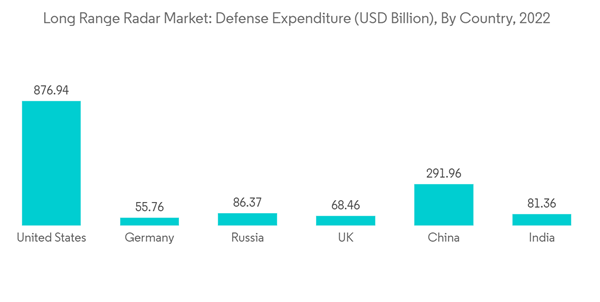

Due to the changing battlefield scenarios and the increasing number of aerial threats with greater lethality, agility, and speed, countries find it necessary to develop and induct long-range radars into their militaries to enhance their detection capabilities and possess higher response times to intercept incoming threats.

Key Highlights

- The growth in airspace violations, maritime and sea incursions, usage of autonomous assets with stealth technologies, development of hypersonic weapons, etc., is leading to increased defense expenditure on long-range radar technology development and procurement for intelligence, surveillance, reconnaissance, airborne early warning operations. This factor is also propelling the growth of the market studied globally.

- The development of large ground-based radars takes years to complete and requires sustained budgetary allocations. Any changes in priorities due to budgetary constraints can also halt the progress of ongoing high-value radar-related projects, restraining the growth of the market studied during the forecast period.

Long Range Radar Market Trends

Naval Radars to Exhibit the Highest Growth Rate

Major military spenders such as the US- and Europe-based NATO nations are significantly investing in the development of new naval vessels. Development projects such as the European Corvette program, FFG(X) frigate development, etc., are expected to drive the growth of the market for sea-based long-range radars. The US Navy plans to induct 46 new vessels to its naval fleet by 2023 and 20 FFG(X) next-generation frigates by 2030. This aforementioned factor is expected to propel the growth of the long-range radar market as there are plans to equip these vessels with advanced C4ISR and battle management systems.The US armed forces have emphasized both next-generation platforms and current-generation platforms. For instance, in September 2023, the US Navy awarded a USD 46 million cost-plus-fixed-fee contract to Lockheed Martin Corporation Rotary and Mission Systems for the digitally expanded, ultra-high frequency, multiple input, multiple output, optimized radar.

Similarly, in June 2023, the British Ministry of Defense (MOD) awarded BAE Systems PLC a 10-year contract worth GBP 270 million (USD 339 million) to support the Royal Navy’s three main radar systems: Artisan, Sampson, and Long-Range Radar (LRR). The support contract replaces several existing contracts, delivering increased value for money and allowing greater investment in future technology development. As per the contract, BAE Systems will provide maintenance support and upgrade existing radars, including a rollout of technology upgrades to systems already in use,e as well as those being installed on the Royal Navy’s new Type 26 frigates. The MOD and BAE Systems are jointly investing a further GBP 50 million (USD 62 million) to develop the next generation of radar technology that the Royal Navy requires to tackle emerging threats, including ballistic missiles and drones. The aforementioned developments are expected to significantly drive the demand for naval long-range radars during the forecast period.

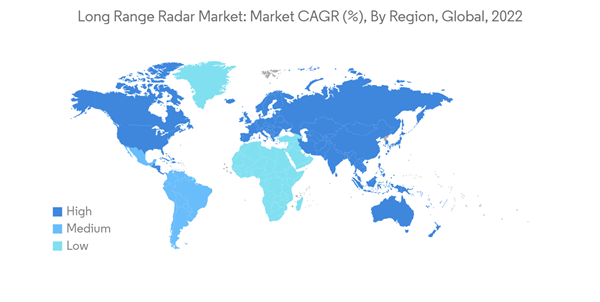

Asia-Pacific to Exhibit the Highest Growth Rate

Asia-Pacific region is home to major military powers, such as India, China, Australia, South Korea, Japan, etc., that account for a significant share of global military spending. The rise in border conflicts, air space violations by several nations, tensions in the South China Sea and Pacific Ocean, the development of hypersonic ballistic missiles, etc., are propelling the demand for advanced long-range surveillance and tracking systems in the region. China is investing heavily in modernizing and upgrading its navy and air force. China is significantly driving its radar technology capabilities by investing in the research and development of pulsed meter wave long-range networked radars that assist in targeting stealth aircraft such as the F-35. China has also supplied its JY-27 phased array three-dimensional long-range radar to Pakistan's Type 054A frigates manufactured by China. Asia-Pacific countries such as South Korea, Japan, and Australia have included fifth-generation F-35 aircraft in their defense fleet, and Japan is already planning to manufacture the aircraft domestically. This factor is expected to drive the demand for airborne long-range radar systems installed onboard the F-35s in the region. Such developments and procurements are propelling the growth of the long-range radar market in the region.Long Range Radar Industry Overview

The long-range radar market is semi-consolidated, with players such as HENSOLDT AG, BAE Systems PLC, Leonardo SpA, Lockheed Martin Corporation, and THALES dominating the market. Market players are expected to enjoy good growth in terms of revenue owing to the growth in demand for intelligence, surveillance, and reconnaissance systems across the world. Governments and defense agencies are investing heavily in the modernization and expansion of their existing defense capabilities by building stealth aircraft, highly advanced naval vessels, and land-based reconnaissance systems, providing orders and contracts to the domestic and global market players for long-range radars.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.