalities, while MRIs provide detailed images of soft tissues, including muscles, ligaments, and cartilage. CT scans offer a comprehensive view of the body's internal structures, useful for complex fracture evaluations and surgical planning. Ultrasound is often employed to assess soft tissue injuries and guide injections. The high-resolution imaging provided by these systems is crucial for accurate diagnosis, allowing for tailored treatment plans that enhance patient outcomes. Orthopedic surgeons and healthcare professionals rely heavily on these imaging systems not only for diagnostics but also for preoperative planning, intraoperative guidance, and postoperative assessment to ensure successful treatment and recovery.In the orthopedic medical imaging systems market, there is a growing shift towards more advanced, integrated, and user-friendly technologies. Digital imaging has largely replaced traditional film, offering numerous benefits such as enhanced image quality, efficient storage solutions, and rapid access to patient records, which streamline clinical workflows. The integration of 3D imaging and reconstruction techniques has revolutionized the field, enabling the creation of detailed anatomical models that assist in complex surgical planning and interventions. This is particularly beneficial for procedures involving joint replacements, spinal surgeries, and fracture repairs. Portable imaging systems are also gaining popularity, allowing for point-of-care diagnostics in diverse settings such as emergency rooms, operating theaters, sports facilities, and remote or underserved locations. The incorporation of Artificial Intelligence (AI) and machine learning algorithms into imaging systems has further improved diagnostic accuracy, reduced human error, and increased the efficiency of image analysis. AI can assist in detecting subtle abnormalities, predicting disease progression, and providing decision support to healthcare professionals. The development of low-dose imaging systems addresses safety concerns by minimizing patient exposure to radiation while maintaining high image quality, which is important for patients requiring frequent imaging, such as those with chronic conditions or undergoing long-term monitoring.

The growth in the orthopedic medical imaging systems market is driven by several factors. Technological advancements, such as the development of high-resolution and 3D imaging capabilities, have enhanced the diagnostic and treatment potential of these systems. The increasing prevalence of musculoskeletal disorders and injuries, driven by aging populations, rising obesity rates, and a growing number of sports-related injuries, has escalated the demand for advanced imaging solutions. These demographic and lifestyle trends are contributing to a higher incidence of conditions such as osteoarthritis, osteoporosis, and traumatic injuries, necessitating more sophisticated diagnostic tools. Additionally, the shift towards minimally invasive surgical techniques, which require precise preoperative imaging for planning and intraoperative guidance, has further boosted the demand for advanced imaging systems. The adoption of digital health technologies and electronic health records (EHRs) has facilitated the integration of imaging systems into broader healthcare networks, enhancing the efficiency of diagnosis, treatment workflows, and patient management. Furthermore, ongoing research and development efforts are focused on enhancing imaging technologies, ensuring continuous innovation and the introduction of new, more effective imaging solutions. These factors collectively drive the robust growth of the orthopedic medical imaging systems market, making advanced diagnostic and treatment options more accessible, effective, and widely adopted across various healthcare settings.

Report Scope

The report analyzes the Orthopedic Medical Imaging Systems market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Product Type (X-ray Systems, Ultrasound Systems, CT Scanners, MRI Scanners, Nuclear Imaging Systems); End-Use (Hospitals, Radiology Centers, Other End-Uses).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the X-ray Systems segment, which is expected to reach US$4.1 Billion by 2030 with a CAGR of 4.3%. The Ultrasound Systems segment is also set to grow at 4.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.7 Billion in 2024, and China, forecasted to grow at an impressive 6.6% CAGR to reach $1.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Orthopedic Medical Imaging Systems Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Orthopedic Medical Imaging Systems Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Orthopedic Medical Imaging Systems Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Boston Scientific Corporation, Cardinal Health, Inc., Carestream Health, Inc., Agfa-Gevaert NV, Esaote SpA and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 50 companies featured in this Orthopedic Medical Imaging Systems market report include:

- Boston Scientific Corporation

- Cardinal Health, Inc.

- Carestream Health, Inc.

- Agfa-Gevaert NV

- Esaote SpA

- Analogic Corporation

- Brainlab AG

- Excelitas Technologies Corporation

- Accuray, Inc.

- ContextVision AB

- BK Ultrasound

- CurveBeam LLC

- Digital ArtForms, Inc.

- Brandster Branding Limited

- Apricot Technologies Limited

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Boston Scientific Corporation

- Cardinal Health, Inc.

- Carestream Health, Inc.

- Agfa-Gevaert NV

- Esaote SpA

- Analogic Corporation

- Brainlab AG

- Excelitas Technologies Corporation

- Accuray, Inc.

- ContextVision AB

- BK Ultrasound

- CurveBeam LLC

- Digital ArtForms, Inc.

- Brandster Branding Limited

- Apricot Technologies Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 390 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

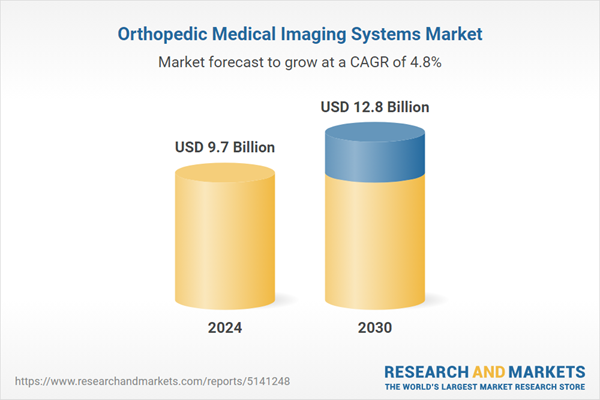

| Estimated Market Value ( USD | $ 9.7 Billion |

| Forecasted Market Value ( USD | $ 12.8 Billion |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | Global |