Key Highlights

- Infrastructure development, digitization, and industrialization are all results of increasing government initiatives for economic diversification. They will probably expand the e-commerce and contract logistics markets, creating a big need for contract logistics services. Several non-asset newcomers are joining current companies as a result of the increase in foreign direct investments (FDIs), the rapid expansion of the e-commerce industry, and the emphasis on risk management in supply chains.

- Additional factors that contribute to market expansion include the manufacturing sector's quick expansion and focus on core competencies, the rising demand for work optimization, achieving cost efficiency, and technological supply chain integrations. The contract logistics industry will not develop because of some constraints and challenges. For instance, managing logistical databases is difficult due to factors including potential misconceptions that lead to inaccurate interpretations of facts, data, and information. Regional disparities and the complexity of the supply chain have a detrimental impact on the process as a whole since there aren't enough experienced people to understand and address problems so that transparency is maintained.

- In 2022, the United States saw a sharp rise in warehouse space rental from regional logistics players in recent years. Retailers are increasingly outsourcing more of their services as a result of rising service requirements like e-commerce and same-day delivery.

- The pandemic's impact on global supply chains put the United States' whole supply chain under unprecedented pressure and exposed long-standing issues with its freight transportation system. Delays and a highly unbalanced flow of products to American ports were caused by interruptions in manufacturing and port closures. More inbound freight arrived at ports as a result of cargo owners switching to "just-incase" inventory plans rather than "just-in-time" methods, which put a strain on storage capacity. The system experienced a significant boost in flow as a result, with each of America's four largest container ports exceeding their prior records and importing over 16% more containers in 2021 than in 2020.

North America Contract Logistics Market Trends

Growing E-commerce in the Region Driving the Contract Logistics Market

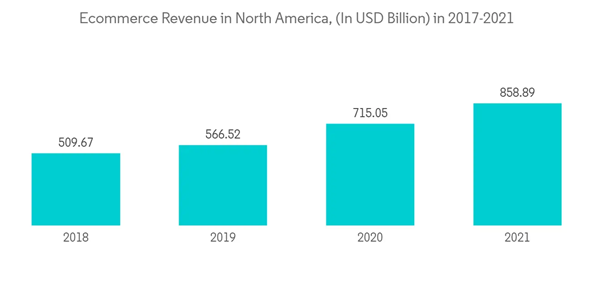

The estimate of US retail e-commerce sales for the third quarter of 2022, adjusted for seasonal variation but not for price adjustments, was USD 265.9 billion, up by 3.0% (0.5%) from the second quarter of 2022, according to a report released by the Census Bureau of the Department of Commerce. The predicted USD 1,792.0 billion in total retail sales for the third quarter of 2022 represents an increase of 0.7% (0.1%) from the second quarter. While total retail sales climbed 9.1% (minus 0.4%) during the same period, the third quarter of 2022 e-commerce projection increased by 10.8% (minus 1.2%) from the third quarter of 2021. In the third quarter of 2022, e-commerce sales made up 14.8% of total sales.Canada has the fastest-growing e-commerce market among the three countries in the area, while the US has the largest and steadiest-growing market. In Mexico, e-commerce user penetration is not very high. However, throughout the projected period, the Mexican e-commerce market is anticipated to rise strongly.

Over 27 million Canadians used e-commerce in 2021, making up 72.5% of the country's total population. In 2025, this percentage is projected to rise to 77.6%. Retail e-commerce sales in Canada are rising steadily in real terms and as a share of overall retail, thanks to a rise in online shoppers. The United States, ahead of China and Japan, was the second-largest e-commerce market in terms of revenue in 2021. In the upcoming years, e-commerce sales may continue to rise. The percentage of e-commerce in all US retail online sales is 13.3%.

Most e-commerce businesses award warehouse and distribution service contracts to logistics service providers. Businesses need to have technical solutions that quicken fulfillment operations because of the high-velocity e-commerce business models.

Startups in the fields of on-demand and cloud-based warehousing are becoming more and more well-known as e-commerce takes off. As opposed to long-term leases for a set space, these businesses give businesses the freedom to use the warehouse space by seasonal demand. These businesses include Stord, Flexe, and Flowspace, to name a few. Long-term projects are also given to these businesses by their clients. Some businesses also provide fulfillment services, giving the current standard contract logistics service providers fierce competition.

Traditional commercial real estate firms also make technology investments. For instance, ProLogis, the industry leader in logistics real estate, offers a venture fund devoted to financing innovations in contract logistics.

Manufacturing and Automotive Expected to Witness High Growth During the Forecast Period

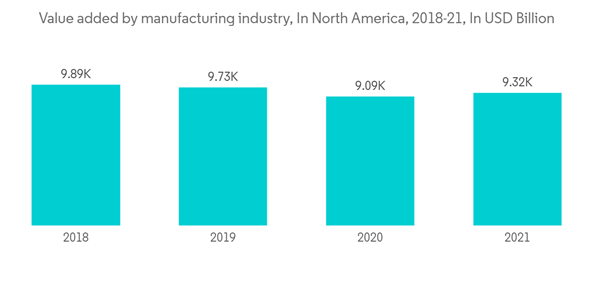

Manufacturing businesses spend a lot of time trying to come up with new and inventive ways to outperform the competition, whether it is by developing new manufacturing techniques, better products, or better supply chain management.Effective routing management is the crux of logistics for the manufacturing sector. To cut the cost of sending goods to the vendors, logistic providers help with bills of lading and freight planning. Manufacturers who outsource their logistical needs avoid the payroll, benefit, and liability costs associated with hiring in-house workers, in addition to saving money on shipping.

