Global Oilfield Chemicals Market - Key Trends & Drivers Summarized

What's Powering the Evolving Role of Oilfield Chemicals in Modern Extraction Techniques?

Oilfield chemicals have become indispensable in today's highly complex and efficiency-driven oil and gas extraction industry. These chemicals serve a broad range of functions - ranging from drilling optimization and cementing to production enhancement and corrosion inhibition. As oil and gas reserves become increasingly difficult to access, with new exploration pushing into deepwater and ultra-deepwater environments, the performance and specificity of oilfield chemicals have taken center stage. Innovations in formulations that can tolerate extreme temperatures, pressures, and salinity levels are becoming crucial. Moreover, unconventional extraction methods such as hydraulic fracturing and enhanced oil recovery (EOR) are heavily reliant on advanced chemical solutions for optimal yield and safety. Companies are increasingly tailoring chemical blends to the geochemical makeup of the reservoir, which is prompting the growth of more intelligent, customizable solutions. This has also brought about a surge in specialty chemicals that offer multifunctional capabilities, thereby reducing operational complexity and costs. Environmental mandates are also prompting R&D toward the creation of eco-friendly, biodegradable alternatives, which add a new dimension to product innovation and regulatory compliance. The demand for such sophisticated products is reshaping the global supply chain, encouraging collaboration between chemical companies, service providers, and energy firms. Additionally, real-time chemical monitoring is being integrated into drilling operations to adjust formulations based on reservoir responses, enhancing overall efficiency. The advent of smart fluids that adapt their properties in real-time is further revolutionizing the role of oilfield chemicals in maximizing production while minimizing environmental risks. As drilling activities reach previously untapped reserves in increasingly hostile environments, these advanced chemical solutions are no longer optional - they are mission-critical. Furthermore, the digitalization of oilfield services is giving rise to predictive analytics tools that recommend optimal chemical dosages, enhancing performance and cost-efficiency. Oilfield chemicals have thus evolved from being mere facilitators to strategic enablers of efficient and sustainable energy production.How Are Regional Dynamics and Geopolitics Shaping Demand Patterns?

The oilfield chemicals market exhibits unique regional behavior driven by geopolitical stability, energy policies, and the pace of industrial development. North America remains the largest market, primarily due to the proliferation of shale gas and tight oil production in the U.S. and Canada. The U.S. market, in particular, is characterized by high consumption of fracking fluids, biocides, and corrosion inhibitors, making it a hotbed for product innovation and volume demand. In contrast, the Middle East, rich in conventional oil reserves, continues to invest in chemicals that enhance recovery and mitigate scaling and corrosion in mature fields. Meanwhile, Asia-Pacific is emerging as a dynamic growth frontier, with countries like China and India expanding their oil and gas infrastructure and engaging in offshore exploration. Russia and Brazil also present notable opportunities, particularly in the deepwater segments, despite occasional political and logistical setbacks. Africa's market, while currently small, is attracting attention due to untapped reserves and investments in upstream development. These diverse regional demands are creating highly localized supply chains and necessitating a more granular approach to chemical development and deployment. Additionally, the influence of national oil companies (NOCs) in dictating procurement strategies, along with government incentives and tax structures, is having a significant impact on vendor dynamics and market competitiveness across borders. European countries, though focusing more on renewable energy, still maintain steady demand for oilfield chemicals in legacy projects and strategic reserves. Latin American nations are exploring innovative production-sharing models that stimulate offshore development, indirectly boosting demand for production chemicals. In Southeast Asia, countries like Indonesia and Malaysia are modernizing their oilfields with enhanced chemical support. Overall, each region reflects a unique combination of geological complexity, energy strategy, and regulatory stance, thereby shaping a highly segmented and strategically varied global market landscape.Why Is Sustainability No Longer Optional in Chemical Formulation?

The environmental footprint of oilfield chemicals is increasingly under the microscope, compelling companies to shift toward greener alternatives. Regulatory frameworks like REACH in Europe and EPA mandates in the U.S. are enforcing stricter controls over the use and disposal of hazardous chemicals, driving a fundamental change in how oilfield chemicals are formulated and utilized. Biodegradable and non-toxic formulations are not just a trend - they're becoming a necessity. The industry is witnessing a transition from traditional chemical agents to bio-based solutions, particularly in drilling and completion fluids. This push toward sustainability is also being reinforced by oil companies' ESG (Environmental, Social, and Governance) commitments, which now form an integral part of investment decisions. In offshore operations, where chemical discharge poses serious ecological risks, the demand for low-toxicity chemicals is particularly acute. Furthermore, advancements in green chemistry are enabling the development of performance-equivalent substitutes that minimize environmental harm without compromising operational efficiency. The use of nanotechnology is also rising, allowing for more targeted chemical action with reduced volumes, thereby curbing waste and enhancing process sustainability. This transformation is altering procurement strategies, making compliance and environmental credentials as critical as price and performance in chemical selection. In some jurisdictions, tax incentives and green certifications are now influencing which chemical suppliers are awarded contracts. Industry leaders are increasingly investing in closed-loop systems and chemical recycling solutions to further mitigate ecological damage. The rise of carbon accountability and lifecycle analysis in procurement also means chemical producers must demonstrate end-to-end sustainability. These changes are not only redefining product portfolios but also encouraging alliances between chemical producers and environmental technology firms to co-develop cleaner solutions. Ultimately, the sustainability paradigm is pushing oilfield chemicals into a new era of responsibility, where environmental stewardship is interwoven with technological advancement.What's Driving the Accelerated Growth of the Oilfield Chemicals Market?

