Oil drilling automation refers to the automation of operational sub-processes as well as downhole activities that are necessary for the drilling of oil. In other words, it refers to integrating surface and downhole measurements with the help of modernized machinery and systems and predictive models to improve operational efficiency cost-effectively. There are growing requirements for safety as well as efficiency during the drilling process. Therefore, these tools and equipment further offer enhanced safety and efficiency with the help of predictive tools and models. Drill automation is increasingly being adopted because it also helps optimize surface activities. For this, a combined system with a comprehensive understanding of the subsurface and its interactions with the drilling systems operating under surface drilling is required.

The market for oil drilling automation is primarily driven by the significant rise in exploration activities owing to the increased demand, which is anticipated to be one of the prime factors expected to supplement the need for automation solutions in oil fields. Furthermore, the increasing focus on the development of new oil fields with reduced risks and enhanced safety and efficiency is a major factor that is playing a significant role in shaping the market growth throughout the next five years. Additionally, the upgradation of the existing infrastructure in the oil fields and the growing penetration of automation processes across several industry verticals are bolstering the oil drilling automation market growth throughout the forecast period.

However, the market may be restrained by the fact that the initial upfront costs of these solutions are further leading to a reluctance in adopting these solutions. The risk of security coupled with the volatile nature of the oil industry is one of the additional factors projected to inhibit market growth.

Oil Drilling Automation Market Geographical Outlook:

North America is expected to have a substantial share.Geographically, the market has been distributed in North America, South America, Europe, the Middle East and Africa, and the Asia-Pacific. The North American region is expected to hold a considerable market share because it boasts of being the early adopter of technology and a world-class infrastructure across the oil and gas industry.

The Asia-Pacific region is also expected to witness promising growth during the forecast period. The presence of the world's fastest-growing economies, such as India and China, among others, coupled with the increasing expenditure in the oil exploration sectors in these countries, further supports the oil drilling market growth in the APAC region throughout the forecast period.

Reasons for buying this report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape up future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decision to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use our reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive IntelligenceReport Coverage:

- Historical data & forecasts from 2022 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, Customer Behaviour, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling (Strategies, Products, Financial Information, and Key Developments among others)

The Oil Drilling Automation market is segmented and analyzed as follows:

By Application

- Offshore

- Onshore

By Offering

- Hardware

- Software

By Geography

- Americas

- USA

- Canada

- Others

- Europe, the Middle East, and Africa

- Russia

- Saudi Arabia

- Norway

- Others

- Asia-Pacific

- China

- Others

Table of Contents

Companies Mentioned

- Huisman Equipment B.V.

- Sekal AS

- HMH

- NOV Inc.

- Rigarm Inc.

- Automated Rig Technologies Ltd.

- Nabors Industries Ltd.

- ABB

- Emerson Electric Co.

- Honeywell International Inc.

Table Information

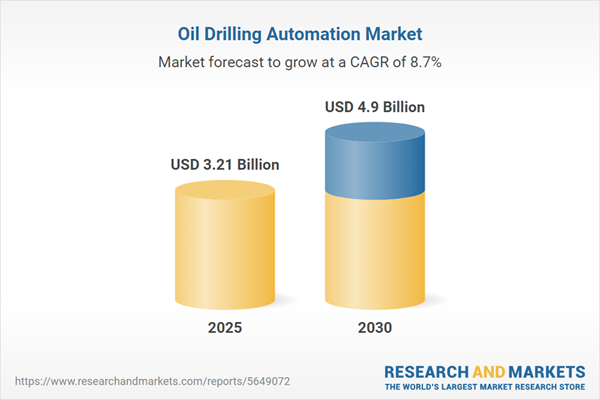

| Report Attribute | Details |

|---|---|

| No. of Pages | 105 |

| Published | December 2024 |

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 3.21 Billion |

| Forecasted Market Value ( USD | $ 4.9 Billion |

| Compound Annual Growth Rate | 8.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |