Considering the COVID-19 outbreak, the perspectives on the present and future state of the economy are still negative. Healthcare also had a large impact and caused damage to its process and flow during the pandemic. This was expected to have a significant impact on the market in Spain. In Spain, 58% of private hospitals lament the lack of physicians, and 95% of hospitals lament the lack of nurses. The cosmetic surgeries were postponed because the other surgeries had to deal with this issue. The country's market is anticipated to be significantly impacted by this. According to an article titled “Cosmetic tourism during the COVID-19 pandemic: Dealing with the aftermath” published in January 2022, during the COVID-19 pandemic, the European Association of Societies of Aesthetic Plastic Surgery (EASAPS) released a statement that advised the immediate suspension of cosmetic surgery so that all resources could be redirected to overcoming the pandemic

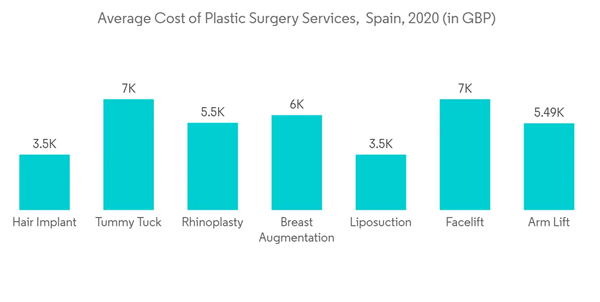

The Spanish medical aesthetic devices market has gained a lot of momentum in recent years due to the increase in the number of cosmetic surgeries being performed and the increasing concern with appearance and looks. As per an article titled “Cosmetic Surgery in Spain” published in 2020, cosmetic surgery in Spain’s prices is about 60% lower than in the United Kingdomor America. For instance, a tummy tuck’s cost in Spain is GBP 7,000 while in the United Kingdom it is over GBP 11,000 for the same procedure. This is expected to boost the market in the country. Spain’s medical tourism packages are available for international patients at more competitive prices than in the United Kingdom. This also helps the market to flourish in the country. As per an article titled “5 Best Countries for Medical Tourism” published in 2022, many patients choose European countries over Spain for various treatments because of no significant cost difference. Spain has 22 Joint Commission International (JCI) accredited hospitals specializing in neurosurgery, oncology, orthopedics, hematology, and plastic surgery. Therefore, the abovementioned factors are expected to promote the market in the country.

The internet steers the nation's population toward different cosmetic operations and is predicted to grow the industry. With the advent of the internet, information became accessible to everyone, and people started becoming more aware of aesthetic procedures. Hence, all these factors have increased the awareness about medical aesthetic procedures, which in turn, has increased the sales of medical aesthetic devices. This is expected to increase the market growth in the country. For instance, as per an article titled “E-commerce in Spain: Determining factors and the importance of the e-trust” published in February 2022, the digital divide between Spain and other European Union (EU) countries has been reduced or overcome, as 90% of the Spanish population has access to the Internet at home. Such an increased usage of the internet is expected to influence the population of the country and have a large impact on the market and help it to grow further in the forecast period.

As per the article “Has the Prevalence of Obesity in Spain Plateaued? A Systematic Review and Meta-Analysis” published in April 2022, the prevalence of excess body weight in Spain increased from 23.3% during the period 1999-2010 to 39.9% during 2011-2021. Thus, obesity has also been one primary factor that has been driving the growth of the market. Moreover, the rising adoption of minimally invasive devices in the field has also made devices and instruments more precise and safer. The adoption of minimally invasive surgical instruments is higher in hospitals and specialty clinics, owing to their higher purchasing power, and highly skilled professionals. Hence, all these factors have helped the market growth.

The poor reimbursement scenario, the high cost of treatment, and risk of malfunctions in the aesthetic surgeries are expected to restrain the market growth in the country.

Spain Aesthetic Devices Market Trends

Application in Skin Resurfacing and Tightening is Expected to Register High Growth During the Forecast Period

Skin tightening is a minimally invasive, non-surgical process that uses an infrared light source to tighten the skin by heating the collagen under the skin’s surface, causing the skin to contract. Laser skin tightening is an approved method for the reduction of fine lines, wrinkles, and skin laxity. While laser skin tightening results may not be as dramatic as those of facelift, patients enjoy moderate results with no downtime. An added benefit of laser skin tightening is that it is safe and effective for restoring a more firm, youthful appearance to skin all over the body. For instance, according to MyMediGroup, data updated in 2022, skin tightening treatment in Spain costs around EUR 303.02.As per an article titled “Plastic Surgery in Spain” published in June 2021, the cost of plastic surgery in Spain may range from USD 200 TO USD 8,000, depending on the type of procedure and other factors. Surgery methods and results have substantially improved with modern medicine. Over the years, several fresh, cutting-edge surgical methods have been developed to assist patients in achieving improved appearances through cosmetic surgery. All ages of both men and women have some form of plastic or cosmetic surgery. A cosmetic procedure's aesthetic benefits have been associated with raising a person's self-confidence and self-esteem. During the consultation, the surgeon goes over the intended results and develops a treatment plan considering them. A candidate for plastic surgery also goes through a thorough medical evaluation to see if they are a good candidate for a particular procedure or method, as certain plastic surgeries are more involved and invasive.

This procedure is thus primarily being used by the older population to reduce the wrinkles on the skin. As of January 2022, the population aged over 65 years in Spain amounted to 9.54 million people, as per World Aging Population 2020 report by the United Nations. Hence, this is expected to help the market to grow in Spain.

Spain Aesthetic Devices Market Competitor Analysis

Spain is a developed country within the European Union region. As a result, it enjoys the presence of most of the global players in the aesthetic devices market. Moreover, the country has a developed healthcare system and the rate of adoption of newer technologies is higher. This makes this market more lucrative for innovation, which encourages companies to enter the Spanish market. Some of the companies which are currently dominating the market are Allergan PLC, Alma Lasers, Cutera Inc., Bausch & Lomb Incorporated, Galderma SA (Nestle), Hologic Inc., and Lumenis Inc.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Allergan PLC

- Alma Lasers

- Cutera Inc.

- Bausch & Lomb Incorporated

- Galderma SA (Nestle)

- Hologic Inc.

- Lumenis Inc.

- LUTRONIC

- Syneron Medical Ltd

- Venus Concept