The State of Israel in the 1970s or 1980s knows that there is only one type of flooring in buildings. These were the "embossments" that were used everywhere, in residential buildings, schools, office buildings, train stations and to a large extent also in courtyards. Beginning with the great construction boom in Israel in the early 1990s, those tiles quickly disappeared from the construction industry in Israel. Which replaced them were porcelain tiles later called ceramic tiles and today mostly referred to as the puzzling "porcelain granite". There were several reasons for this replacement and the first and decisive reason was the Israeli standard. The Israeli standard for embossing requires the tiles to withstand a strength test of 350 kg. A tile that is twenty inches long will withstand this load easily, but a tile that is sixty inches long will already need to be thicker, so it will be heavier and less comfortable for flooring. So ceramic tiles became popular in Israel.

The raw materials for manufacturing of ceramic tiles in Israel are imported from Turkey and Ukaraine, which incurs additional costs to the manufacrurers in the country. The Ceramic tile market in Israel consists of many importers who sell and market similar products and substitutes for the manufacturer's products.

Key Market Trends

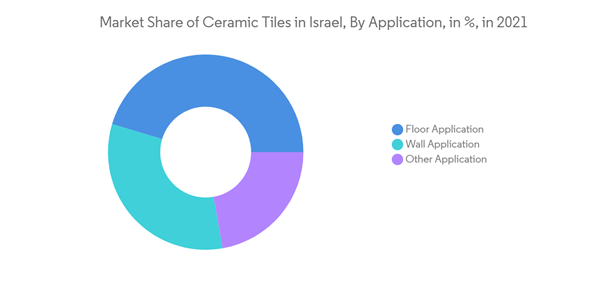

Wall Application Segment is Gaining More Significance in the Recent Times

In order to capture the dynamic customer preferences, interior designers no more confining ceramic tiles to flooring applications to the kitchen and bathroom areas in the residential use and are also preferring them in non-conventional areas like living rooms, bedrooms. Along with the floor tiles, the latest rage is wall tiles that are chosen by customers for beautifying their walls and facade cladding, replacing paints which were the only option available earlier. Tiles that are resistant to stains and dirt, which can be cleaned with a damp mop, sponge, or common household cleaners. Hence, these are preferred in the living areas, on walls, floors, or facades. Also, manufacturers are focusing on making a variety of products that will catch customer interest. Wall tiles with extra sheen and have glossy surfaces, which illuminate a dull room and enhance the style quotient of the living area are gaining more significance in recent times.

Increased Government's focus to Expand Residential Construction Sector is Forecasted to Drive the Market

The Ministry of Construction and Housing and the Israel Land Authority (ILA) said that some 30,000 affordable housing units will be listed for sale in 2022, starting with 10,000 units set to go on the market. In fact, for nearly a decade the average number of buildings constructed annually was 325 000 which according to estimates has contributed to an accumulated deficit of over 100,000 units. In order to overcome this, the Israeli government announced the "Design and Build" program which facilitates the Large Scale Development of Residential Areas. This program focuses on shortening the construction period and reducing costs by implementing advanced construction methods in large residential projects. This also allows foreign construction companies to construct large scale residential projects which helps to expand building activity and increase productivity in the residential construction sector.

Competitive Landscape

The report covers major players operating in Israel ceramic tiles market along with their product portfolio, key financials, and developments. The ceramic tiles market is transforming with many technological advancements through product innovation and process automation. Owing to the technological advancements and creativity in designs, key players are offering plenty of choices that are readily available to the customer in tiles for interiors and exteriors of homes, hotel lobbies, retail outlets, office receptions, and so on.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Caesarstone Ltd

- Negev Ceramics Ltd

- Marazzi

- Balian Armenian ceramics tiles of Jerusalem

- Zuk Marble Products Ltd

- Milstone Marble Works Ltd

- Harash

- Ceramic Depot

- Fea Ceramics

- Pekiin Tiles*