The market was negatively impacted by COVID-19. Presently the market has now reached pre-pandemic levels.

Key Highlights

- Factors, such as increasing demand for natural gas and rising production of oil and gas, coupled with increasing demand for petroleum products in the country, are expected to boost the demand in the market during the forecast period. In a process to modernize the downstream industry, new petrochemical plants integrated with the old refineries are making headway. The increase in investment is expected to augment the growth in the market.

- However, a decrease in oil consumption is expected to impede the growth of the market.

- The government may reduce the sulfur contents in refined crude oil to follow the climate agreement. Modernizing the desulfurization process is expected to create an opportunity in the downstream sector in the future.

Azerbaijan Oil & Gas Downstream Market Trends

Petrochemicals Plants is Expected to Witness Growth

- The petrochemical business produces chemicals through several process steps such as cracking, condensation, or distillation, where intermediate or end products are generated under precisely regulated pressure and temperature conditions.

- In 2022, SOCAR Polymer is expected to increase production to 237,000 tonnes. SOCAR Polymer includes plants for the production of polypropylene and high-density polyethylene with an annual capacity of 184,000 tonnes and 120,000 tonnes per year, respectively.

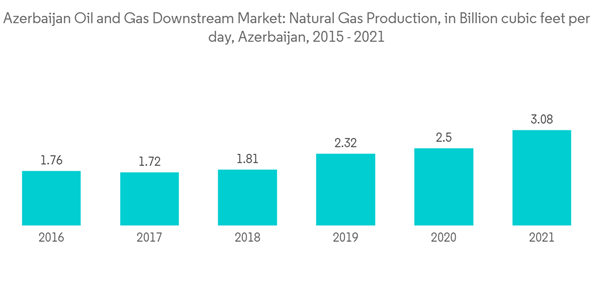

- Natural gas production in the country increased by 23.3%, from 2.50 Billion cubic feet per day (Bcf) in 2020 to 3.08 Bcf in 2021. Natural gas consumption in the country accounted for 1.2 Bcf in 2021, which is expected to increase in the forecast period. An increase in natural gas consumption is likely to be used as a feedstock for the petrochemical industry.

- Hence, a further increase in petrochemical plants is expected in the forecast period due to the government’s efforts to modernize the downstream sector.

Increase in Production of Oil and Natural Gas to Drive the Market

- Azerbaijan's one of the most essential crude oil blends is the BTC, with API gravity of 36.6, a high quality, and low sulfur 0.16% crude oil. The oil grade is of excellent quality and requires a low level of refining maintenance and equipment.

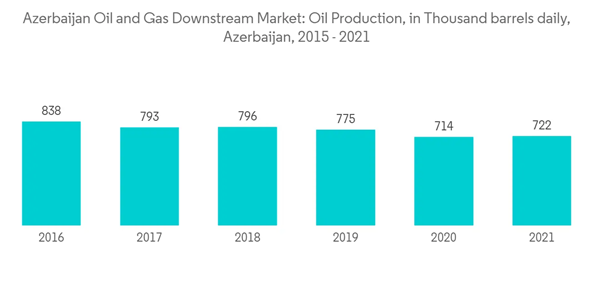

- Oil consumption in the country increased by 4.3%, from 91 thousand barrels daily in 2020 to 95 thousand barrels daily in 2021. Oil production increased by 1.2% from 714 thousand barrels daily in 2020 to 722 thousand barrels daily in 2021.

- In Azerbaijan, the capacity of refineries in 2021 increased to 135 Thousand barrels daily, with a 12.5 % jump compared to 2020. The refinery throughput increased considerably by 2.8% to 118 kb/d in 2020 from 121 kb/d in 2021. As the production of oil and gas increases, throughput is also expected to increase in the forecast period.

- Hence, the Azerbaijan oil and gas downstream market is expected to grow slightly in the forecast period due to an increase in oil and gas production in the country.

Azerbaijan Oil & Gas Downstream Market Competitor Analysis

The Azerbaijan oil and gas downstream market is consolidated. The major companies (not in particular order) include the State Oil Company of the Azerbaijan Republic, Royal Dutch Shell PLC, Total SA, KBR Inc., and TechnipFMC PLC.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- State Oil Company of the Azerbaijan Republic

- Royal Dutch Shell PLC

- Total SA

- KBR Inc.

- TechnipFMC PLC