Free Webex Call

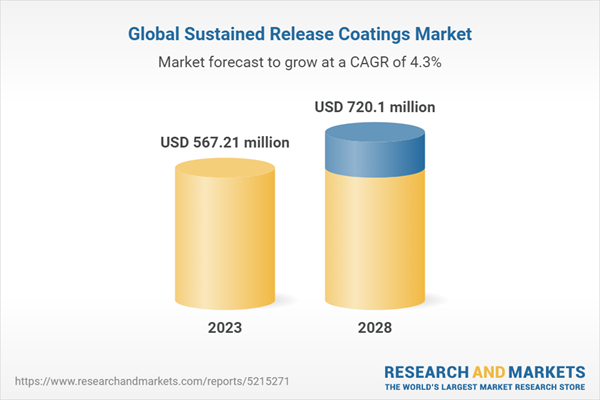

The Global Sustained Release Coatings Market was valued at USD567.21 million in 2022 and is anticipated to project robust growth in the forecast period with a CAGR of 4.29% through 2028. Sustained-release coatings are specially designed to release drugs in the body over a controlled period of time. These coatings often utilize polymer materials such as polyvinyl, cellulose acetate, methacrylic acid, ethyl and methyl cellulose, polyethylene glycol, and others. They play a crucial role in the production and development of various pharmaceutical forms, including tablets, capsules, pills, and more. Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The growing demand for controlled drug delivery is a key factor driving the market's growth. This is further fueled by advancements in technology and development of sustained-release coating techniques. Additionally, government support, a thriving economy, and the expiration of patents, along with the need for pediatric and geriatric dosage forms, are among the major driving forces in the sustained-release coating market. Moreover, the market is witnessing an increase in research and development activities, leading to the development of advanced technologies that tap into niche markets. These factors collectively create new opportunities for the sustained-release coating market in the forecast period.

However, it is important to note that the high cost associated with the microencapsulation process is a significant challenge. This, along with other factors, may act as restraints to the growth of the sustained-release coating market in the mentioned forecast period.

Key Market Drivers

Growing Demand of Sustained Release Coatings in Food & Beverage Industry

Sustained release coatings are meticulously applied to a wide range of products, including pharmaceuticals and food ingredients, with the primary objective of meticulously controlling their release over an extended period of time. These coatings can be customized to release the encapsulated substance at a highly specific rate, thereby extending the product's effect and optimizing its overall performance.In the dynamic and ever-evolving food and beverage industry, sustained release coatings serve as invaluable tools for enhancing not only the taste and texture but also the shelf life of various products. By enabling the controlled release of flavors, sweeteners, and other active ingredients, these coatings elevate the consumer experience to new heights.

Moreover, sustained release coatings play a pivotal role in the realm of functional foods and beverages, which are specifically designed to offer health benefits beyond basic nutrition. By meticulously controlling the release of beneficial compounds such as probiotics, vitamins, and mineral supplements, sustained release coatings effectively optimize their absorption and overall efficacy.

The surging demand for sustained release coatings in the food and beverage industry is fueling the global market in multiple ways. Firstly, as consumers increasingly prioritize healthier choices and seek out products that offer additional health benefits, the demand for effective delivery systems such as sustained release coatings continues to rise.

Secondly, the relentless pursuit of innovation in food and beverage formulations is opening up new avenues for sustained release coatings. As manufacturers develop increasingly complex and sophisticated products, the need for advanced coating solutions becomes even more apparent and essential.

Lastly, the growing emphasis on product quality and shelf life in the food and beverage industry is driving the demand for sustained release coatings. By significantly enhancing product stability and longevity, these coatings emerge as highly appealing options for manufacturers striving to meet and exceed consumer expectations.

In conclusion, the escalating demand for sustained release coatings in the food and beverage industry plays a pivotal role in driving the global market forward. As this industry continues to evolve and innovate, the significance of sustained release coatings is destined to grow even further, cementing their position as indispensable assets for product optimization and success.

Growing Demand of Sustained Release Coatings in Pharmaceutical Industry

In the pharmaceutical industry, sustained release coatings play a crucial role in drug delivery systems. These coatings enable the controlled release of medication, ensuring a consistent dosage over time and enhancing patient compliance. By incorporating modified-release technologies, they offer targeted action to specific sites, further enhancing their value.The demand for sustained release coatings in the pharmaceutical industry is growing for several reasons. Firstly, as the industry continues to advance and develop more complex drug formulations, there is a need for advanced coating technologies. Sustained release coatings provide a solution to these challenges, enabling the creation of more effective and patient-friendly medications.

