Key Highlights

- During the pandemic, the research and development activities of pharmaceutical and biotechnology companies increased significantly, leading to a rise in the usage of molecular weight markers. Genomic technologies were employed by researchers worldwide to better understand the biology of SARS-CoV-2 and its evolution, leading to an increase in genomic research, which also raised the usage of molecular weight markers. Although the pandemic initially impacted the market, it is expected to have stable growth during the forecast period of the study due to other applications.

- The market growth is expected to be boosted by factors such as increasing investment in R&D and a growing focus on proteomics and genomics technologies research. The increasing research and development investments by major pharmaceutical and biotechnology companies are one of the major factors driving the usage of molecular weight markers. For example, Pfizer invested heavily in R&D, with USD 13,829 million in FY 2021, compared to USD 9,343 million in the past year. Similarly, Biocon Biologics Limited plans to increase its R&D investments heavily by 10-15% in the next financial year (FY 2023) to drive future growth.

- Furthermore, the increasing research on proteomics and genomics is expected to boost market growth. With the increased usage of ladder systems in proteomic and genomic research, the usage of molecular weight markers is also expected to increase during the forecast period of the study. Additionally, the rising developments of such protein ladders or molecular weight markers, such as those developed by undergraduate students at Penn State, are also expected to boost the growth of the studied market.

- However, the lack of skilled healthcare professionals and strict government regulations are expected to impede the market growth. Overall, the above-mentioned factors, such as increasing investment in R&D and a growing focus on proteomics and genomics technologies research, are expected to drive market growth, despite the challenges posed by regulations and a shortage of skilled professionals.

Molecular Weight Marker Market Trends

RNA Marker Segment is Expected to Show Significant Growth Over the Forecast Period

- RNA molecular weight markers are synthetic chains of defined lengths that are used to determine the molecular weight of RNA species. These markers are typically prepared by in vitro transcription of linearized plasmids using RNA polymerases in separate reactions. They are then dissolved in a storage buffer, such as EDTA, and have a shelf life of up to 2 years when stored at -80 °C. To make them detectable on gel electrophoresis, markers are usually stained, with the most commonly used dye being ethidium bromide. RNA markers are commonly used as size standards in northern blotting and RNA gel electrophoresis.

- According to an article published by SpringerLink in August 2022, a study was carried out for both in vitro and in vivo mapping of RNA structure. During this study, denaturing acrylamide gel electrophoresis of the pool of p-labeled cDNAs and the corresponding sequencing RNA ladders were used, highlighting the importance of RNA markers in research.

- In addition to their increasing usage in genomic research, major pharmaceutical and biotechnology companies are investing more in research and development activities, which is expected to boost the segment growth of RNA markers. For instance, the New South Wales Government in Australia has allocated funding of USD 119 million over 10 years to RNA R&D to support a pipeline of projects for piloting at the facility, as published in December 2022.

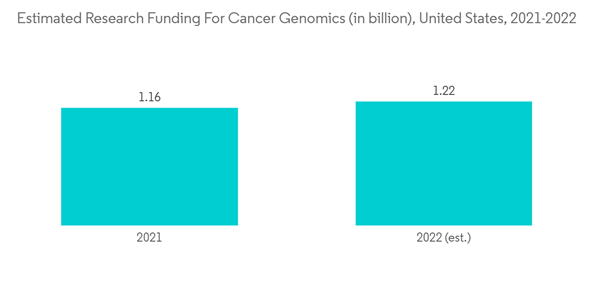

- Overall, the increasing investment in R&D in genomic research, including cancer genomics, and the growing focus on genomics technologies research are expected to drive the growth of the RNA marker segment.

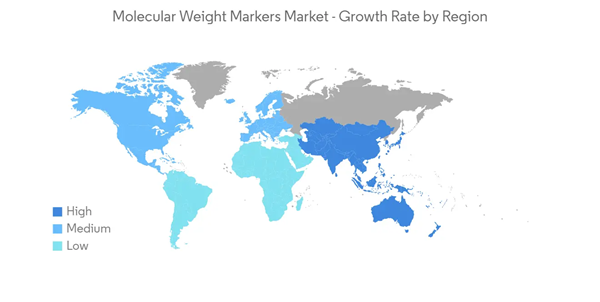

North America is Expected to Hold a Significant Share in the Market Over the Forecast Period

- The North American market for molecular weight markers is heavily influenced by the presence of numerous large pharmaceutical and biotechnology companies in the United States, as well as the growing burden of various infectious and chronic diseases and the rising investment in research and development (R&D).

- For example, the Canadian Cancer Society estimated in November 2022 that 233,900 people would be diagnosed with cancer in 2022, and this increase in incidence is largely due to Canada's aging and growing population. Therefore, the rising prevalence of chronic diseases is expected to result in increased research and development activities, which will drive the growth of the molecular weight markers market in the region over the forecast period.

- In September 2022, the Centers for Disease Control and Prevention (CDC) allocated USD 90 million to the Pathogen Genomics Centers of Excellence (PGCoE) network. The PGCoE network is intended to foster and enhance innovation and technical capacity in pathogen genomics, molecular epidemiology, and bioinformatics to better prevent, control, and respond to microbial threats of public health importance. Such investments in genomics are expected to increase the usage of molecular weight markers during the study's forecast period.

- As a result, the aforementioned factors, such as increased investment in research and development and a rising prevalence of chronic and infectious diseases, are expected to drive growth in the molecular weight markers segment.

Molecular Weight Marker Industry Overview

The market for molecular weight markers is moderately fragmented, with several major players competing for market share. Agilent Technologies, Bio-Rad Laboratories, F. Hoffmann-La Roche, Merck KGaA, New England Biolabs, Promega Corporation, Qiagen, Thermo Fisher Scientific, and VWR International are among the leading companies in this market, with a significant share of the market.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Agilent Technologies, Inc

- Bio-Rad Laboratories, Inc.

- F Hoffmann-La Roche AG

- Merck KGaA

- New England Biolabs

- Promega Corporation

- QIAGEN N.V.

- Thermo Fisher Scientific Inc.

- VWR International

- Takara Bio Inc.

- HiMedia Laboratories

- GeneDireX, Inc.