Agroscience Market Analysis:

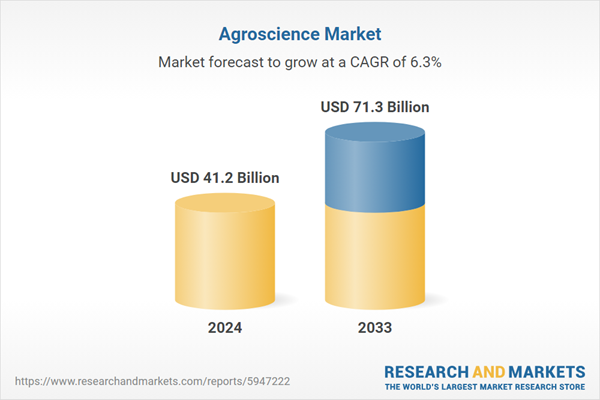

- Market Growth and Size: The market is witnessing stable growth, driven by advancements in biotechnology and crop protection and the integration of IoT, and remote sensing technologies for efficient crop management.

- Technological Advancements: Technological innovations in agroscience are transforming industry, with precision farming, genetic engineering, and data-driven decision-making becoming commonplace.

- Industry Applications: Agroscience encompasses a wide range of applications, including crop production, pest control, soil management, and genetic modification of crops. It plays a vital role in ensuring adequate food production, improving crop quality, and minimizing environmental impacts.

- Geographical Trends: The Asia-Pacific region, including countries like China and India, is witnessing significant growth in agroscience due to its large agricultural sector and increasing demand for food. North America and Europe remain leaders in technological advancements and sustainable agriculture practices.

- Competitive Landscape: The market is characterized by intense competition with key players focusing on innovation, mergers and acquisitions (M&A), and expanding their global footprint. There is also a growing presence of innovative startups and smaller companies offering specialized solutions.

- Challenges and Opportunities: Challenges include climate change-related uncertainties, pest and disease outbreaks, and regulatory hurdles for genetically modified organisms. Opportunities lie in adopting sustainable practices, leveraging technology for precision farming, and exploring untapped markets.

- Future Outlook: The future of the Agroscience Market looks promising, with continued growth expected to address global food security challenges. Advancements in biotechnology, precision agriculture, and sustainable farming practices will play a pivotal role in shaping the industry's future.

Agroscience Market Trends:

Advancements in technology

The agroscience market is heavily influenced by technological innovations. These include developments in genetic engineering, precision agriculture, and biotechnology. These technologies enable more efficient crop production, pest control, and soil management. For instance, genetic engineering allows the creation of crops resistant to diseases and pests, significantly reducing crop losses. Precision agriculture, utilizing GPS and IoT devices, enables farmers to optimize field-level management with real-time data. These advancements not only increase yield but also contribute to sustainability by reducing resource wastage and environmental impact.Government policies and regulations

Governmental interventions play a pivotal role in shaping the Agroscience market. Policies and regulations regarding crop safety standards, environmental protection, and use of genetically modified organisms (GMOs) can significantly influence market dynamics. Subsidies for sustainable farming practices or R&D in new agricultural technologies can spur innovation and growth in the sector. Conversely, stringent regulations on GMOs or pesticides can limit market growth. Therefore, understanding and complying with these regulatory frameworks is essential for businesses operating in this space.Climate change and environmental concerns

The impact of climate change is a major driver for the agroscience market. With changing weather patterns, increased frequency of extreme weather events, and environmental degradation, there is a growing demand for climate-resilient crops and sustainable farming practices. Agroscience companies are increasingly focusing on developing products and solutions that address these challenges, such as drought-resistant seeds or eco-friendly pesticides. This trend not only helps in adapting to climate change but also aligns with the global shift towards sustainability.Rising global population and food demand

The growing global population, projected to reach nearly 10 billion by 2050, significantly drives the agroscience market. This population growth translates into higher food demand, necessitating an increase in agricultural productivity. To meet this demand, the industry is focused on developing higher-yielding crop varieties, improving pest management solutions, and enhancing soil health. The challenge is not only to increase production but also to do so in a sustainable and environmentally friendly manner.Agroscience Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on product.Breakup by Product:

- Genetically Modified (GM) Seeds

- By Trait

- Herbicide-Tolerant

- Insect-Resistant

- Others

- By Seed Type

- Corn

- Soybean

- Cotton

- Canola

- Others

- Biopesticides

- Bioherbicides

- Bioinsecticides

- Biofungicides

- Others

- Biostimulants

- Acid-based

- Humic Acid

- Fulvic Acid

- Amino Acid

- Extract-based

- Seaweed Extract

- Other Plant Extracts

- Others

- Microbial Soil Amendments

- Chitin & Chitosan

- Others

Genetically modified (GM) seeds accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the product. This includes genetically modified (GM) seeds [by trait (herbicide-tolerant, insect-resistant, and others), and by seed type (corn, soybean, cotton, canola, and others)], biopesticides [bioherbicides, bioinsecticides, biofungicides, and others], biostimulants [acid-based (humic acid, fulvic acid, and amino acid), extract-based (seaweed extract and other plant extracts) and others (microbial soil amendments, chitin & chitosan, and others. According to the report, genetically modified (GM) seeds represented the largest segment.The genetically modified (GM) seeds segment holds the largest share in the agricultural market due to its widespread adoption. GM seeds are engineered to possess desirable traits such as pest resistance, drought tolerance, and increased yield potential. These seeds have revolutionized modern agriculture by enhancing crop productivity and reducing the need for chemical pesticides. Major crops like corn, soybeans, and cotton have seen significant adoption of GM seeds, contributing to higher agricultural output. However, this segment also faces scrutiny and regulatory challenges in some regions due to concerns over environmental impact and food safety.

