Over the course of the crisis, the COVID-19 pandemic had a significant impact on the growth of the esoteric testing market, initially due to disruptions in supply chain activities and R&D related to several drug research projects. However, the increasing adoption of esoteric test techniques in research activities and clinical trials has provided a wide range of growth opportunities for market players. The demand for esoteric tests like flow cytometry observed a slight decline in the preliminary phase of the outbreak and later increased for testing effective treatments and therapies as the COVID-19 pandemic worsened in patients. Moreover, the impact is expected to follow the same trend in the coming future for the evaluation of the COVID-19 vaccination. For instance, as per the report published by IJID in February 2022, to measure neutralizing antibody (NAb) levels, a unique and sensitive automated chemiluminescent immunoassay (CLIA) was created. This test can be used to diagnose SARS-CoV-2, determine treatment, and see if a vaccine is effective in a patient. Thus, as per the analysis, the market is expected to have a positive impact due to the growing use of COVID-19 vaccination against emerging strains of the virus among the population.

Furthermore, the key contributors to the market's growth are rising cases of chronic diseases, infectious diseases, and rare diseases, coupled with the growing burden of the geriatric population. The rapid expansion of the market is being aided by the rise in the frequency of chronic diseases and the creation of specialized testing kits for dedicated therapeutic fields. According to the WHO report from October 2021, by 2030, one out of every six people worldwide will be 60 years of age or older. The number of people aged 60 and above is expected to rise from 1 billion in 2020 to 1.4 billion by 2050. As the geriatric population becomes more susceptible to genetic and chronic diseases, there will be a significant increase in demand for esoteric tests over the forecast period.

Similarly, rare diseases can be easily detected with esoteric tests. Hence, the rise in rare disease cases among the population is expected to augment the market’s growth. For instance, as per the CDC, in September 2022, a total of 420 new cases of West Nile virus disease in people were reported to the CDC, of which 65% were neuroinvasive diseases and 35% were non-neuroinvasive diseases. These rare diseases can be easily detected using esoteric tests for infectious diseases, boosting the market growth for esoteric testing.

However, the stringent regulatory framework is a major factor hindering the esoteric testing market's growth.

Esoteric Testing Market Trends

Oncology Segment is Expected to Exhibit a Significant Market Growth Over the Forecast Period

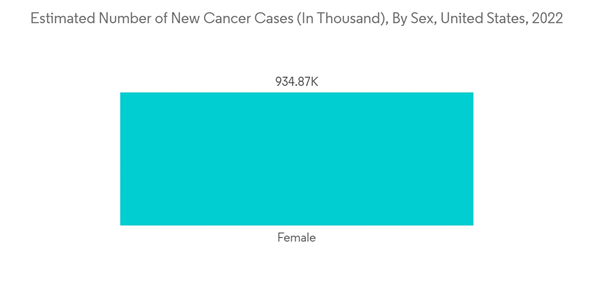

Esoteric testing is an effective method for the detection of multiple tumor markers with high throughput, ease of operation, and low cost. Under esoteric tests, a few of the in-vitro techniques can be used for measuring antibody levels that are specific to cancers.The oncology segment is expected to show healthy growth in the esoteric testing market during the forecast period owing to the rising importance of early diagnosis and treatment for cancer. The fecal occult blood test (FOBT) is one of the esoteric tests used to check stool samples for hidden (occult) blood. Occult blood in the stool may indicate colon cancer or polyps in the colon or rectum.

Moreover, the rise in cancer cases has increased demand for the diagnosis of diseases through esoteric testing. For instance, according to the FICCI-EY Paper, in 2022, around 19 to 20 lakh new cancer cases are estimated to be reported in India. It is tentatively predicted that the actual incidence of cancer is 1.5 to 3 times greater than what is recorded by cancer registries. Hence, it is expected to have a significant rise in esoteric tests such as fecal occult blood tests that can diagnose colon cancer, which help to drive the segment's growth over the forecast period.

Furthermore, the increasing investments in R&D activities are expected to drive the demand for testing. According to the EFPIA, in 2022, the overall R&D expenditure in the pharmaceutical industry for the European region in 2020 was recorded at approximately EUR 39,656 million (USD 411,31.20 million) and in 2021 at EUR 41,500 million (USD 43,043.80 million). This demonstrates an increase in R&D expenditure on research, which is likely to boost the development of newer esoteric tests.

Hence, the aforementioned factors are expected to boost the market growth for the cancer segment over the forecast period.

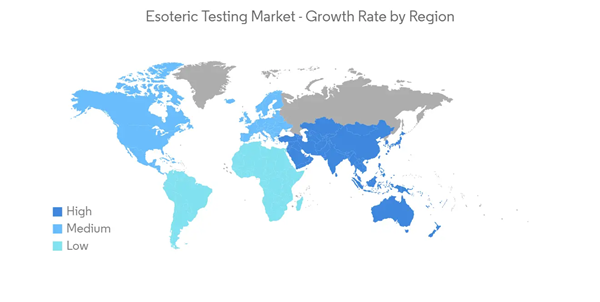

North America is Expected to Hold a Significant Share in the Market and Expected to do Same in the Forecast Period

North America is expected to be a dominant region in the esoteric testing market owing to the increasing number of R&D activities, and investments, the surge in the burden of chronic diseases, and the growing number of rare disease cases. As per the data from the NORD, around 25-30 million people were suffering from some type of rare disease in 2021. Also, almost one out of every ten individuals in America has a rare disease, and more than half of these are children. Furthermore, according to the NIH RCDC, the estimated funding for rare disease research in the United States is USD 6,191 million in 2021 and will increase to USD 6,482 million by the end of the year 2022. Thus, with the growing burden of rare diseases and increasing investment into research and development activities for rare diseases, the demand for esoteric testing is expected to increase, in turn propelling market growth in this region.The introduction of new testing services and collaborations between major players in the region also act as drivers for the growth of the market. For instance, in January 2021, BioReference Laboratories, Inc., an OPKO Health company, introduced Scarlet Health, an in-home, fully integrated digital platform providing access to on-demand diagnostic services. Scarlet has been designed similarly to the tools consumers use daily to provide ease of use and ubiquitous convenience. Similarly, in February 2021, GRAIL, Inc. agreed with Quest Diagnostics to provide phlebotomy services to support Galleri, GRAIL’s multi-cancer early detection blood test.

Likewise, in 2020, the US FDA granted a EUA to LabCorp, allowing it to test self-collected nasal swab samples from patients for coronavirus disease with its COVID-19 RT-PCR Test. While the EUA permits at-home sample collection, the testing was conducted at LabCorp’s Center for Esoteric Testing, and other Clinical Laboratory Improvement Amendments (CLIA)-certified high-complexity laboratories designed by the company. All these factors are expected to augment the esoteric testing market's growth in the country.

Thus, due to the above-mentioned factors, the market is expected to witness significant growth in North America over the forecast period.

Esoteric Testing Market Competitor Analysis

The esoteric testing market is moderately fragmented in nature, with major key players including Kindstar Globalgene Technology, Inc., Quest Diagnostics, Laboratory Corporation of America Holdings, bioMontr Labs, Arup Laboratories, H.U. Group Holdings, Inc., Fulgent Genetics, Nordic Laboratories, and Grifols, S.A.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Kindstar Globalgene Technology, Inc.

- Arup Laboratories

- bioMontr Labs

- Fulgent Genetics

- Grifols, S.A.

- Laboratory Corporation of America Holdings

- H.U. Group Holdings, Inc.

- Nordic Laboratories

- Quest Diagnostics