The pandemic's impact on US manufacturing in 2022 will be beneficial. Due to the introduction of vaccines and increasing demand, the recovery gathered steam in 2021, and by the middle of the year, industrial production and capacity utilization were higher than they were before the pandemic. Strong rises in new orders across all key subsectors could spur further expansion in 2022. Manufacturing GDP growth in the United States is predicted to reach 4.1% in 2022, according to industry sources. In Canada, lockdowns were loosened, which resulted in a rise in manufacturing activity in 2021.

The COVID-19 pandemic, continuous cost volatility, policy decisions, and industry disruption risk continue to be factors for the manufacturing sector. There is pressure on US industries to start producing essential commodities domestically and rely less on European and Asian nations as a result of the pandemic-related shortages.

Most of the management of the North American automotive supply chain is done by logistics businesses. The majority of the engines and gearboxes used in Mexican automobile manufacturing are imported from the United States.

North America Contract Logistics Industry Overview

The North American contract logistics business is fragmented, with many different players competing for customers and offering services at different price points. Some of the major participants in the market are DHL, XPO Logistics, UPS, FedEx, DB Schenker, and Ryder Systems. To establish a presence in the market, the businesses are following the trends of consolidation and expansion.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

1 INTRODUCTION1.1 Study Deliverables

1.2 Study Assumptions

1.3 Scope of the Study

2 RESEARCH METHODOLOGY

2.1 Analysis Methodology

2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

4.1 Current Market Scenario

4.2 Market Dynamics

4.2.1 Drivers

4.2.2 Restraints

4.2.3 Opportunities

4.3 Industry Attractiveness - Porter's Five Forces Analysis

4.4 Value Chain/Supply Chain Analysis

4.5 Government Regulations and Initiatives

4.6 Technological Trends

4.7 Insights into the E-commerce Industry in the Region (Domestic and Cross-border)

4.8 Insights into Contract Logistics in the Context of After-Sales/Reverse Logistics

4.9 Brief on Different Services Provided by Contract Logistics Players (Integrated Warehousing and Transportation, Supply Chain Services, and Other Value-added Services)

4.10 Spotlight - Freight Transportation Costs/Freight Rates

4.11 Effect of the Shift from NAFTA to USMCA on the Transport and Logistics Industry

4.12 Impact of COVID-19 on the Contract Logistics Market

5 MARKET SEGMENTATION

5.1 By Type

5.1.1 Insourced

5.1.2 Outsourced

5.2 By End User

5.2.1 Manufacturing and Automotive

5.2.2 Consumer Goods and Retail

5.2.3 High-tech

5.2.4 Healthcare and Pharmaceuticals

5.2.5 Other End Users

5.3 By Country

5.3.1 United States

5.3.2 Canada

5.3.3 Mexico

6 COMPETITIVE LANDSCAPE

6.1 Overview (Market Concentration, Major Players)

6.2 Company Profiles (Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements)

6.2.1 Deutsche Post DHL Group (DHL Supply Chain)

6.2.2 United Parcel Service Inc. (UPS Supply Chain Solutions)

6.2.3 FedEx Corporation (FedEx Supply Chain)

6.2.4 Kuehne + Nagel International AG

6.2.5 XPO Logistics Inc.

6.2.6 Ryder System Inc.

6.2.7 J.B. Hunt Transport Services Inc.

6.2.8 DB Schenker

6.2.9 CEVA Logistics

6.2.10 Geodis

6.2.11 Penske Logistics Inc.

6.2.12 Hellmann Worldwide Logistics GmbH & Co. KG

6.2.13 Americold

6.2.14 Schnedier National*

6.3 Other Companies (Key Information/Overview)

6.3.1 Neovia Logistics Services LLC

6.3.2 TIBA

6.3.3 Yusen Logistics Co. Ltd

6.3.4 PiVAL International

6.3.5 SCI*

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 APPENDIX

8.1 GDP Distribution, by Activity for Key Countries

8.2 Insights into Capital Flows

8.3 External Trade Statistics - Export and Import, by Product

8.4 Insights into Key Export Destinations

8.5 Insights into Key Import Origins

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Deutsche Post DHL Group (DHL Supply Chain)

- United Parcel Service Inc. (UPS Supply Chain Solutions)

- FedEx Corporation (FedEx Supply Chain)

- Kuehne + Nagel International AG

- XPO Logistics Inc.

- Ryder System Inc.

- J.B. Hunt Transport Services Inc.

- DB Schenker

- CEVA Logistics

- Geodis

- Penske Logistics Inc.

- Hellmann Worldwide Logistics GmbH & Co. KG

- Americold

- Schnedier National*