The biopesticides segment is experiencing robust growth driven by the increasing demand for sustainable and eco-friendly pest control solutions. Biopesticides are derived from natural sources like microorganisms, plants, and biochemicals, making them safer for the environment and human health compared to synthetic chemical pesticides. With the growing awareness of the negative impacts of chemical pesticides, biopesticides are gaining favor among farmers and consumers alike. They are particularly popular in organic farming practices and integrated pest management strategies, offering effective pest control with reduced ecological harm.

The biostimulants segment is emerging as a key player in modern agriculture, focusing on enhancing crop growth and yield through the stimulation of natural plant processes. Biostimulants contain beneficial microorganisms, organic matter, or growth-promoting substances that improve nutrient uptake, stress tolerance, and overall plant health. They are applied in conjunction with traditional fertilizers to optimize nutrient efficiency and reduce the environmental footprint of agriculture. As sustainability becomes a top priority in farming, biostimulants are poised for continued growth, offering a holistic approach to crop management and resource utilization.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest agroscience market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.North America's agroscience market is characterized by advanced agricultural practices and significant investments in research and development. The United States and Canada lead the region, with a focus on precision agriculture, biotechnology, and sustainable farming. Key drivers include the need for higher crop yields, climate-resilient agriculture, and environmental conservation. The market is dominated by major agroscience companies, and technological advancements in crop protection and genetic engineering are prevalent. The region also emphasizes sustainability and reducing the environmental impact of agriculture.

Europe's agroscience market is known for its stringent regulations and commitment to sustainable agriculture. Countries like Germany, France, and the Netherlands are leaders in innovative farming techniques, organic agriculture, and reducing chemical inputs. The European market prioritizes crop protection, soil health, and biodiversity conservation. Organic farming and the use of biopesticides are gaining popularity. The region is also a hub for research and development in agroscience, focusing on environmentally friendly solutions.

The Asia Pacific agroscience market is driven by the region's large agricultural sector and the need to feed its growing population. Countries like China and India are key players, with a focus on increasing crop yields and adopting modern farming techniques. Precision agriculture and biotechnology are gaining traction, as are sustainable practices to address environmental concerns. The Asia Pacific is a significant market for crop protection products and genetically modified crops, driven by the need for food security and improving agricultural productivity.

Latin America's agroscience market is characterized by its vast arable land and extensive agricultural production. Brazil and Argentina are major contributors, known for soybean and corn production. The region places emphasis on genetically modified crops, herbicides, and pesticides to boost yields. However, there is also a growing trend toward sustainable practices and organic farming. The Latin American market faces challenges related to land use, deforestation, and pesticide use, prompting efforts to balance productivity with environmental concerns.

The Middle East and Africa's agroscience market face unique challenges related to arid climates and limited water resources. The focus here is on drought-resistant crops, efficient irrigation techniques, and desert agriculture. The region seeks to improve food self-sufficiency and reduce reliance on food imports. Sustainable practices like organic farming and precision agriculture are emerging trends. Local crop protection solutions tailored to specific environmental conditions are crucial for the growth of agriculture in this region.

Leading Key Players in the Agroscience Industry:

The key players in the agroscience market are actively pursuing a range of strategies to maintain their market leadership and address evolving industry demands. They are heavily investing in research and development to innovate new crop protection solutions, genetic engineering techniques, and precision farming technologies. These companies are also committed to sustainability, focusing on eco-friendly and organic products to meet increasing consumer and regulatory demands. Additionally, they are expanding their global presence through strategic acquisitions, partnerships, and collaborations to tap into emerging markets and enhance their product portfolios. Furthermore, key players are investing in digital farming solutions, leveraging data analytics and artificial intelligence to optimize agricultural practices and improve crop yields while minimizing environmental impacts.The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided.

Some of the key players in the market include:

- Agrinos Inc.

- Nutrien

- Arysta LifeScience Corporation (United Phosphorus Ltd.)

- BASF

- Bayer

- Corteva Agriscience

- Novozymes (Novo A/S)

- Sumitomo Chemical

- Syngenta (ChemChina)

Key Questions Answered in This Report

1. What was the global agroscience market size in 2024?2. What are the key factors driving the global agroscience market?

3. What has been the impact of COVID-19 on the global agroscience market?

4. What is the breakup of the global agroscience market based on the product?

5. What are the key regions in the global agroscience market?

6. Who are the key players/companies in the global agroscience market?

Table of Contents

Companies Mentioned

- Agrinos Inc.

- Nutrien

- Arysta LifeScience Corporation (United Phosphorus Ltd.)

- BASF

- Bayer

- Corteva Agriscience

- Novozymes (Novo A/S)

- Sumitomo Chemical

- Syngenta (ChemChina)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 125 |

| Published | January 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 41.2 Billion |

| Forecasted Market Value ( USD | $ 71.3 Billion |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |