The global lager market growth is driven by adding consumer preference for light, refreshing beers, rising disposable inflows, and strong brand marketing. Lager, known for its crisp taste and lower alcohol content compared to other beer types, appeals to a wide range of consumers, from casual drinkers to beer enthusiasts. The growing fashionability of social drinking culture, especially among youthful grown-ups, has further boosted lager consumption worldwide. In addition, the expansion of craft and premium lagers has contributed to demand growth, as consumers seek high- quality, scrumptious alternatives to mass- produced beers. Breweries are instituting with new flavors, packaging designs, and sustainable brewing practices to attract environmentally conscious consumers. The rise of e-commerce and direct- to- consumer sales has also made lager more accessible, allowing brands to reach wider audiences. Also, the adding demand for low- calorie and alcohol-free lagers aligns with health-conscious consumer trends, further driving market expansion.

The United States has emerged as a key regional market for lager. Lager remains the most popular beer style in the U.S. due to its crisp, smooth taste and lower bitterness compared to ales. Consumers, particularly youngish demographics, favor easy- to- drink beers that complement social occasions and casual consumption. Light lagers, which offer lower calories and alcohol content, are especially in demand. The craft beer movement has expanded beyond IPAs, with numerous breweries now producing high- quality lagers. These craft lagers appeal to beer enthusiasts seeking traditional brewing styles with enhanced flavor and authenticity. Leading beer brands are investing in creative marketing campaigns, limited- edition releases, and packaging inventions to attract consumers. Also, the rise of seasoned lagers and premium imports is farther fueling market expansion.

Lager Market Trends:

The significant expansion in the e-commerce and online retail channels

The lager market revenue is rising with the significant expansion of e-commerce and online retail channels. According to industry statistics, global B2C ecommerce sales is predicted to reach USD 5.5 trillion by 2027, with a consistent 14.4% compound annual growth rate. In addition, growing digitization, increasing internet connectivity, and rising disposable income, allow consumers to access and purchase products, thus contributing to the market growth. Along with this, online platforms are emerging as convenient hubs for consumers to explore an extensive larger brand from numerous regions and breweries, transcending geographical limitations, which is augmenting the market growth. Moreover, the easy accessibility provided by e-commerce facilitates the discovery of unique and rare products that are not readily available in local markets, thus offering a favorable lager market outlook. Besides this, the convenience of doorstep delivery eliminates the need for physical visits to liquor stores, making the buying process more streamlined and efficient, thus accelerating the product adoption rate. Furthermore, the easy accessibility to online reviews, ratings, and descriptions empowers consumers to make informed decisions, enhancing their confidence in selecting product that align with their preferences, thus providing a positive thrust to the market growth.The increasing social media influence

The growing social media platforms influence are influencing consumer behaviors and decisions in the market. According to statistics, there were 5.22 Billion social media users worldwide by the beginning of October 2024, accounting for 63.8% of the entire global population. In addition, social media is transforming how breweries interact with their audience, allowing them to engage with consumers directly, share product updates, and build brand loyalty, thus contributing to the market growth. Moreover, the growing influence of several platforms such as Instagram, Twitter, and Facebook are becoming hubs for beer enthusiasts to share their experiences, reviews, and recommendations representing another major growth-inducing factor. Along with this, several breweries use these platforms to showcase their products, share behind-the-scenes content, and even host virtual tasting events, accelerating the product adoption rate. Besides this, user-generated content amplifies brand visibility and authenticity, as consumers trust recommendations from their peers, which is propelling market growth. Furthermore, influencers and beer bloggers are significantly introducing new products to several audiences, creating a ripple effect of interest and curiosity, thus creating a positive market outlook.The growing popularity of beer tourism and brewery experiences

The growing popularity of beer tourism and brewery experiences among consumers seeking immersive experiences are contributing to the market growth. According to UN Tourism, around 1.4 billion foreign travelers were recorded, representing an 11% increase over 2023. In addition, the accessibility to numerous breweries offers a direct connection to the several kinds of products, thus augmenting the market growth. Moreover, beer tourism offers enthusiasts the opportunity to witness the brewing process firsthand, interact with brewers, and gain insights into the craft representing another major growth-inducing factor. Along with this, brewery tours, tastings, and events create memorable experiences that deepen consumer engagement and appreciation for products, thus propelling the market growth. Besides this, breweries often create exclusive releases or limited-edition lagers that are only available at the brewery which enhances the appeal of beer tourism, enticing consumers to travel and explore different breweries to access unique product offerings, thus providing a positive thrust to the market growth.Lager Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global lager market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, and distribution channel.Analysis by Product:

- Standard

- Premium

Analysis by Distribution Channel:

- On-Trade

- Supermarkets and Hypermarkets

- Specialist Retailers

- Convenience Stores

- Others

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Besides this, the mature and well-developed beer market is driven by the presence of established breweries, large and small that provide consumers with a plethora of options, thus accelerating the market growth. Furthermore, the robust trade networks of Europe facilitate the distribution of lagers across borders, ensuring their availability even in remote regions, thus propelling the market growth.

Key Regional Takeaways:

United States Lager Market Analysis

In the United States, the increasing adoption of lager can be largely attributed to the rising influence of social media platforms. For example, US influencer marketing spending is expected to reach USD 7.14 billion by 2024, indicating a 15.9% year-over-year increase. Social media has transformed how consumers engage with beverages, with influencers, brands, and communities promoting various lager styles and trends. As online content spreads, it creates widespread awareness about the diverse offerings available in the market. This has shifted consumer preferences, especially among younger generations, who now prioritize unique and craft lager varieties. The power of social media in driving consumer decision-making cannot be overstated, as it plays a significant role in shaping the perception of beer brands. By engaging with beer culture and sharing experiences, social media platforms have allowed for more dynamic interactions between breweries and consumers, fostering brand loyalty. This digital presence enables lager brands to attract new customers, which in turn drives overall sales, as individuals are more likely to try what’s being discussed or shared on their feeds.Asia Pacific Lager Market Analysis

In the Asia-Pacific region, lager adoption is increasingly driven by the rapid growth of supermarkets and hypermarkets, which play an essential role in providing convenient access to a wide variety of products. According to statistics, India has 66,225 supermarkets as of January 23, 2025, a 3.88% rise from 2023. These retail channels have become a one-stop destination for consumers, offering an extensive selection of food and beverages, including lager. With the expansion of supermarkets and hypermarkets into urban and suburban areas, lager brands benefit from higher visibility and accessibility. Consumers are drawn to the ease of purchasing their favorite drinks in these stores, where they can browse through a range of local and international lager varieties. The growing presence of retail giants has contributed to the rise in lager consumption, as these channels often feature promotional offers, discounts, and seasonal deals that attract shoppers. Furthermore, the increasing convenience of purchasing lager through these outlets has led to more frequent buying behavior, making lager a staple beverage in many households.Europe Lager Market Analysis

In Europe, the growing adoption of lager can be attributed to the expansion of e-commerce and online channels. According to industry sources, Europe is the world's third largest retail ecommerce market, with a total sales of USD 631.9 billion. By 2027, European retail online sales will be worth USD 902.3 billion, based on a 9.31% annual revenue growth rate. The convenience of purchasing lager online has proven to be a key motivator for many consumers, especially those seeking to explore a broader selection of beers. Online platforms enable lager brands to reach a larger audience, offering a variety of lager types, flavors, and pack sizes that may not be readily available in local stores. As online shopping becomes increasingly popular in the region, more consumers are turning to e-commerce for their beer purchases. This shift is further amplified by the ease with which consumers can compare prices, read reviews, and access exclusive deals from various online retailers. Moreover, the increasing number of delivery services has enhanced the overall convenience of purchasing lager, further boosting its consumption. The seamless integration of online shopping with lager buying habits has positioned e-commerce as a major contributor to the rise in lager consumption across Europe.Latin America Lager Market Analysis

