The market was negatively impacted by COVID-19 in 2020. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the medium term, factors such as increasing natural gas production and consumption and investments in the oil and gas upstream sector are expected to drive the growth of the Algerian oil and gas market during the forecast period.

- On the other hand, oil price volatility and comparably higher production costs for unconventional resources are expected to create hindrances for the Algerian oil and gas upstream market during the forecast period.

- Sizeable natural gas field discoveries have been made in southwestern Algeria. These fields have an estimated capacity to produce 275 cubic meters of gas and approximately 300 liters of condensate per hour, which may provide an opportunity for the oil and gas upstream industry in Algeria in the future.

- Increasing consumption of oil and gas in the country is expected to drive the market, and it is expected to attract further investments in the onshore gas fields in the country. Increasing demand for natural gas worldwide is also expected to positively impact the growth.

Algeria Oil & Gas Upstream Market Trends

Onshore Gas Field Production to Witness Growth

- Algeria held an estimated 11 billion barrels of proven crude oil reserves as of 2021. The country's proven oil reserves are held onshore due to limited offshore exploration.

- Algerian oil fields produce high-quality, light crude oil with low sulfur content. The quality of oil increases the demand for oil, as it does not require a specific refinery to refine oil.

- In July 2022, for two onshore blocks in the Berkin Basin, 404a and 208, the French multinational TotalEnergies agreed to a new 25-year production sharing contract (PSC) with Sonatrach, Occidental, and Eni.

- The PSC, which was signed in accordance with Algeria's new hydrocarbon law, will permit the exploitation of more liquid hydrocarbon resources while lowering the carbon intensity in the onshore areas. The four businesses will invest about USD 4 billion in the perimeter of Berkine to produce 1 billion oil equivalent barrels.

- The new expansion in gas production is taking place in the country, mainly by the government-owned Sonatrach. The company plans to increase its gas production by producing more than 1 billion cubic feet per day during the forecast period.

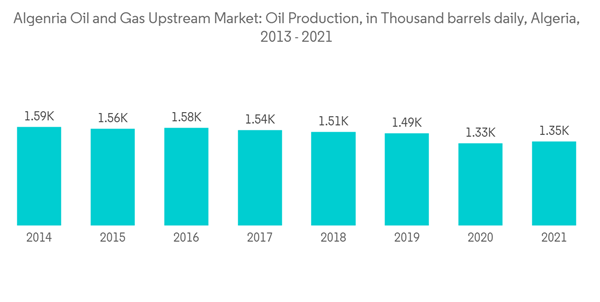

- Algeria's oil production increased by 1.72% in 2021. In the same year, the oil production was 1,353 thousand barrels per day compared to 2020, i.e., 1,330 thousand barrels per day.

- Hence, onshore oilfields are expected to witness growth due to investment in gas basins.

Increasing Consumption of Oil and Gas to Drive the Market

- The country witnessed an increase in the consumption of natural gas and oil during 2020-2021. The continuation of the increasing consumption is expected to drive the market’s growth over the forecast period.

- In 2021, the volume of oil consumed stood at 403 thousand barrels per day in Algeria compared to previous year, i.e., 385 thousand barrels per day.

- In March 2022, as Europe intensified its efforts to access alternate sources in response to Russia's invasion of Ukraine, Italy's foreign minister announced that a visit to Algeria to seek a rise in gas supplies from the nation had produced positive results.

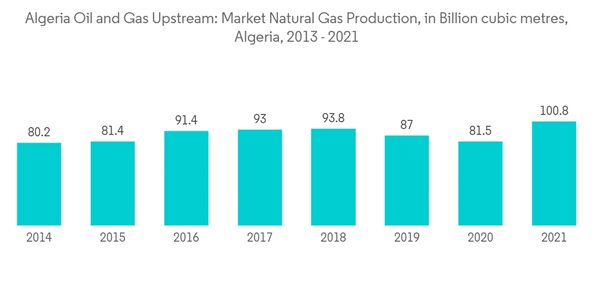

- Production of gas in Algeria increased by 23.6%, to 100.8 billion cubic meters, in 2021, from 81.5 billion cubic meters in 2020. Consumption of natural gas increased in the country by 5.04 %, to 45.8 billion cubic meters, in 2021, from 43.6 billion cubic meters in 2020. Increasing production further increases the company's profits.

- Hence, increasing gas production is anticipated to drive Algeria's oil and gas upstream market over the forecast period.

Algeria Oil & Gas Upstream Market Competitor Analysis

The Algerian oil and gas upstream market is moderately consolidated. Some of the major companies include (in no particular order) Sonatrach SPA, Engie SA, TotalEnergies SA, BP PLC, and Petroceltic Ain Tsila Ltd.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Sonatrach SPA

- Engie SA

- TotalEnergies SA

- BP PLC

- Petroceltic Ain Tsila Ltd