Secondly, the global rise in chronic diseases necessitates long-term medication regimes. Sustained release coatings allow for less frequent dosing, making it easier for patients to adhere to their medication schedules. This improves patient outcomes and overall treatment effectiveness.

Moreover, the push towards personalized medicine is also contributing to the increased demand for sustained release coatings. These coatings can be tailored to meet individual patient needs, allowing for customized medication release profiles. This personalized approach is a key aspect of modern treatment strategies and can greatly improve patient experiences and outcomes.

In conclusion, the growing demand for sustained release coatings in the pharmaceutical industry is a significant driver of the global market. As the industry continues to innovate and evolve, the role of these coatings in drug delivery systems will become increasingly important. Their ability to ensure controlled and targeted release, improve patient compliance, and support personalized medicine makes them an essential component of the pharmaceutical landscape.

Key Market Challenges

Rise in Quality Control and Testing

Quality control and testing play a pivotal role in ensuring that products meet the specified standards and requirements in the sustained release coatings industry. These critical processes involve a comprehensive evaluation of the coating's capability to effectively control the release of an active ingredient over an extended period of time, thus enhancing the performance and safety of the end product.In the context of the pharmaceutical applications of sustained release coatings, the significance of quality control and testing becomes even more evident. These coatings must accurately control the release rates of drugs to ensure optimal therapeutic effectiveness and patient safety. The meticulous evaluation and verification of these coatings guarantee that they meet the stringent regulatory standards and requirements set forth by governing bodies.

However, the increasing demand for rigorous quality control and testing poses several challenges for the sustained release coatings market. Firstly, it necessitates substantial investments in advanced testing equipment and the recruitment of highly skilled personnel. Small players in the market may find this financial burden overwhelming, making it difficult for them to compete with larger industry players.

Secondly, the comprehensive nature of quality control and testing requires significant time and resources. This can potentially delay product development and market launch, affecting a company's competitive position and profitability. Striking a balance between thorough testing and timely product release becomes crucial in such a competitive market.

Lastly, the ever-evolving regulatory landscape further adds complexity to the sustained release coatings market. Companies must continually monitor and adapt to the changing regulatory standards and requirements to ensure their products remain compliant and avoid any potential legal or regulatory issues.

In summary, quality control and testing are fundamental processes in the sustained release coatings industry, ensuring that products meet the necessary standards and requirements. However, the increasing demand for rigorous testing poses challenges in terms of financial investment, time constraints, and staying up-to-date with evolving regulations. Overcoming these challenges is essential for companies to maintain competitiveness and ensure the success of their products in the market.

Key Market Trends

Growing Demand of Biodegradable and Eco-Friendly Coatings

Biodegradable and eco-friendly coatings are specifically formulated to minimize their environmental impact. These coatings are designed to naturally break down over time, reducing waste and pollution. By being made from renewable resources and avoiding the use of harmful chemicals, they offer significant environmental benefits.In the sustained release coatings market, biodegradable and eco-friendly options are emerging as a promising alternative to traditional coatings. These coatings not only provide the same level of controlled release of active ingredients but also offer a significantly lower environmental footprint.

These environmentally friendly coatings are increasingly being adopted across various sectors, including pharmaceuticals, food and beverage, agriculture, and personal care. They provide a valuable means to enhance product performance while also meeting the growing consumer and regulatory demands for sustainability.

The growing demand for biodegradable and eco-friendly coatings is shaping the global sustained release coatings market in several significant ways.

Firstly, there is a noticeable increase in consumer awareness and concern about environmental issues. As a result, more and more consumers are actively seeking out products that not only deliver effectiveness but also demonstrate eco-friendliness. This surge in demand is driving the adoption of biodegradable and eco-friendly coatings across multiple sectors.

Secondly, regulatory pressures are mounting worldwide. Governments and regulatory bodies are implementing stricter environmental standards and actively encouraging the use of eco-friendly materials. This regulatory push is compelling companies in the sustained release coatings market to innovate and adopt more sustainable practices.

Lastly, technological advancements are playing a pivotal role in making the production of biodegradable and eco-friendly coatings easier and more cost-effective. As these technologies continue to evolve, the accessibility and attractiveness of these coatings are expected to increase further.

In conclusion, the growing demand for biodegradable and eco-friendly coatings represents a significant trend in the global sustained release coatings market. As consumer awareness, regulatory standards, and technological advancements continue to align, the role of these coatings in shaping the market's future is set to become increasingly important.

Segmental Insights

Material Type Insights

Based on the category of material type, the polyvinyl alcohol segment emerged as the dominant player in the global market for Sustained Release Coatings in 2022.In the pharmaceutical industry, polyvinyl alcohol (PVOH) has emerged as a popular choice for sustained release coatings in drug delivery systems. These coatings play a crucial role in controlling the release of medication, ensuring a consistent dosage over time.PVOH's dominance in this market can be attributed to its unique properties and advantages. Tablets coated with polyvinyl alcohol have been extensively studied and found to exhibit the lowest moisture uptake rates among other coating materials. This feature is of utmost importance as it helps maintain the stability and efficacy of the medication, preventing any potential degradation or loss of potency.

Furthermore, the global demand for PVOH has been steadily increasing, with mainland China being a significant contributor, accounting for 39% of the total demand in 2021. This substantial demand reflects the widespread adoption of PVOH in various pharmaceutical applications, highlighting its versatility and effectiveness.

With its proven performance and wide-ranging applications, polyvinyl alcohol continues to be a preferred choice for sustained release coatings in the pharmaceutical industry. Its unique properties and growing global demand position PVOH as a key player in enhancing drug delivery systems and ensuring optimal patient outcomes.

Application Insights

The in vitro segment is projected to experience rapid growth during the forecast period. The growth of in vitro application is driven by various factors, including the increasing production of drugs and advanced pharmaceuticals worldwide. A report from the International Federation of Pharmaceutical Manufacturers & Association (IFPMA) revealed that in 2020 alone, an astounding number of drugs were developed, with approximately 2500 for cancer, 1400 for neurology, 1200 for infectious disease, and 1500 for immunology. To achieve controlled and managed drug release, a blend of hydrophilic and hydrophobic polymers is often employed as a coating material in in vitro applications.The demand for in vitro coatings is further influenced by the rise in pharmaceutical drugs consumption, particularly among the pediatric and geriatric populations. The need for a promising delivery system that offers high sustained release action and drug bioavailability has fueled the growth of in vitro applications. As the pharmaceutical industry continues to witness major developments and advancements in drugs production, along with the introduction of tailored drug dosing mechanisms and enhanced efficiency in in vitro applications, the demand for sustained release coatings is expected to surge in the forecast period.

With these factors at play, the in vitro industry is poised for significant growth, catering to the evolving needs of the healthcare sector and contributing to the overall advancement of drug delivery systems.

Regional Insights

North America emerged as the dominant player in the Global Sustained Release Coatings Market in 2022, holding the largest market share in terms of value. The growing pharmaceuticals sector in the United States, Canada, and other countries is significantly influencing the growth of the market. The increasing demand for pharmaceutical and Nutraceuticals drugs, coupled with their high production rates, is creating a major drive in this region. As per the Pharmaceuticals Research and Manufacturers Association, US companies invested a staggering USD 83 billion in pharmaceutical research and development in 2019 alone. The expansion of pharmaceutical drug manufacturers in this region has resulted in a surge in the demand for sustained release coatings.Furthermore, the North American region is experiencing substantial growth in the manufacturing of generic drugs and has made remarkable advancements in medical research and development. The continuous development of drug delivery systems and the availability of generic medications are further fueling the demand for sustained release coatings. Additionally, the growing demand from pediatric and geriatric populations is also boosting the market.

Considering these factors, it is evident that the sustained release coatings market in the North American region will continue to witness the fastest growth during the forecast period, driven by the increasing presence of pharmaceuticals and advanced drug delivery applications.

Report Scope:

In this report, the Global Sustained Release Coatings Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Sustained Release Coatings Market, By Material Type:

- Ethyl & Methyl Cellulose

- Polyvinyl Alcohol

- Methacrylic Acid Copolymer

- Cellulose Acetate

- Others

Sustained Release Coatings Market, By Application:

- In Vitro

- In Vivo

Sustained Release Coatings Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

- Turkey

- Egypt

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Sustained Release Coatings Market.Available Customizations:

Global Sustained Release Coatings Market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

1. Product Overview

2. Research Methodology

3. Executive Summary

4. Global Sustained Release Coatings Market Outlook

5. Asia Pacific Sustained Release Coatings Market Outlook

6. Europe Sustained Release Coatings Market Outlook

7. North America Sustained Release Coatings Market Outlook

8. South America Sustained Release Coatings Market Outlook

9. Middle East and Africa Sustained Release Coatings Market Outlook

10. Market Dynamics

11. Market Trends & Developments

13. Porter’s Five Forces Analysis

14. Competitive Landscape

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- BASF SE

- Evonik Industries AG

- Colorcon, Inc.

- Coating Place, Inc.

- Mylan N.V.

- Pfizer, Inc.

- Novartis AG

- GlaxoSmithKline plc

- Sun Pharmaceutical Industries Ltd.

- Eastman Chemical Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 184 |

| Published | November 2023 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 567.21 million |

| Forecasted Market Value ( USD | $ 720.1 Million |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Global |