In Latin America, the rising disposable income among consumers has played a pivotal role in increasing lager adoption. According to studies, Latin America's total disposable income is anticipated to increase by approximately 60% between 2021 and 2040. As economic conditions improve in the region, more individuals have the financial means to indulge in premium lager brands or explore new options that were previously outside their budget. With an increase in disposable income, there is greater willingness to spend on higher-quality beverages, leading to a surge in lager market demand. The growing middle class in various Latin American markets is fuelling this trend, as people now have more freedom to enjoy leisure activities such as dining out, socializing, and attending events where lager is often consumed. This has translated into higher sales for lager brands, as consumers are more likely to choose premium products that align with their changing lifestyles and preferences.Middle East and Africa Lager Market Analysis

In the Middle East and Africa, the rise in tourism is contributing to the growing popularity of lager. As international visitors flock to tourist destinations, they bring with them a demand for familiar beverages, including lager. For instance, Dubai welcomed 14.96 Million overnight visitors from January to October 2024, marking an 8% increase compared to the same period in 2023, highlighting a strong growth in tourism. Local bars, restaurants, and hotels are increasingly catering to the preferences of tourists by offering an extensive selection of lager brands. This demand for lager has not only boosted the local beverage market but also encouraged the establishment of new outlets and venues designed to meet the expectations of travellers. Additionally, as tourism continues to expand, there is a greater emphasis on promoting local brewing traditions and introducing unique regional lager styles to attract international consumers. The surge in tourism has thus played an important role in making lager more accessible and popular in this region, resulting in increased consumption across various hospitality settings.Competitive Landscape:

Major beer brands such as Budweiser, Coors, and Miller are introducing new lager variants, including low-calorie, non-alcoholic, and flavored lagers, to appeal to health-conscious and younger consumers. Craft breweries are also developing premium lagers with unique ingredients and brewing techniques to differentiate themselves.Key players are leveraging digital marketing, influencer partnerships, and sports sponsorships to boost brand visibility. Social media engagement and limited-edition releases help maintain customer loyalty and attract new consumers. Breweries are adopting sustainable practices such as eco-friendly packaging, water conservation, and carbon footprint reduction to align with consumer demand for environmentally responsible products. These efforts enhance brand reputation and attract eco-conscious customers, reinforcing market dominance. These efforts are creating a favorable lager market outlook.The report provides a comprehensive analysis of the competitive landscape in the lager market with detailed profiles of all major companies, including:

- Anheuser-Busch Companies LLC

- Asahi Breweries Ltd.

- Carlsberg Breweries A/S

- China Resources Beer (Holdings) Company Limited

- Diageo Plc

- Heineken N.V.

- Kirin Brewery Company Limited

- Molson Coors Beverage Company

- Tsingtao Brewery Company Limited

- United Breweries Holdings Limited.

Key Questions Answered in This Report

1. How big is the lager market?2. What is the future outlook of lager market?

3. What are the key factors driving the lager market?

4. Which region accounts for the largest lager market share?

5. Which are the leading companies in the global lager market?

Table of Contents

Companies Mentioned

- Anheuser-Busch Companies LLC

- Asahi Breweries Ltd.

- Carlsberg Breweries A/S

- China Resources Beer (Holdings) Company Limited

- Diageo Plc

- Heineken N.V.

- Kirin Brewery Company Limited

- Molson Coors Beverage Company

- Tsingtao Brewery Company Limited

- United Breweries Holdings Limited.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 120 |

| Published | August 2025 |

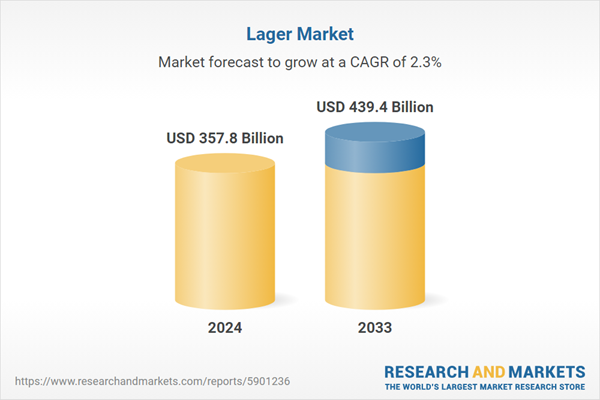

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 357.8 Billion |

| Forecasted Market Value ( USD | $ 439.4 Billion |

| Compound Annual Growth Rate | 2.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |