The COVID-19 pandemic has disrupted healthcare patterns, as missed visits have led to the potential for significant disease progression in some patients with noninfectious uveitis. Uveitis patients may be at higher risk than the general population of contracting COVID-19 or suffering a more severe course of the virus. As per the article published in March 2021 by the National Library of Medicine, there was an 86% reduction in outpatient treatment for uveitis in spring 2020 compared to the same period in 2019, thereby affecting the market significantly. However, with the increase in vaccination programs, the outpatient departments started operating at full capacity and are expected to grow during the study period. Furthermore, market growth is stabilizing in the current scenario following COVID-19 as global restrictions ease and disease screening services resume.

There has been an increasing prevalence of uveitis across the globe, leading to blindness. An article published in the journal Frontiers in Medicine in September 2021 indicated that non-infectious uveitis is a leading cause of vision loss around the world. The article indicated that the estimated prevalence of non-infectious uveitis in the United States is 121 per 100,000 people every year. Uveitis is a sight-threatening inflammatory disease affecting the uveal layer of the eye. Redness of the eyes, blurring of the vision, the small size of the pupil, and sensitivity to light can be possible symptoms of anterior uveitis, which, if not treated, can result in permanent blindness. As a result, there are ongoing developments in product applications and treatment modalities.

New treatment options for uveitis, such as corticosteroids and anti-inflammatory drugs, are already gaining traction in the market. The growing number of product launches and rising research and development studies are expected to boost market growth. For instance, in May 2021, Oculis S.A. reported positive data from two clinical proof-of-concept Phase 2 trials with OCS-02, its novel, topical anti-TNF alpha antibody fragment candidate, in Dry Eye Disease (DED) and Acute Anterior Uveitis (AAU). With such good results from the studies, the approval process is likely to be easier, which will help the market.

Furthermore, in August 2021, Cipla received final approval from the United States Food and Drug Administration for its abbreviated new drug application for difluprednate ophthalmic emulsion 0.05%. Difluprednate ophthalmic emulsion 0.05% is the generic version of Novartis’s Durezol and is used for the treatment of inflammation and pain associated with ocular surgery as well as for the treatment of endogenous anterior uveitis. So, more product approvals meet the growing demand for treatments for anterior uveitis, which boosts the market.

In addition, other factors, such as the growing geriatric population, are also expected to be driving factors in the growth of the market. However, the high cost of medications and the side effects of corticosteroid treatment are expected to stymie market growth.

Anterior Uveitis Treatment Market Trends

The Corticosteroids Segment is Expected to Hold a Major Market Share in the Anterior Uveitis Market.

Corticosteroids are found to dominate the uveitis treatment market as they are first-line therapies for uveitis management and are given systemically or locally, in the form of drops, periocular injections, intravitreal suspensions, or intravitreal implants. They are the most preferred option over biologics; however, researchers are currently exploring biological therapies for the treatment of uveitis. Early on in the course of uveitis, corticosteroids can quickly and effectively stop inflammation. This is the main benefit of corticosteroids.Corticosteroids are also used in sustained-release treatment, i.e., in ocular implants. It has thus shown significant results in curing the condition, and researchers are also exploring biological therapies to treat anterior uveitis. In addition, corticosteroids and anti-inflammatory drugs are found to be gaining traction in the market.

Moreover, rising research and development studies highlighting the efficacies of treating corticosteroids in noninfectious uveitis are likely to increase their adoption, thus driving the segment. For instance, the study published in January 2022 by the Journal of Ophthalmic Inflammation and Infection stated that corticosteroids are the standard of care treatment for noninfectious uveitis and can be administered topically, regionally, or systemically. They are often used to treat noninfectious uveitis, such as when there is active inflammation inside the eye or uveitic macular edema.

The innovative product launches by key market players all over the world are contributing to market growth. For instance, in February 2022, Alimera Sciences, Inc., a pharmaceutical company, launched ILUVIEN, which contains fluocinolone acetonide, a corticosteroid, for non-infectious posterior uveitis, in Spain through its Ireland-based European subsidiary, Alimera Sciences Europe Limited. Such product launches are likely to boost the growth of the market over the forecast period.

So, because of the above factors, it is likely that the studied market will grow a lot during the study period.

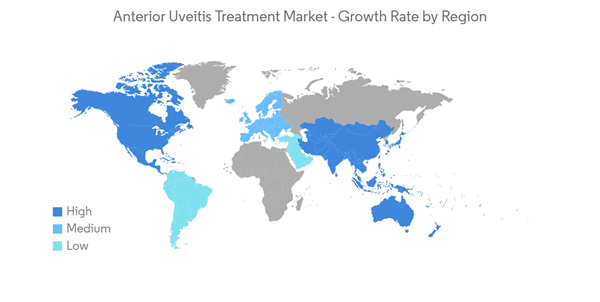

North America is Expected to Hold a Significant Share in the Market and is Expected to do the Same Over the Forecast Period.

Because of the rising prevalence of uveitis disease in the United States, North America dominates the market. There is also an increasing number of key players in the region, which is leading to the high growth of this regional segment. The other factors resulting in the growth of the market are the growing geriatric population, the rising prevalence of uveitis in the region, and increasing investments in research and development by drug manufacturing companies for innovating new treatments such as corticosteroids.The growing burden of uveitis in the region will boost the demand for its therapeutics, thus driving the market. According to an article published by the Ocular Immunology and Uveitis Foundation in April 2022, uveitis has an estimated prevalence of about 38 cases per 100,000 people and an incidence of 15 cases per 100,000 people. As per the same source, it is estimated that uveitis afflicts 109,000 people in the United States and that 43,000 new cases a year are diagnosed. Thus, the high prevalence of uveitis is expected to boost the growth of the market over the forecast period.

Additionally, product approvals and launches, a rise in investments, and the adoption of key strategies such as partnerships, mergers, acquisitions, and others are expected to drive market growth. Furthermore, R&D studies demonstrating the efficacy of anterior uveitis treatment will drive market growth. For instance, in September 2021, Tarsier Pharma initiated the Phase III trial TRS4VISION by randomizing the first patient for treatment. TRS4VISION is a Phase III randomized, active-controlled, double-masked study to evaluate the safety and efficacy of TRS01 eye drops in the treatment of subjects with active, non-infectious anterior uveitis, including subjects with uveitic glaucoma. Positive results from such studies will ease the approval process of TRS01 and increase its adoption, thus boosting the market.

Thus, the above-mentioned factors are expected to drive market growth in the United States during the study period.

Anterior Uveitis Treatment Industry Overview

The Anterior Uveitis Treatment Market is consolidated and moderately competitive. There has been a presence of a considerable number of companies that are increasingly adopting strategic initiatives such as new product development, mergers and acquisitions, and regional expansion. Major players in the market include Novartis AG, AbbVie Inc., Aciont Inc., Tarsier Pharma Ltd., and Amgen, among others.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AbbVie Inc.

- Aldeyra Therapeutics, Inc.

- Amgen

- Clearside Biomedical, Inc.

- Novartis AG

- Aciont Inc.

- Bausch & Lomb Incorporated

- Sirion Therapeutics, Inc.

- Santen Inc.

- Tarsier Pharma Ltd.

- Oculis