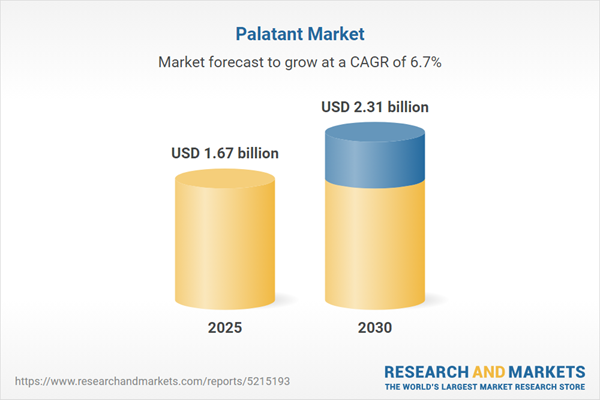

The palatant market is experiencing significant growth, driven by the rising number of pet owners, increasing demand for premium and nutritious pet food, and heightened awareness of animal health and nutrition. Palatants, which enhance the taste, smell, and texture of pet and animal feed, are becoming essential in meeting consumer expectations for high-quality, palatable products.

Market Drivers

Pet Humanization

The trend of pet humanization, where pets are treated as family members, is a primary driver of the palatant market. Pet owners are increasingly focused on providing nutritious, high-quality food that appeals to their pets’ senses. Palatants enhance the palatability of pet food by improving taste, aroma, and texture, encouraging consumption and ensuring nutritional intake. This shift in consumer behavior, particularly in urban areas, is driving demand for premium and custom-made pet food products, positioning palatants as critical components in the pet food industry.Growing Pet Population

The global pet population is expanding, particularly in urban centers, fueling demand for palatants. As pet ownership rises, so does the need for palatable, high-quality feed that supports animal health. The focus on pet nutrition and the increasing popularity of premium pet food brands are driving market growth, as palatants ensure that pets find their food appealing, thereby improving feed efficiency and overall health outcomes.Expansion of the Cattle Segment

The cattle segment is anticipated to hold a significant market share by 2028, driven by growing demand for high-quality, nutritious animal feed. Increasing awareness among livestock owners about animal health and nutrition has led to the adoption of palatants to enhance feed palatability and efficiency. The focus on animal welfare and safety, coupled with rising incomes and population growth, further supports the demand for natural and additive-free palatants in this segment, contributing to market expansion.Growth in the Poultry Sector

The global poultry sector is expanding, driven by increasing demand for protein-rich foods and growing awareness of poultry’s nutritional benefits. According to the USDA’s World Agricultural Supply and Demand Estimates, global poultry exports are projected to increase by approximately 25% from 2021 to 2031, reaching about 16 million metric tons by 2031. This growth in poultry production and international trade is boosting the need for palatants to improve feed palatability, ensuring optimal feed intake and supporting the sector’s expansion.Geographical Outlook

North America’s Market Leadership

North America, particularly the United States, is expected to experience significant growth in the palatant market. The rise in pet ownership, coupled with increasing demand for high-quality pet food and heightened awareness of palatability’s role in pet nutrition, drives market expansion. The poultry sector’s growth, supported by initiatives like the joint venture between the U.S. Poultry & Egg Association (USPOULTRY) and the USA Poultry & Egg Export Council (USAPEEC) through “The Coop Group, LLC,” further fuels demand for palatability-enhancing ingredients. This expansion underscores North America’s position as a key market for palatants, driven by consumer demand for premium and nutritious animal feed.Market Segmentation Analysis

Cattle and Poultry Segments

The cattle and poultry segments are poised for significant growth, driven by the need for nutritious and palatable feed. In the cattle sector, palatants address the demand for high-quality feed that supports animal health and productivity. In poultry, the global increase in exports and domestic consumption necessitates palatants to enhance feed appeal, ensuring efficient feed intake. The focus on natural and additive-free palatants aligns with consumer preferences for sustainable and safe animal feed solutions.Key Developments

In April 2023, Zoetis launched Zoetis Palatant, a natural palatant made from amino acids and nucleotides, designed to improve the palatability of animal feed and increase intake. This product reflects the industry’s shift toward natural ingredients to meet consumer demands for high-quality, health-focused feed solutions.The palatant market is on a strong growth trajectory, driven by pet humanization, the rising pet population, and the expanding cattle and poultry sectors. North America leads the market, supported by increased pet ownership and poultry industry growth, while the demand for natural and premium feed solutions fuels innovation. Developments like Zoetis’s natural palatant launch in 2023 highlight the industry’s focus on health and sustainability. As consumer awareness of animal nutrition grows, the palatant market is well-positioned for sustained expansion, catering to the needs of both pet owners and livestock producers during the forecast period.

Key Benefits of this Report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, and other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decisions to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use these reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive IntelligenceReport Coverage:

- Historical data from 2022 to 2024 & forecast data from 2025 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling (Strategies, Products, Financial Information, and Key Developments among others.

Market Segmentation:

By Nature

- Organic

- Conventional

By Form

- Dry

- Liquid

- Powdered

By Source

- Meat Based

- Vegetable Based

- Others

By Application

- Animal Feed

- Poultry

- Cattle

- Swine

- Others

- Pet Food

By Distribution Channel

- Online

- Offline

By Geography

- North America

- By Nature

- By Form

- By Source

- By Application

- By Distribution Channel

- By Country

- United States

- Canada

- Mexico

- South America

- By Nature

- By Form

- By Source

- By Application

- By Distribution Channel

- By Country

- Brazil

- Argentina

- Others

- Europe

- By Nature

- By Form

- By Source

- By Application

- By Distribution Channel

- By Country

- Germany

- France

- UK

- Spain

- Others

- Middle East and Africa

- By Nature

- By Form

- By Source

- By Application

- By Distribution Channel

- By Country

- Saudi Arabia

- South Africa

- Others

- Asia Pacific

- By Nature

- By Form

- By Source

- By Application

- By Distribution Channel

- By Country

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

Table of Contents

Companies Mentioned

- Kemin Industries Inc.

- AFB International

- Diana Pet Food (Syrise)

- Trilogy Essential Ingredients Inc.

- Ohly (ABF Ingredients)

- Innovad SA

- Essentia

- ADM

- Syndel

- Kerry Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 152 |

| Published | August 2025 |

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 1.67 billion |

| Forecasted Market Value ( USD | $ 2.31 billion |

| Compound Annual Growth Rate | 6.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |