United Kingdom furniture manufacturing makes a significant contribution to the United Kingdom economy. The United Kingdom is the second home furniture consumer in Western Europe. United Kingdom furniture distribution is the highest share of non-specialist retailers. Growth is also likely to be boosted by increased demand from the housing market, expanding online operations and adding value-added services. The sudden COVID-19 pandemic, which hit the world in the initial days, changed the face of the furniture industry on a large scale. The disruptions in the supply chain and the temporary ban on global trade highly affected countries with high dependencies on imports for their furniture needs.

The market is expected to witness substantial growth during the forecast period, owing to rising disposable income, increasing the number of households in the country, and increasing spending on home improvement and furnishing products. The technological advancement in the company's product landscape will help gain high furniture market penetration.

UK Furniture Market Trends

Increasing Real-Estate Industry is Driving the Market

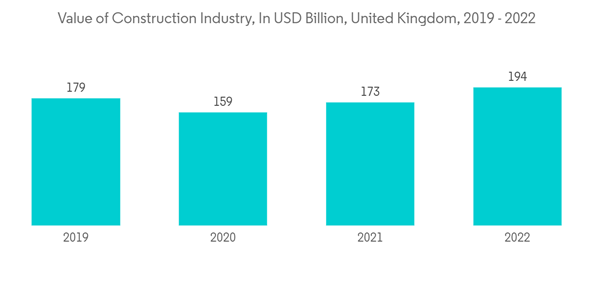

The United Kingdom plays a vital role in the European furniture industry. The growth of the real estate sector and increasing residential and commercial construction are some of the factors expected to drive market growth. The major drivers for the development of this market are increasing construction activities and rising infrastructure due to the increasing urbanization and growing population. The increase in single-person and two-person households has contributed to increased home construction. There exists a specifically high demand for portable and compact furniture. Housing and commercial development growth is expected to positively affect furniture demand, driven by the need to furnish new constructions.Export of Furniture from UK Driving the Market

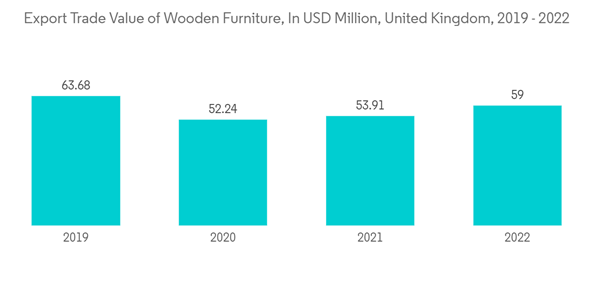

Export of furniture from United Kingdom is driving the market. In previous year, the UK exported wooden furniture more than 50 million U.S. dollars worth for office use. The rising purchasing power of households along with the change in lifestyle, as well as the increasing trend of purchasing the living and dining room furniture through an online channel, are expected to drive the export growth of the market. The increasing demand for export of furniture is also one of the key drivers of the market.UK Furniture Industry Overview

The report covers major international players operating in the United Kingdom Furniture Market. In terms of market share, some of the major players currently dominate the market. However, with technological advancement and product innovation, mid-size to smaller companies are increasing their market presence by securing new contracts and by tapping new markets. The key Players include Morgan Furniture, Dare Studio, The Senator Group, Modus furniture, and Benchmark.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Morgan Furniture

- Dare Studio

- The Senator Group

- Modus furniture

- Benchmark

- Williams Ridout

- On & On Designs

- Case Furniture

- The Bisley Group

- Hugh Miller Furniture

- Staverton