The growth in the oilfield chemicals market is driven by several factors rooted in technological advancement, expanding end-use sectors, and changing consumer behavior within the oil and gas industry. First and foremost, the increasing global demand for energy - fueled by industrialization and urbanization in emerging economies - is amplifying the need for more efficient extraction and production technologies, where oilfield chemicals play a pivotal role. The expansion of unconventional oil and gas resources, such as shale and tight oil, particularly in North America, is propelling the consumption of specialty chemicals tailored for complex geological formations. Technological progress in horizontal drilling, EOR, and deepwater exploration has intensified reliance on high-performance chemical solutions. In terms of end-use, the shift from conventional to more challenging extraction environments demands precise chemical engineering to ensure efficiency and equipment longevity. The industry's focus on maximizing reservoir life has further boosted the use of demulsifiers, corrosion inhibitors, and scale preventers. Consumer behavior trends within energy companies - favoring digitization, automation, and chemical performance monitoring - have led to greater investments in smart chemical systems that can adapt to dynamic operational parameters. Furthermore, fluctuating crude oil prices have led companies to seek efficiency-enhancing solutions to sustain profitability, enhancing the appeal of performance-boosting chemicals. The rise in mature oilfields requiring secondary and tertiary recovery techniques is also increasing the demand for advanced chemical formulations. Regional expansion of refineries and storage infrastructure, particularly in Asia and the Middle East, is generating parallel demand for process-specific oilfield chemicals. Additionally, growing collaborations between oilfield service companies and chemical manufacturers are accelerating innovation cycles. The ongoing transition toward localizing chemical production to reduce import dependency, enhance customization, and ensure supply chain resilience is another important growth driver. Together, these factors are fueling a robust expansion of the oilfield chemicals market, with strong momentum projected across both developed and emerging markets.Report Scope

The report analyzes the Oilfield Chemicals market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Location (Onshore Location, Offshore Location); Application (Drilling Application, Production Application, Well Stimulation Application, Enhanced Oil Recovery Application, Other Applications).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Onshore Location segment, which is expected to reach US$23.2 Billion by 2030 with a CAGR of 3.5%. The Offshore Location segment is also set to grow at 4.5% CAGR over the analysis period.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Oilfield Chemicals Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Oilfield Chemicals Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Oilfield Chemicals Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Albemarle Corp., Ashland, Inc., Baker Hughes, BASF SE, CES Energy Solutions Corp. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 152 companies featured in this Oilfield Chemicals market report include:

- Albemarle Corp.

- Ashland, Inc.

- Baker Hughes

- BASF SE

- CES Energy Solutions Corp.

- Chevron Phillips Chemical Company LLC

- Dow Chemical Company

- Elementis Plc

- Halliburton Company

- Oren Hydrocarbons Middle East FZCO.

- Schlumberger Limited

- Solvay SA

- Weatherford International Ltd.

- Zirax Limited

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Albemarle Corp.

- Ashland, Inc.

- Baker Hughes

- BASF SE

- CES Energy Solutions Corp.

- Chevron Phillips Chemical Company LLC

- Dow Chemical Company

- Elementis Plc

- Halliburton Company

- Oren Hydrocarbons Middle East FZCO.

- Schlumberger Limited

- Solvay SA

- Weatherford International Ltd.

- Zirax Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 935 |

| Published | February 2026 |

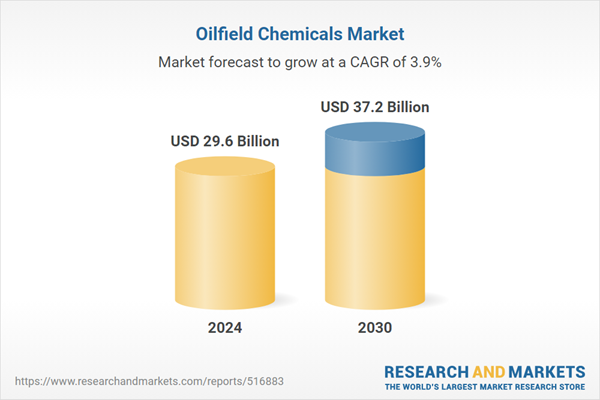

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 29.6 Billion |

| Forecasted Market Value ( USD | $ 37.2 Billion |

| Compound Annual Growth Rate | 3.9% |

| Regions Covered | Global |