Key Highlights

- Figs are among the sweetest fruits, and their chewy texture sets them apart. Antioxidants, phytonutrients, minerals, and vitamins are abundant in figs. Dried figs are popular among dried fruits for their rich taste and are considered expensive for their short shelf life. Figs are well-suited to the climate and growing conditions in the Menderes basins, which are located in western Turkey. The region's warm, dry summers and mild, rainy winters provide an ideal environment for fig trees to grow and produce high-quality fruit. The Sarilop variety is one of the most popular figs grown in the area, known for its sweet, juicy flesh and thin skin.

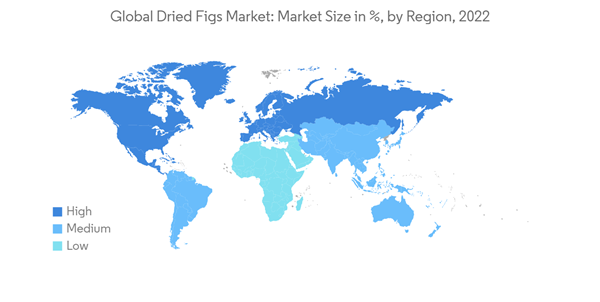

- Middle Eastern countries such as Turkey, Iran, and Afghanistan are among the top producers of dried figs. Turkey is the largest producer, accounting for about 70% of the world's dried fig production, followed by Iran, which accounts for around 15% of global production. The climate in these countries is well-suited for cultivating figs, and they have a long history of growing and exporting this fruit.

- Nearly 15-20% of the world's dry fig production is consumed by the producer countries, and the remaining portion of the domestic consumption of the producer countries is exported. Figs are produced in a limited number of countries worldwide due to their specific growing requirements. They thrive in warm, dry climates and require a specific type of wasp for pollination.

- Turkey is the major producing country of figs, followed by Egypt, Iran, Morocco, Algeria, Iran, Syria, the USA, and Spain. In 2021, Turkey ranked first with approximately 300,000 tons of production and about 30% of World Wet fig production. The world's annual fig production was about 1,121,000 tons in 2021; dried fig production accounted for one-quarter of the fig production, with around 105.000 tons.

- According to the National Agricultural Statistics Service, the United States is both an importer and exporter of figs. While the country produces figs, over 80% of the figs produced in the United States go into processing industries due to the demand for dried figs. This is because dried figs have a longer shelf life and can be used in a variety of products, including baked goods, snacks, and breakfast cereals. As a result, the rising inclusion of figs in the processed industry will likely accelerate the demand for figs over the forecast period.

Dried Figs Market Trends

Rising Per Capita Consumption from High-income Economies

- The global per capita consumption of dried figs modestly increased from 0.017 kg per year in 2016 to 0.019 kg per year by 2019. The global per capita consumption of dried figs modestly increased from 0.017 kg per year in 2016 to 0.019 per year by 2019. Although, a relatively higher per capita consumption has been observed in the high-income economies. For instance, as per the facts revealed by the International Nut & Dry Fruit Council, dried figs account for 6% of the overall dried fruit consumption in high-income economies. In contrast, they account for merely 3% of the overall dried fruit consumption across middle-income economies.

- According to the latest statistical yearbook of 2020-2021, the per capita consumption was highest in Iran, which was 0.43 kg per year per person, followed by Switzerland and UAE, with 0.37 kg and 0.28 kg per year per person, respectively. This unveils the potential opportunity for high-income economies over middle-income economies.

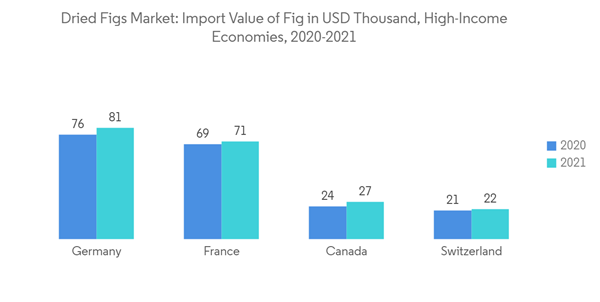

- However, the production of figs in high-income countries like Germany, France, Canada, and Switzerland is negligible. The demand for dried figs in these countries is being fulfilled by import. According to International Trade Center (ITC) Trade, Germany was the second topmost country that imported 23,286 metric tons of dried figs in 2021. Consumption, import & export of dried figs increased globally. Hence, these factors are expected to drive the market.

Iran is Expected to Dominate the Dried Figs Market

- Iran is one of the largest consumers of dried figs, attributing nearly 17,352 metric tons of consumption during 2018-19. Moreover, per the information, the International Nuts & Dry Fruit Council revealed the per capita consumption of dried figs toggled during 2016-18. For instance, the per capita consumption of dried figs was registered at 0.248 kg per year in 2016-17, and it had significantly fallen by 18.1% to 0.203 kg per year by 2017-18. However, the per capita consumption increased in 2019 by 28.3% compared to 2018 and is expected to continue during the forecast period. Iran is not only a major consumer but also one of the world's largest producers and exporters of figs.

- According to the statistics released by the Tropical and Subtropical Fruits Department of Agriculture Ministry, Iran produced nearly 25,000 tons of figs in 2020. Thus, the country's status as the second largest producer is paralleled by the lower consumption in other countries. Turkey will likely be treated as a potential opportunity to serve the international markets. This could enhance the per capita consumption of dried figs over the coming years.

Dried Figs Industry Overview

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support