COVID-19 had a profound impact on the medical simulation market owing to the cancellations of minimally invasive surgeries and a decline in research initiatives by key players in the initial phases of the pandemic. Various healthcare organizations also organized medical simulation training for the better management of COVID-19, which has also impacted the market growth. For instance, according to an article published in the Australian Journal of General Practice in June 2020, a simulation training course for family medicine residents in Shanghai, China, was conducted virtually to train the management of COVID-19. 96% of participants found the simulation extremely beneficial. However, the market has been recovering well over the last two years since the restrictions were lifted. With the new product launches and rising minimally invasive surgeries in the Asia-Pacific region, the market is expected to gain pace during the forecast period.

In addition, the increasing demand for minimally-invasive treatments, continuous technology innovation, and growing focus on patient safety is actively affecting the growth of the market studied.

Minimally-invasive techniques are becoming standard for several surgical procedures at a very fast pace. Minimally-invasive surgery (MIS) is associated with less pain, shorter hospital stays, and fewer post-surgical complications. For instance, according to an article published in the South Asian Journal of Cancer in December 2021, the postoperative complication rate of the minimally invasive esophagectomy (MIE) group was much less (18.5%) as compared with the open esophagectomy (OE) group (41%). Pulmonary complications reported in the MIE group was 7.4% compared to 25.6% in the OE group for Resectable Esophageal Cancer. Also, a research article published in BMC Psychiatry Journal in January 2022 reported the prevalence of minimally invasive facial cosmetic surgery (MIFCS) among Chinese college students was 2.7% among the surveyed population. The advantages of MIS and the high incidence of these surgeries are estimated to propel the market growth during the forecast period. Therefore, the requirement of medical simulation in the training of minimally-invasive surgery has been established over the past few years and is expected to propel the market growth during the forecast period.

Furthermore, the utility of medical simulation in cataract surgical procedures is propelling market growth. For instance, in October 2021, B.J. Government Medical College launched a pilot program with HelpMeSee to bring its virtual reality, simulation-based training in order to combat the cataract blindness epidemic in India by training more cataract specialists. The training also allowed ophthalmologists to overcome the limits of COVID-19 on surgical skills training to increase patient safety. In December 2021, 190 trainees completed simulation-based training in India. These courses will create an opportunity for various hospitals to treat more untreated patients in developing and underdeveloped countries with fewer doctors, which is anticipated to propel the market growth during the forecast period.

Therefore, owing to the factors such as rising medical simulation training for MIS and increasing strategic initiatives by key players, the market studied is anticipated to witness growth over the analysis period. However, the high cost of simulators and reluctance to adopt new training methods is likely to impede the market growth.

APAC Medical Simulation Market Trends

Academic and Research Institutes Segment is Expected to Hold a Significant Market Share Over The Forecast Period

Academic and Research Institutes widely use the medical simulation for training healthcare professionals and treatment purposes. The learning platform enables training surgeons to review and analyze their performance data. It allows faculty to connect with their trainees from anywhere in the world, allocate tasks, review performance, provide written feedback, and issue certificates of competency.Various summits and workshops are hosted by academic and research institutes for different therapeutic areas simulations, which educate healthcare professionals regarding the benefits of simulation in the medical industry. For instance, the 7th Chinese Research Hospital Association Thyroid Disease Summit and the 7th China Neuromonitoring Workshop were held in Zhengzhou in March 2022. One of the sessions was a simulation session that was hosted virtually. The China-Japan Friendship Hospital of Jilin University professors demonstrated neuromonitoring problems and solutions. The virtual simulation session on neuromonitoring technology by academic professors is estimated to boost the utility among educational and research institutes, thereby propelling the segment's growth.

Academic and research institutes are making medical simulation training mandatory for healthcare professionals, which is expected to add to the market growth. For instance, in November 2022, Armed Forces Medical College (AFMC), India, announced medical simulation as an essential part of resuscitation and critical care training. Since doctors, nurses, and paramedics can polish their emergency response skills in the security of a laboratory where their actions can be carefully observed, it is anticipated that the quality of care will increase. The Central Clinical Skills and Simulation Lab is located in the Anesthesiology and Critical Care Department. Such initiatives are anticipated to propel the segment's growth during the forecast period.

India is Expected to Hold a Significant Market Share Over The Forecast Period

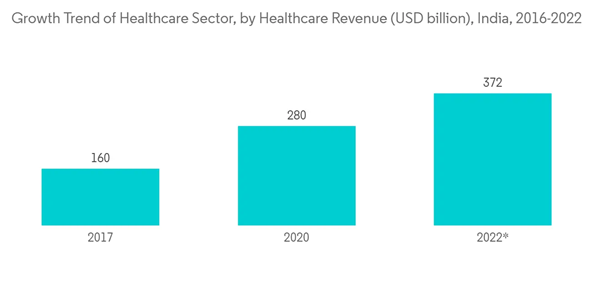

India is expected to hold a significant market share during the forecast period owing to the high healthcare expenditure by government organizations, product launches, and rising demand for medical simulation in the country.The Union Budget for the Financial Year 2022-23 presentation in February 2022 stated that there was an increase in health expenditure to 2.1% of GDP in 2021-22 against 1.8% in 2020-21 and 1.3% in 2019-20 in India. The high healthcare expenditure was estimated to increase medical simulation expenses for better healthcare facilities in the country, thereby boosting market growth.

The strategic initiatives adopted by key players, such as product launches, partnerships, and research and development investment in the country, are expected to fuel the market growth. For instance, in June 2022, MediSim VR, a Med-tech company engaged in the field of healthcare simulation, opened a fully automated Virtual Reality (VR) lab in the Puducherry Institute of Medical Sciences (PIMS) for MBBS students to improve their fundamental medical abilities and prepare them for the future. The company also got funding from IIT Madras and the Department of Science and Technology for R&D.

Also, in April 2022, the Delhi Academy of Medical Sciences (DAMS) launched a simulation-based medical education facility. The facility allows medical students of intermediate and advanced levels to practice without causing harm to patients. Such initiatives are estimated to boost the utility of medical simulation, thereby augmenting the market growth in the country.

APAC Medical Simulation Market Competitor Analysis

The Asia-Pacific medical simulation market is consolidated in nature due to the presence of a few companies operating in the region. The competitive landscape includes an analysis of a few international and local companies that hold major market shares. Some key players are 3D Systems, Canadian Aviation Electronics (CAE) Inc., Kyoto Kagaku Co. Ltd, Laerdal Medical, Limbs & Things Ltd, Mentice AB, Simulab Corporation, Inovas Medical, and IngMar Medical.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3D Systems

- Canadian Aviation Electronics (CAE) Inc.

- Kyoto Kagaku Co. Ltd

- Laerdal Medical

- Limbs & Things Ltd

- Mentice AB

- Simulab Corporation

- IngMar Medical

- Inovas Medical